INSTANT DOWNLOAD!

Original price: $1,299.00

Your price: $15.00 98% OFF Retail!

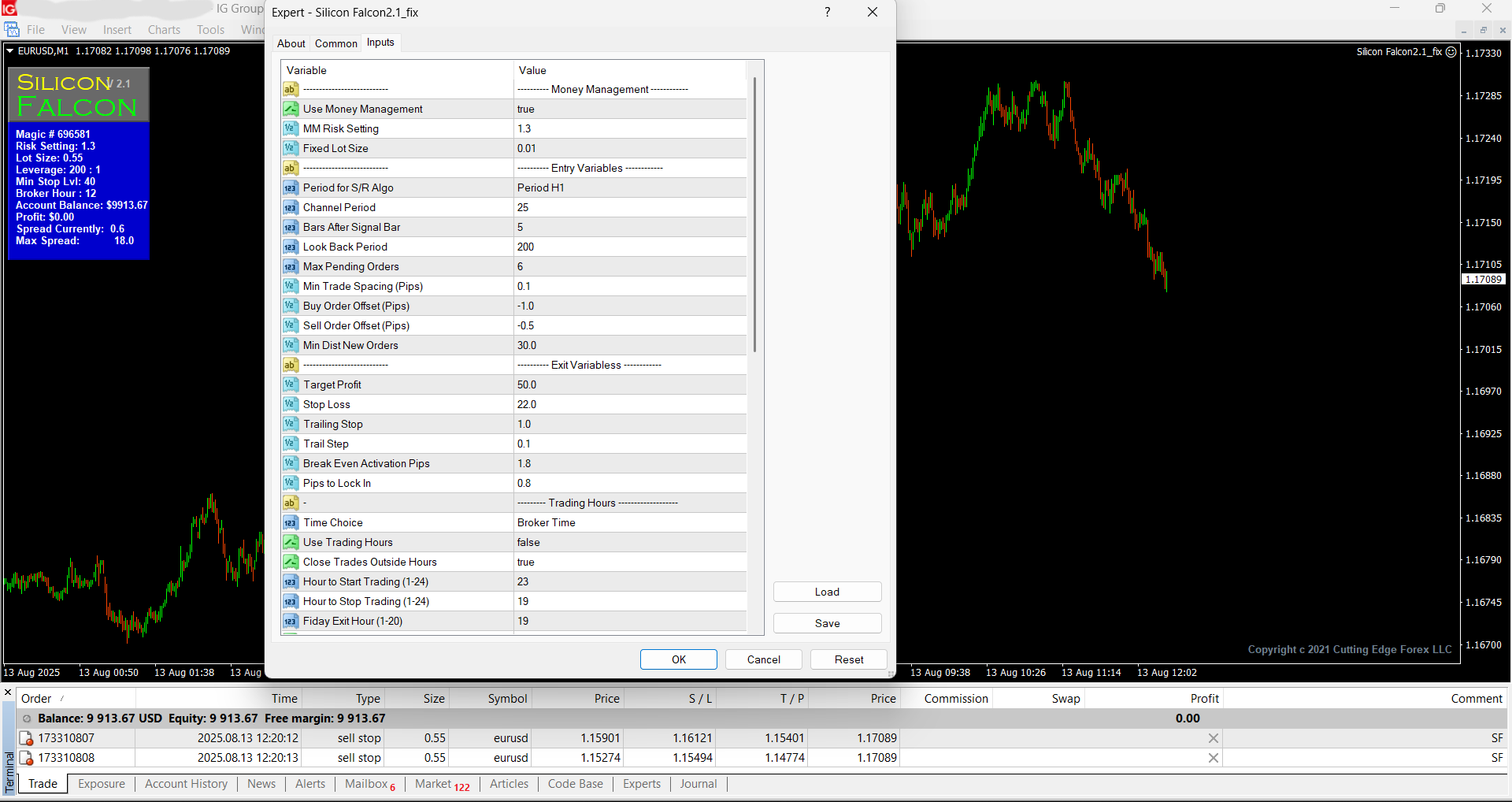

Content: Expert: Silicon Falcon2.1_fix.ex4 (Unlocked-Unlimited), Presets: SF EURUSD H1 RC1 Min Trade Spacing.set, SF EURUSD H1 RC1.set, SF USDJPY H1 RC1 No Hours.set, SF USDJPY H1 RC1.set, UserGuide: SiliconFalconUsersGuide.pdf.

💡 Adaptive Forex Algorithm – Institutional-Grade Trading System

Experience the precision of Wall Street-caliber technology—now made available for retail traders.

🔍 Smarter Trading Starts Here

This Expert Advisor is powered by intelligent algorithms that dynamically adapt to the ever-evolving conditions of the forex market. Designed to operate with precision and resilience, it mirrors the same strategic backbone used by hedge funds and institutional desks.

🧠 Built with Institutional DNA

Originally developed in Node.js under contract for a hedge fund, this EA is an exact replica of the proprietary system deployed by top-tier banks and prop firms.

⚙️ Backtesting Instructions

To accurately backtest the system:

Use EURUSD on the H1 (1-hour) timeframe

Select “Every Tick” mode

Apply the current spread

Start the test and review results

This setup ensures you experience the EA’s full potential under realistic market conditions.

Optimized for EURUSD – But Flexible

While the system was meticulously engineered for EURUSD H1, it includes customizable settings to allow adaptation to other currency pairs for advanced users.

✅ Why Traders Trust This EA

🎯 Adaptive Intelligence: Reacts to real-time shifts in volatility and momentum

🧪 Proven Framework: Derived from real hedge fund systems

⚙️ Robust Backtesting: Built for accurate tick-by-tick simulation

🔒 Institutional Logic: Designed with capital preservation and long-term profitability in mind

Bring institutional power to your personal trading—automate smarter with this elite-grade forex algorithm.

🔧 Apex EA – User Settings Overview

Take full control of the EA’s behavior with this extensive set of configuration options:

📊 Money Management

Use Money Management: Enable dynamic lot sizing based on risk (%).

MM Risk Setting: Risk percentage used when money management is active.

Lot Size: Fixed lot size (only used when money management is disabled).

🧠 Signal Logic & Entry Setup

Period for S/R Algo: Timeframe used for support/resistance-based entries.

Channel Period: Number of bars used to define the price channel.

Bars After Signal Bar: Delay (in bars) after a signal is detected before evaluating entry.

Look Back Period: Historical range (bars) to scan for scalping setups.

📈 Order Management

Max Pending Orders: Cap on total pending orders at any given time.

Min Trade Spacing: Minimum pip distance between open trades or new orders.

Buy Order Offset: Pips above channel high to place buy stop orders.

Sell Order Offset: Pips below channel low to place sell stop orders.

Min Dist New Orders: Minimum distance from market price to allow new entries.

🎯 Trade Management

Target Profit: Desired profit in pips per trade.

Stop Loss: Protective stop in pips.

Trailing Stop: Trailing stop size in pips.

Trail Step: Increment by which the trailing stop moves.

Break Even Activation Pips: Distance into profit to trigger breakeven logic.

Pips to Lock In: Pips locked in after breakeven is activated.

⏰ Time Settings

Time Choice: Select between GMT, Broker Time, or Local Time.

Use Trading Hours: Enable custom trading hours.

Close Trades Outside Hours: Exit trades when outside the defined trading window.

Hour to Start Trading: Start hour for trading (based on selected time type).

Hour to Stop Trading: Stop hour for trading (based on selected time type).

Friday Exit Hour: Cutoff time for trading on Friday (orders deleted).

Close Trades on Friday: Exit all open positions before the weekend.

🛡️ Rollover Protection

Use Rollover Protection: Enable protection around broker rollover (high spreads).

Rollover Hour: Broker’s rollover time (e.g., 0 for broker time, 22 for GMT+2).

Rollover Order Distance: Pips near current price to cancel during rollover.

Rollover Widen SL Pips: Pips added to widen SL temporarily during rollover.

📆 Day-Based Filters

Sunday – Friday: Enable/disable trading for each weekday.

Trade NFP Friday: Enable/disable trading on NFP Fridays.

Trade Thursday Before NFP: Enable/disable trading on the day before NFP.

Trade Christmas Break: Pause trading for the holidays.

Day to Begin Break: Day to pause trading in December (e.g., 15 = Dec 15).

Trade New Year Holiday: Enable/disable trading during New Year.

Day to Return After Break: Resume trading after January holiday (e.g., 3 = Jan 3).

🖥️ Interface & Display

Transparent Display: Show semi-transparent chart display panel.

Trade Comment: Custom comment added to each trade ticket for tracking.

🔐 Safety Settings

Max Spread: Maximum spread allowed for trade entry or maintenance.

Distance to Cancel: Delete pending orders if within this pip range when spread is high.

Max 1 Min Spike Size: Maximum allowed 1-minute spike; cancels orders if exceeded.

Time Out: Cooling-off period (in minutes) after large spread or spike is detected.

⚖️ Broker Compatibility

FIFO Friendly: Set

trueif using FIFO-compliant brokers (U.S. regulations).Magic Number: Unique ID for each EA instance; must differ for each pair/strategy.

![]()