Awesome Scalper Pro

$360.00 Original price was: $360.00.$14.00Current price is: $14.00.

It works like a magic!

As a trader, I found this tool useful for spotting market trends and making informed decisions. The real-time data and clear chart patterns help identify potential trade opportunities.

Christina K

Verified Purchase

INSTANT DOWNLOAD!

Original price: $360.00 (Per Year)

Your price: $14.00 96% OFF Retail!

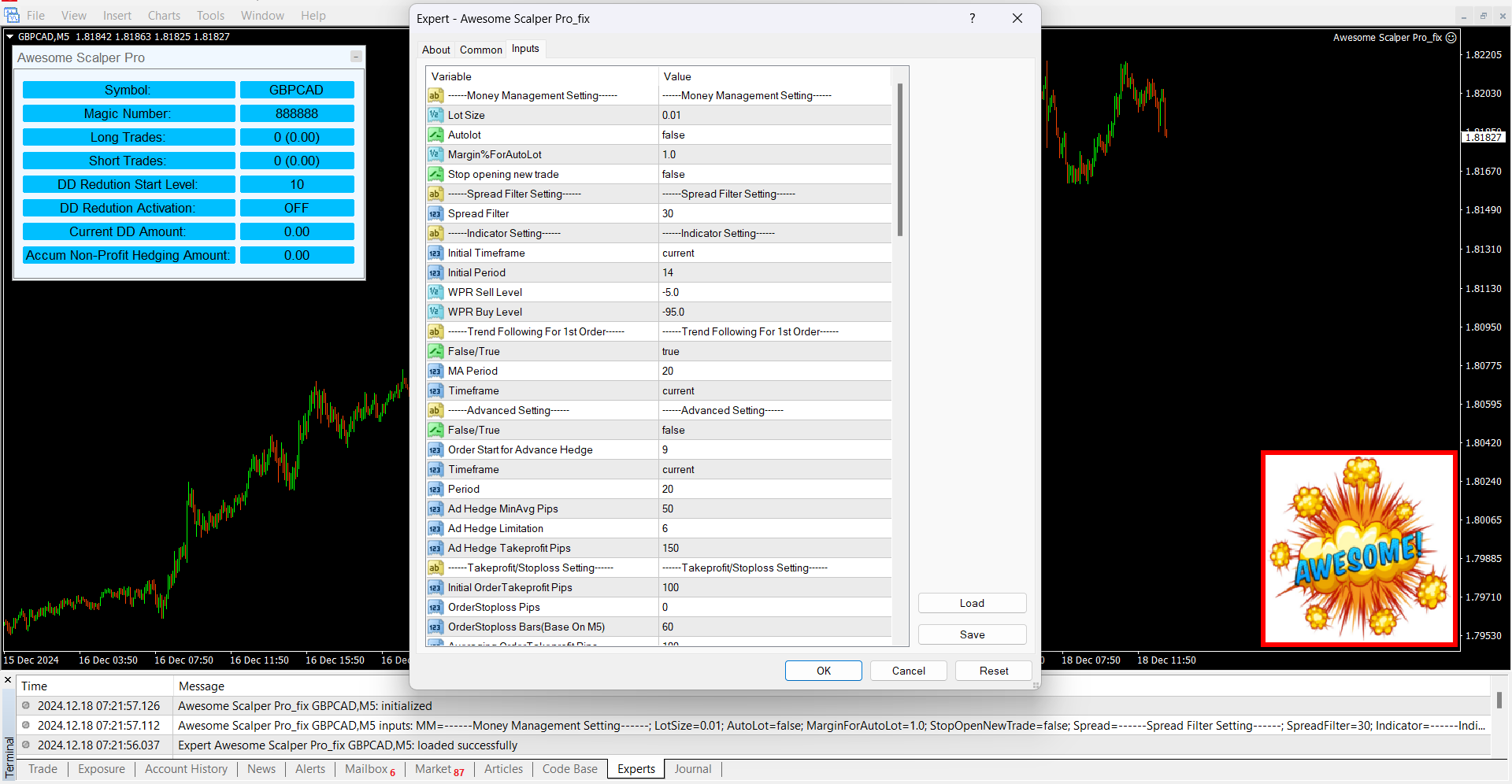

Content: Expert: Awesome Scalper Pro_fix.ex4 (Unlocked-Unlimited), Presets, NO MANUAL.

Awesome Scalper Pro Trading Algorithm

The Awesome Scalper Pro utilizes the William Percentage Range (W%R) indicator to identify key entry points based on oversold or overbought conditions. With a built-in grid system and a range of advanced safety mechanisms, this system is designed to minimize drawdown while maximizing profitability in trending and consolidating markets.

Key Features:

-

No Curve Fitting

-

The strategy is robust, tested without over-optimization, ensuring real-world effectiveness.

-

-

Spread Filter

-

Ensures optimal trading conditions by filtering trades during high spread periods.

-

-

Hedge System

-

Implements a hedging strategy to protect against significant losses during market reversals.

-

-

Flexible Grid System

-

A dynamic grid system that can recover from losing positions by adding positions at strategic intervals.

-

-

User-defined Averaging Lot Size

-

Adjustable lot sizes based on user preferences and risk tolerance.

-

-

Advanced Drawdown Reduction System

-

Designed to reduce drawdowns and manage risk effectively during unfavorable market conditions.

-

-

Backtested Performance

-

Backtested with 15 years of tick data at 99.9% modeling quality, ensuring reliability and performance consistency.

-

Recommended Currency Pairs:

-

AUDCAD

-

NZDCAD

-

CADCHF

-

GBPCAD

-

AUDNZD

Trading Settings and Requirements:

-

Timeframe: 5-minute (5M)

-

Account Type:

-

An ECN account with a leverage of 1:100 or higher is recommended for optimal performance.

-

-

Initial Deposit:

-

USD 1,200 per 0.01 lot for each pair is suggested. This amount will help manage significant drawdowns during unexpected market movements.

-

Trading with a lower deposit is possible, but ensure you have sufficient reserves.

-

-

Note:

-

The provided settings file is for 0.01 lot size. If trading with a higher lot size, adjust the averaging lot size setting accordingly.

-

Key Considerations:

-

Risk Management: Always ensure your account has sufficient capital to handle the grid system’s risk, especially during high volatility or unexpected market shifts.

-

Flexibility in Lot Size: The algorithm allows you to adjust lot sizes based on risk tolerance and trading preferences.