INSTANT DOWNLOAD!

Our price: $19.00

Full Course.

What You’ll Learn

Master Momentum Profits: Dive into a century’s worth of successful trend-following strategies and understand how they have evolved over time.

Unlock Momentum Turning Points: Gain the skills to identify critical market shifts and capitalize on these key moments.

Adapt to Volatility Regimes: Learn how to switch between fast and slow trading parameters based on different market volatility to boost profits and improve your risk-adjusted returns.

Smart Position Sizing: Discover how Volatility Targeting can help optimize your position sizes, enhancing both returns and the Sharpe Ratio across various assets.

Leverage Natural Language Processing (NLP): Understand how NLP analyzes news and sentiment signals to build effective time-series momentum strategies.

Explore Deep Momentum Strategies: Uncover advanced momentum techniques powered by deep learning and time-series analysis.

Rank with Precision: Use Learning to Rank algorithms to improve your ability to select the best assets for cross-sectional momentum trading.

Forecast with Insight: Integrate key features into machine learning models to make more accurate market predictions and informed decisions.

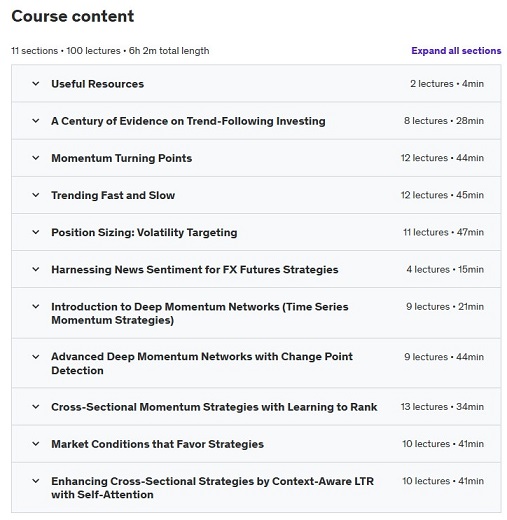

Course Overview: Advances in Momentum Trading Strategies

This advanced course offers a deep dive into momentum trading, blending theory, practical applications, and the latest research. Designed for graduate students and seasoned professionals, it equips you to master sophisticated momentum strategies that work across diverse market environments.

Requirements

-

Python Proficiency: Comfort with Python programming is essential, as it’s the main tool used for analysis and strategy development throughout the course.

-

Market Savvy: A solid grasp of financial markets and trading principles will help you fully benefit from the material.

-

Mathematical Fluency: Ability to read and understand mathematical formulas is crucial for mastering the advanced concepts covered.

-

Strong Foundation in Math & Statistics: Knowledge of linear algebra and statistics is fundamental since these form the basis of the trading strategies discussed.

What You’ll Study

-

A Century of Trend-Following Evidence: Discover how trend-following strategies have performed over the last 100 years, including during financial crises and varied economic cycles.

-

Momentum Turning Points: Learn how to identify key momentum turning points, and understand the difference between dynamic and static strategies as well as the effects of noise and signal persistence.

-

Trending Fast and Slow: Explore how varying trend speeds (window periods) affect analysis and risk management, with insights drawn from S&P 500 statistics.

-

Position Sizing with Volatility Targeting: Understand how adjusting position sizes based on volatility improves risk-adjusted returns across different assets.

-

Deep Momentum Networks: Study how deep neural networks enhance time-series momentum strategies through signal construction and performance evaluation.

-

Advanced Deep Momentum with Change Point Detection: Examine how incorporating change point detection refines deep momentum models.

-

Cross-Sectional Momentum Using Learning to Rank: Build systematic momentum strategies with Learning to Rank techniques, including hands-on Python implementation of LambdaMart algorithms.

-

Market Conditions and Strategy Performance: Analyze how various strategies—like carry, momentum, and value—perform under different market scenarios and how to construct signals and portfolios accordingly.

-

Context-Aware Learning to Rank with Self-Attention: Learn how to improve cross-sectional momentum rankings using advanced transformer models and context-aware approaches.

Why Take This Course?

Whether you are a graduate student specializing in financial engineering, machine learning, applied mathematics, or a professional quant trader or analyst, this course will elevate your expertise. It goes beyond basic theory to teach you practical, cutting-edge momentum trading methods—preparing you to thrive in today’s fast-evolving markets.

Who Should Enroll?

-

This course is NOT for beginners. It’s designed for those with a strong foundation who want to deepen their skills.

-

Ambitious Graduate Students: Especially those in machine learning, applied math, financial engineering, or computer science seeking a challenging, rewarding course.

-

Aspiring Quant Traders and Analysts: Ideal if you want to design your own momentum-based trading strategies.

-

Experienced Traders: Perfect for traders looking to broaden their knowledge with advanced cross-sectional and time-series momentum techniques.