VolSignals – VolStudies Course

$997.00 Original price was: $997.00.$29.00Current price is: $29.00.

It works like a magic!

As a trader, I found this tool useful for spotting market trends and making informed decisions. The real-time data and clear chart patterns help identify potential trade opportunities.

Christina K

Verified Purchase

INSTANT DOWNLOAD!

Original price: $997.00

Your price: $29.00 97% OFF Retail!

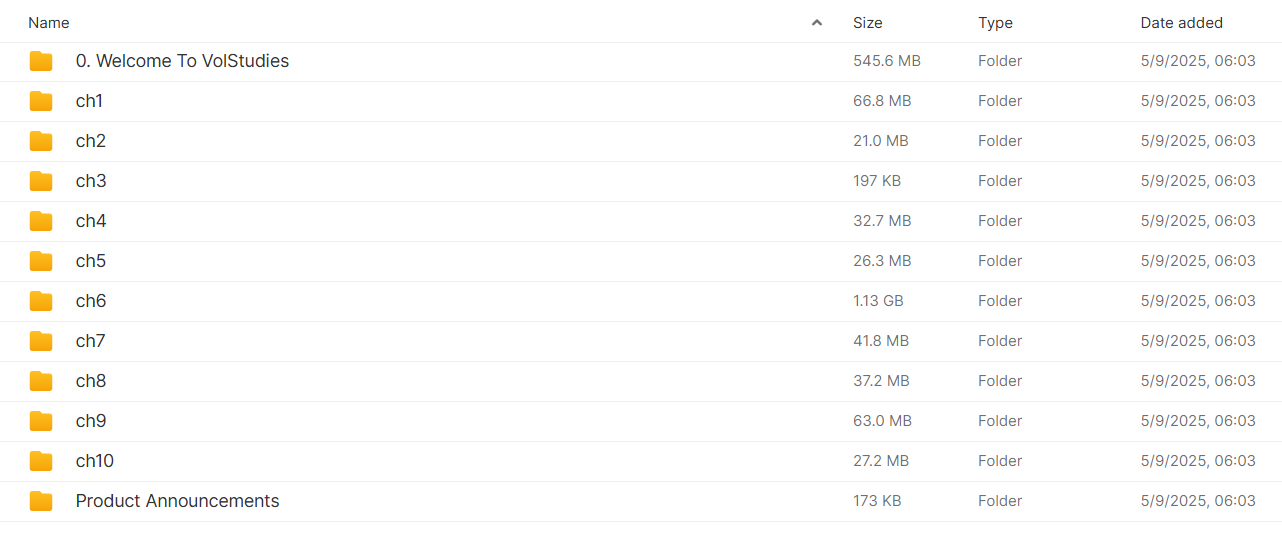

Content: Full Course – 12 folders, 41 Files (1.98GB).

VolStudies Course – Mastering Volatility & Options Trading

Unlock the full potential of volatility trading with the VolStudies Course — a comprehensive program tailored for traders, analysts, and finance professionals looking to master options and advanced volatility concepts.

🔍 What You’ll Learn

This in-depth course covers everything from the foundational concepts to advanced strategies, ensuring you gain a robust understanding of the modern options market:

-

Financial Contracts & Forwards

Learn the mechanics and use-cases of forward contracts and other derivatives that underpin options pricing. -

Introduction to Options Pricing Models

Understand the theoretical frameworks behind options valuation, including Black-Scholes and beyond. -

Volatility, Skew & the Greeks

Dive deep into the drivers of options pricing. Analyze implied vs. realized volatility, skew dynamics, and how to interpret Delta, Gamma, Theta, Vega, and Rho. -

Risk Measurement & Dynamic Hedging

Learn how professional traders manage risk using Greeks-based adjustments and real-time hedging techniques. -

Spreading Techniques & Synthetic Positions

Discover practical options strategies, including verticals, calendars, ratios, and synthetics that mimic or enhance directional and volatility exposure. -

Real-World Application

Apply theoretical concepts in practical trading scenarios with case studies and strategic breakdowns.

🎯 Who This Course Is For

-

Options traders wanting to deepen their understanding of volatility

-

Financial professionals managing risk or building hedged portfolios

-

Intermediate to advanced traders seeking a strategic edge

📦 What’s Included

-

Structured video modules

-

Detailed PDFs and cheat sheets

-

Real-world examples & case studies

-

Lifetime access & future updates

Build the expertise to trade with confidence in volatile markets — enroll in the VolStudies Course today.