Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

When markets crash, fear dominates and volatility skyrockets. Many traders lose their accounts simply because they continue trading risky pairs. However, some currency pairs are known for stability, liquidity, and low volatility — making them safer to trade during uncertain times. Let’s explore which forex pairs to focus on during the 2025 crash and how the right Expert Advisors (EAs) can help manage that risk effectively.

A market crash often brings panic-driven moves, rapid liquidity withdrawals, and unpredictable spikes in spreads. Major currencies like the USD, JPY, CHF, and gold (XAU) act as safe-haven assets. These currencies attract institutional money when the global economy turns unstable.

During such periods, traders should:

USD/JPY remains one of the most stable pairs during global turmoil. The Japanese yen tends to strengthen when risk aversion rises, while the U.S. dollar maintains liquidity.

To trade this pair efficiently, use EAs that adjust to volatility automatically, like Scalping Robot EA V5.0. It works best in fast-moving markets and can adapt to changing spread levels by tightening entries and exits.

Recommended Settings:

The Swiss franc, backed by one of the world’s most stable banking systems, performs well when global confidence drops.

You can enhance your USD/CHF strategy using FXscalper 4x Deluxe. This EA combines short-term scalping with trend filters, making it ideal for volatile markets where precision and timing matter most.

Pro Tip: Use a trailing stop and reduce trade frequency during news hours to avoid spread spikes.

The EUR/USD pair is the most traded globally. Its high liquidity means slippage and spread increases are moderate even during crashes.

Trade Assistant v10.27 MT4 helps manage entries, stop losses, and trailing exits efficiently. It’s not an automated EA but an excellent semi-manual assistant for disciplined trading when volatility is high.

Use It For:

Gold is traditionally the best hedge when fiat currencies fluctuate wildly. During the 2025 crash, gold’s demand has surged, providing steady opportunities for short-term trades.

GOLD Scalper PRO v1.5 is purpose-built for this pair. It uses adaptive algorithms to detect micro-trends and short bursts of volatility common in gold movements.

Key Benefits:

The pound tends to move sharply during global economic stress, but with the right system, it can still offer profitable trades.

For controlled exposure, MEDICI v2 MT4 is a solid choice. It uses artificial intelligence to find optimal entries in high-volatility pairs like GBP/USD and USD/JPY.

Recommended Setup:

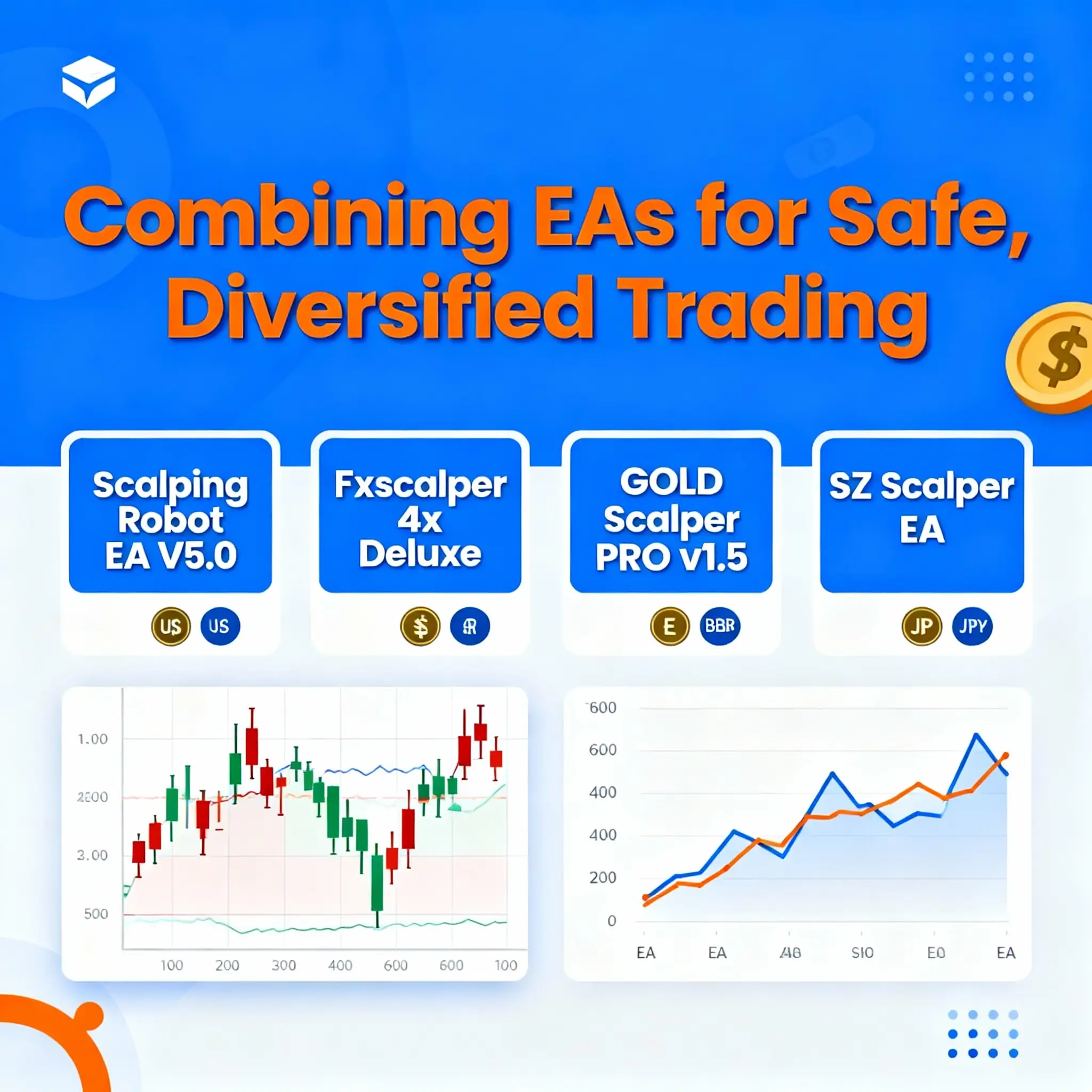

You can also diversify risk by using multiple EAs across pairs. For example:

By splitting risk across several pairs, no single crash movement can wipe out your account.

Make sure to run all EAs on a VPS with stable latency and conduct backtesting on at least three months of 2025 data to adjust parameters according to the new volatility norms.

Trading during a market crash is not about chasing profits — it’s about survival and consistency. Safe-haven pairs like USD/JPY, USD/CHF, and XAU/USD remain the best choices for capital preservation.

Pair them with tested tools such as Scalping Robot EA V5.0, FXscalper 4x Deluxe, and GOLD Scalper PRO v1.5 to ensure that every trade is backed by sound automation and controlled risk.

Even in turbulent markets, the right combination of pairs and optimized EAs can keep your trading account safe — and your profits steady.

Jack Henry

20/10/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...