INSTANT DOWNLOAD!

Your price: $9.00

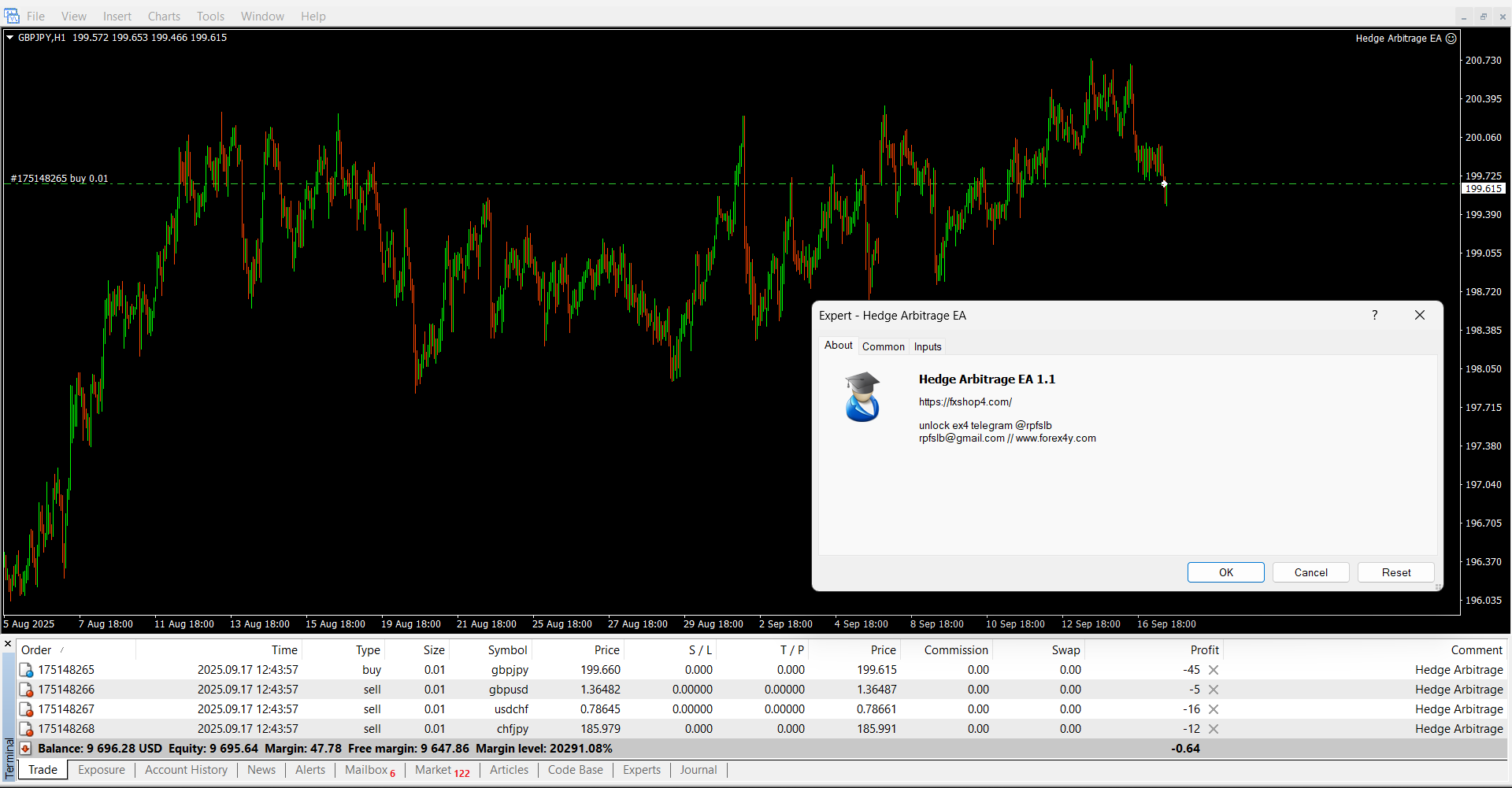

Content: Expert: Hedge Arbitrage EA.ex4 v1.1 (Unlocked-Unlimited), NO MANUAL.

Default settings H4

Put EA in one pair only H4

Four-Currency Hedging Arbitrage EA

Smart. Strategic. Long-Term Profits.

Overcome market volatility with a multi-currency hedge strategy designed for steady growth.

This Expert Advisor (EA) uses a sophisticated four-currency arbitrage system, tested primarily on USDJPY and EURJPY, and fine-tuned for long-term reliability across multiple currency pairs.

⚠️ Before You Buy – Please Read Carefully

Trading involves risk, and it’s important to understand what this EA is and isn’t:

-

No Guarantees of Profit – Like any trading system, past performance doesn’t ensure future success. Losses are still possible.

-

Strategic Backtesting – This EA uses USDJPY and EURJPY for historical backtests, based on its multi-currency logic.

-

Handles Market Shocks – The strategy is built to adapt to unexpected news and even market crashes. However, due to leverage, please use reasonable risk settings. We recommend sticking with the default configuration.

-

Not Spread-Sensitive – Works well even on high-spread brokers. However, a platform with low swap/rollover fees is recommended.

-

Holding period: typically 3 to 20 days

-

-

Designed for Patience, Not Quick Profits – This is a non-scalping, low-risk EA aimed at consistent, long-term returns. If you’re looking for quick gains, this may not be for you.

🧠 Key Features

-

All-in-One Execution: Just attach the EA to one chart — it handles all selected currency pairs automatically.

-

Recommended Currency Pairs:

EURUSD, GBPUSD, USDCHF, USDCAD, USDJPY, EURJPY, AUDUSD, NZDUSD -

Timeframe: H4

-

Minimum Deposit: $2000

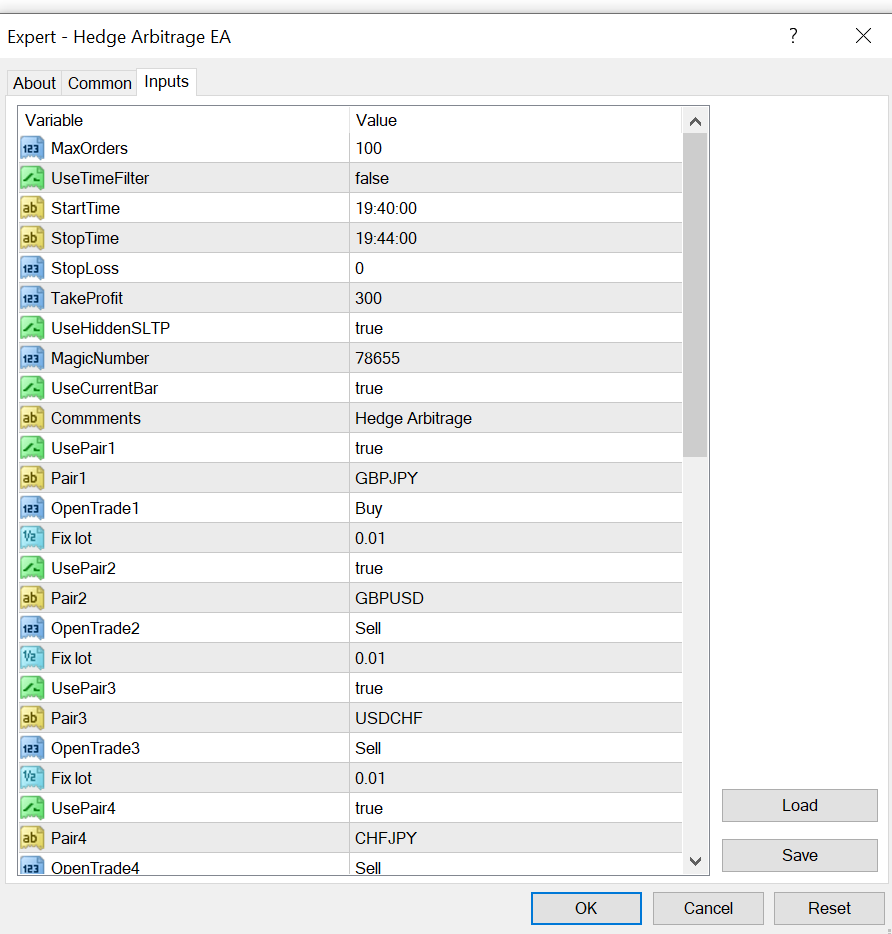

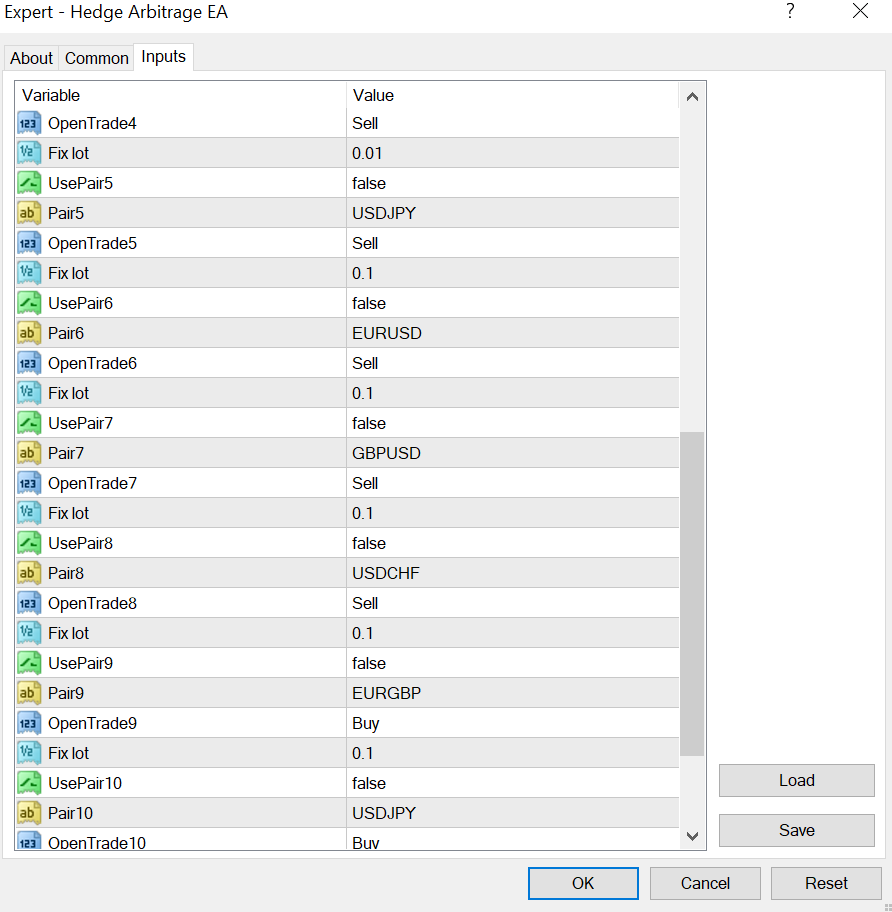

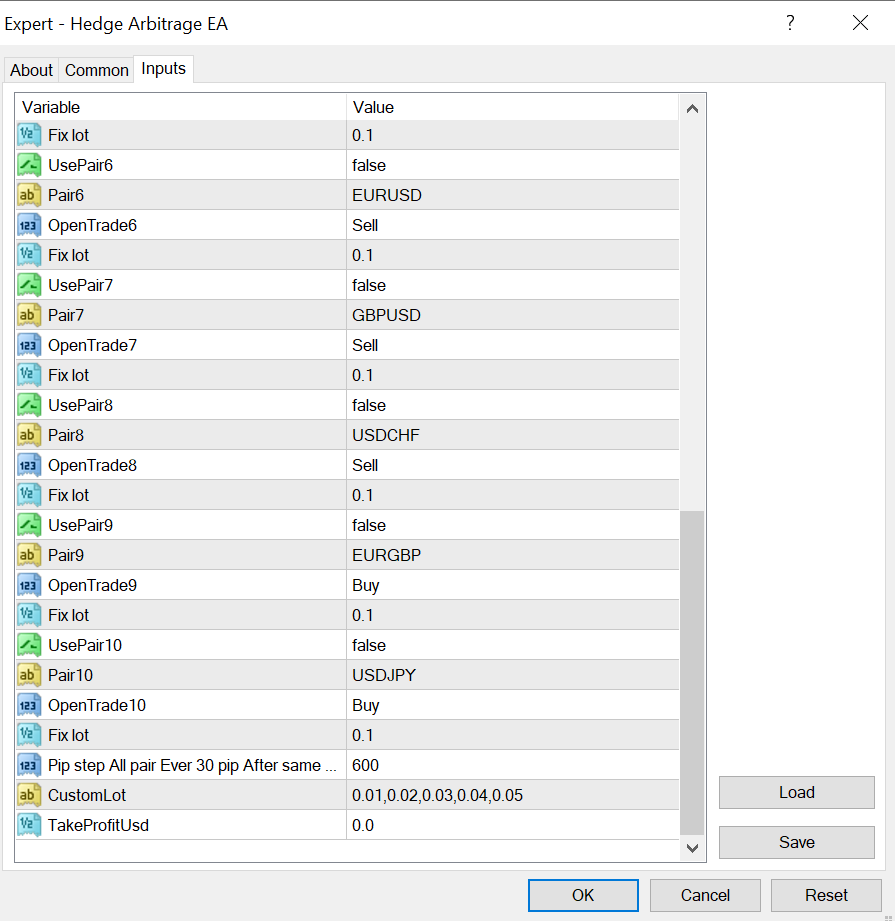

⚙️ Parameter Settings Overview

Currency Groupings

-

Groups1Currency1&Groups1Currency2 -

Groups2Currency1&Groups2Currency2 -

Groups3Currency1&Groups3Currency2 -

Groups4Currency1&Groups4Currency2

Lot Size Settings

-

Lots: Fixed lot size (only active if Autolots is disabled) -

Autolots: Automatically calculates lot size based on deposit -

Risk: Used when Autolots is enabled (1–100 scale)

Strategy Factors

-

StatisticalDays: Number of days used for strategy analysis -

Kaidanyinzi: Entry adjustment factor (0–1) -

Dazhouqiyinzi: Higher time-frame adjustment factor (0–1) -

Yingliyinzi: Profit factor (0–1)

Trade Management

-

Scale In: Enable or disable adding to positions (Not recommended) -

Distance of Filling: Controls grid spacing -

Maximum Position: Max open trades per currency pair (affects risk control when scaling is enabled)

🎁 Limited-Time Offer: Get 50% Cashback!

We’re rewarding our early adopters!

Send us a 5-star review screenshot to QQ: 807603044 and receive 50% of your profits back as a bonus!