Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

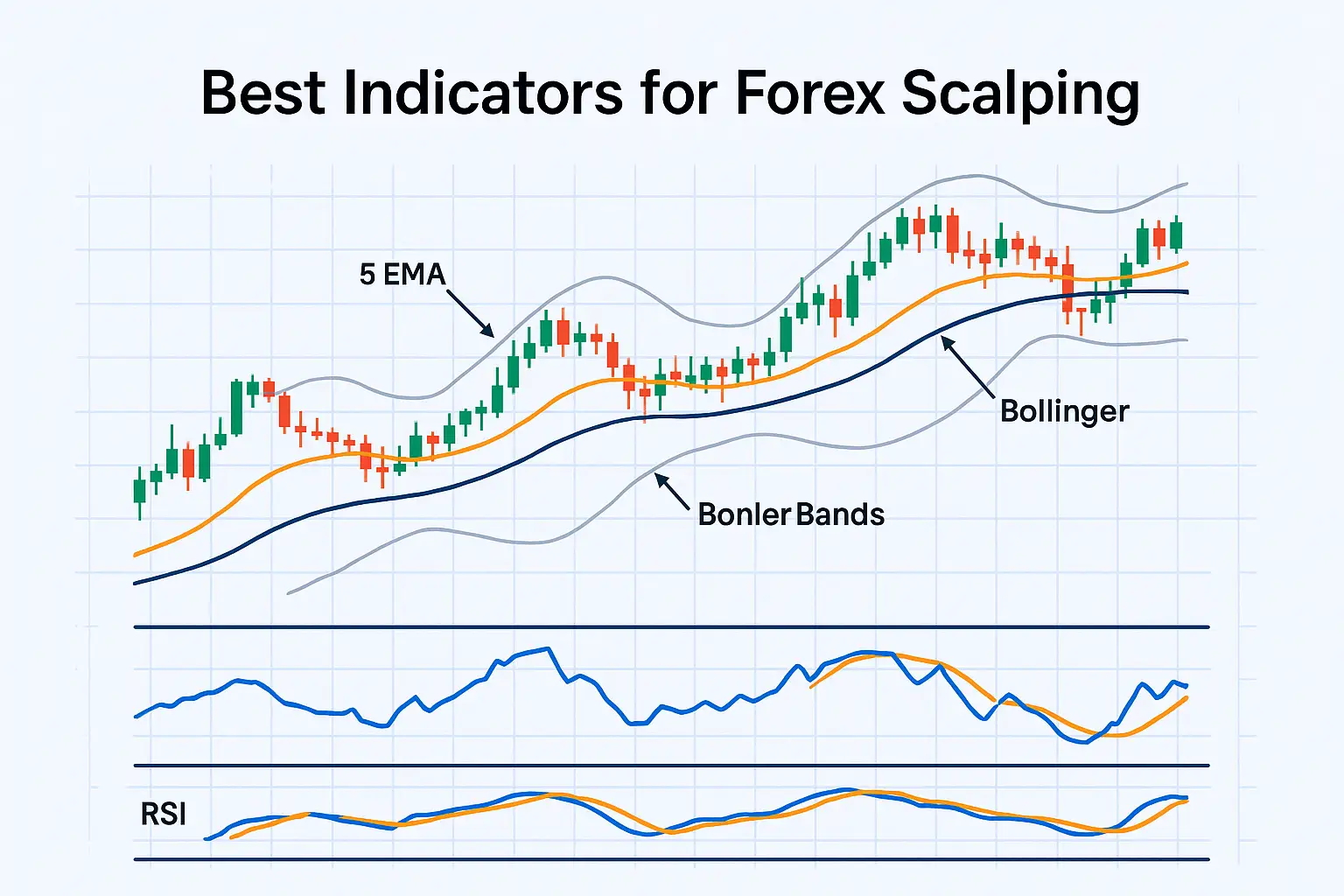

Forex scalping is a precise, rapid trading method that seeks to profit from numerous small price movements. This high-frequency technique is centered on short timeframes—1-minute (M1) to 15-minute (M15) charts—and requires strict discipline, fast execution, and highly effective technical indicators.

This guide examines the most reliable indicators suited for scalping, details practical strategies, and highlights tools available on GregForex that enhance scalping performance.

To be effective in scalping, indicators must:

Scalpers often combine multiple indicators to create high-confidence trading setups.

EMAs place greater weight on recent data, making them more reactive than simple moving averages.

A momentum oscillator that identifies overbought and oversold conditions.

When used alongside EMAs, RSI helps confirm the validity of signals.

These bands consist of a moving average with upper and lower standard deviation boundaries, adjusting dynamically with volatility.

Keltner Channels use the Average True Range (ATR) to set volatility-based envelopes around a moving average. Combining Bollinger Bands with Keltner Channels can effectively reveal squeeze patterns—periods of low volatility destined for breakout.

A momentum indicator ideal for spotting quick reversals.

Tick volume approximates trading activity in Forex and is valuable when used alongside price action.

Key levels (pivot points, recent swing highs/lows) can frame effective scalp entries.

A successful scalping strategy typically includes:

To automate your scalping methodology, consider these expertly reviewed EAs available on GregForex:

Forex scalping demands acute timing, discipline, and precision tools. By integrating EMAs, RSI, Bollinger Bands, Keltner Channels, Stochastic Oscillator, volume analysis, and structured support/resistance, traders can craft reliable scalp entries with controlled risk. GregForex’s affordable scalping tools and automation options provide a solid foundation for both manual and automated trading.

Would you like assistance designing custom template files or backtesting one of the $5 tools for your specific scalping strategy?

Jack Henry

02/07/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...