Building a smart EA portfolio is one of the most effective ways to protect your account during market crashes. In unpredictable conditions, no single Expert Advisor can survive every type of volatility. But a portfolio of different systems, each designed for specific behaviors—trend, grid, scalping, swing—creates balance, reduces drawdown, and increases long-term consistency.

Below is a complete guide on how traders create crash-protected EA portfolios with proper diversification, safety layers, and market-adapted setups.

Why a Single EA Can Never Protect You in a Crash

Most traders blow their accounts because they rely on just one robot.

Market crashes expose all weaknesses inside an EA: wrong logic, aggressive lot scaling, or failure to detect trends.

Markets Shift Faster Than a Single Strategy Can Handle

No EA can handle everything at once:

- Trend systems fail during sideways markets

- Grid systems collapse during one-directional spikes

- Scalping systems freeze in low liquidity

- News EAs blow during unexpected releases

Crash events like the 2025 volatility shock showed how dangerous it is to rely on one strategy. External volatility resources such as Investing.com’s volatility index help traders understand when markets become too unstable for single-system trading.

Core Principles of a Crash-Protected EA Portfolio

A smart EA portfolio does not just run multiple robots.

It combines different strategies, different trading styles, and tools designed to handle extreme conditions.

Combine Multiple Strategy Types

The key is to mix uncorrelated systems, such as:

- Trend-based EAs

- Grid-and-recovery systems

- Swing robots

- Scalpers with tight filters

- Gold or commodity-focused EAs

- News-sensitive systems

- Equity-protection tools

This reduces the chance that all systems fail at the same time.

Distribute EAs Across Different Pairs

A strong crash portfolio spreads risk across:

- Major currency pairs

- Gold or metals

- Select indices

- Low-correlation pairs

Tools like TradingView market correlation pages help identify pairs that don’t move together.

Selecting EAs That Perform During Crisis Conditions

Below are EA types that historically survived high-volatility periods.

Trend EAs With Strict Filters

Systems that trade only in confirmed trend directions stay safer during crash events.

Many traders use tools like Trend Pulse Pro to verify direction before their EAs place trades.

Controlled Grid Systems With Safety Logic

Grid robots are risky unless paired with:

- Adaptive spacing

- Anti-martingale logic

- Equity-based shutdown

Tools like Ultra Grid Manager Pro help reduce grid failure risk.

Gold-Specific EAs

XAUUSD becomes extremely volatile during global uncertainty.

Gold-focused systems like AI Gold Sniper perform better because they are designed for gold’s movement patterns.

Equity Protection Layers

Equity protection is mandatory in any crash-resistant portfolio.

Tools like Account Protector Shield can freeze all trades during dangerous drawdowns.

Essential Safety Tools for Crash-Protected Portfolios

This section is rewritten as you requested — proper explanation, not just names.

Account Protector Shield

A critical tool for crash protection.

It automatically stops all EAs once equity drops to a predefined level.

This prevents a losing basket from destroying the entire account.

Risk Manager Pro

This tool controls daily risk by limiting:

- Maximum loss per day

- Maximum number of open trades

- Maximum lot exposure

A portfolio survives only when risk is properly contained.

Balance Recovery Engine

Useful after breakdowns or during recovery phases.

It helps unwind losing positions with a soft recovery mechanism rather than aggressive martingale.

Recovery Manager Pro

Allows precise manual intervention during market crashes.

Traders use it to close partial trades, set tighter stops, or pause the EAs when markets become unstable.

Trend Pulse Pro

An important confirmation tool.

It detects real market direction, helping traders attach the right EA to the right trend.

This prevents EAs from trading blindly during market chaos.

How to Structure an EA Portfolio for Crash Protection

Step 1 — Divide EAs by Strategy Category

Most portfolios follow this structure:

- 1–2 trend systems

- 1 controlled grid system

- 1 gold or metals EA

- 1 scalper or swing EA

- 1–2 protection tools

This ensures a balanced risk-to-performance ratio.

Step 2 — Allocate Capital to Each EA

Do not give every EA the same balance.

A typical model looks like:

- 40% Trend Systems

- 25% Gold EA

- 20% Grid System

- 10% Scalper

- 5% Protection Tools (running in background)

This protects the portfolio during unexpected spikes.

Step 3 — Use Separate Charts and Magic Numbers

Every EA must have a separate identity to prevent interference.

Step 4 — Set Equity Protection Rules

Hard rules prevent catastrophic losses:

- Max daily loss

- Max weekly loss

- Absolute stop-out level

Tools like Account Protector Shield automate these rules.

Step 5 — Monitor Correlation Weekly

Use external correlation trackers such as Myfxbook.

High pair correlation makes portfolios more vulnerable.

Tools for Account’s Crash Protection

Below are recommended tools that help build a crash-protected EA portfolio.

These descriptions are not promotions — purely functional explanations.

- Account Protector Shield

Prevents full-account wipeouts by stopping all activity when equity hits danger zones. - Risk Manager Pro

Manages exposure, lot size, and daily loss limits to keep the portfolio stable. - Balance Recovery Engine

Helps recover damaged positions softly when markets move unexpectedly. - Recovery Manager Pro

A manual trade assistant that improves execution when EAs need human intervention. - Trend Pulse Pro

Ensures every EA is aligned with the dominant market trend.

These tools act as the backbone of every crash-resistant portfolio.

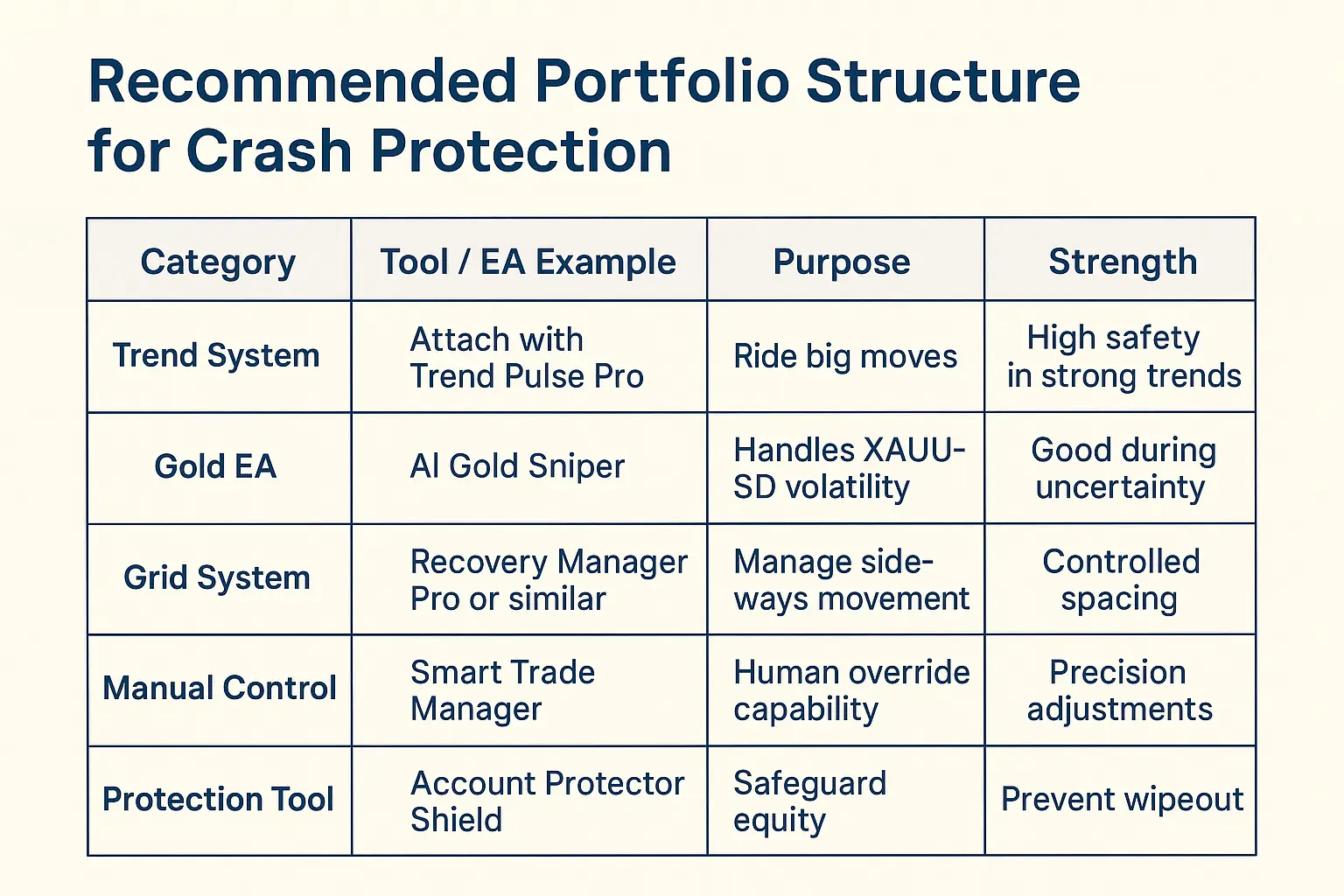

Recommended Portfolio Structure for Crash Protection

| Category | Tool / EA Example | Purpose | Strength |

|---|---|---|---|

| Trend System | Attach with Trend Pulse pro | Ride big moves | High safety in strong trends |

| Gold EA | AI Gold Sniper | Handles XAUUSD volatility | Good during uncertainty |

| Grid System | Ultra Grid Manager Pro or similar | Manage sideways movement | Controlled spacing |

| Manual Control | Recovery Manager Pro | Human override capability | Precision adjustments |

| Protection Tool | Risk Manager Pro | Safeguard equity | Prevent wipeout |

Signs Your EA Portfolio Is Ready for a Crash

Your Systems Have Low Correlation

They do not open the same direction at the same time.

You Have Equity Protection Running

Crash portfolios always use automated shutdown protection.

Your EAs Cover Multiple Strategies

Trend, swing, grid, and gold systems minimize surprise losses.

You Use Confirmation Tools Before Letting EAs Run

Tools like Trend Pulse Pro help avoid wrong-direction trades.

FAQs

How many EAs should a crash-protected portfolio use?

Usually 4–6 EAs plus safety tools.

Do grid systems belong in a crash-protected portfolio?

Yes, but only controlled grids with safety spacing.

Should I run EAs on gold during a crash?

Gold EAs can perform well if designed specifically for metal volatility.

Do I still need manual intervention in a portfolio?

Yes. Tools like Recovery Manager Pro help during extreme events.

How do I know if pairs in my portfolio are highly correlated?

Use tools like Myfxbook or TradingView correlation pages.

Conclusion

A smart EA portfolio is not about running many robots—it is about running the right combination of systems with robust risk protection. By mixing trend EAs, controlled grid systems, gold-focused tools, swing robots, and essential safety layers such as Account Protector Shield and Risk Manager Pro, traders create a defensive structure that survives even during extreme market crashes.

A carefully built portfolio adapts to changing volatility, spreads risk across markets, and remains stable even when shocks occur. With trend confirmation from Trend Pulse Pro and manual control through Recovery Manager Pro, traders maintain full control during uncertain periods.

A crash-protected EA portfolio is built on discipline, diversification, and risk control — and these principles are what keep traders safe when the market becomes dangerous.