Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

When a major market crash hits, volatility often surges and market behavior becomes unpredictable — but these conditions also create opportunities. After a crash, the market tends to overreact, then gradually stabilize. In those post-crash periods, the best forex robots are those that combine careful risk control, adaptive logic, and robust exit/entry strategies. Below are some of the robots from your catalog that are especially suited to post-crash recovery and growth periods, along with strategies to maximize their performance.

After a crash, the market often goes through a few characteristic phases: initial shock, volatility spike, panic selling or buying, and then stabilization or retracement. Robots that perform best in this environment tend to have:

Using external market-overview tools — like volatility indicators on TradingView (e.g. ATR and volatility bands) — can help traders gauge when to enable or disable EAs. For example, when volatility is extremely high, you may want to reduce risk or avoid trading until things calm down.

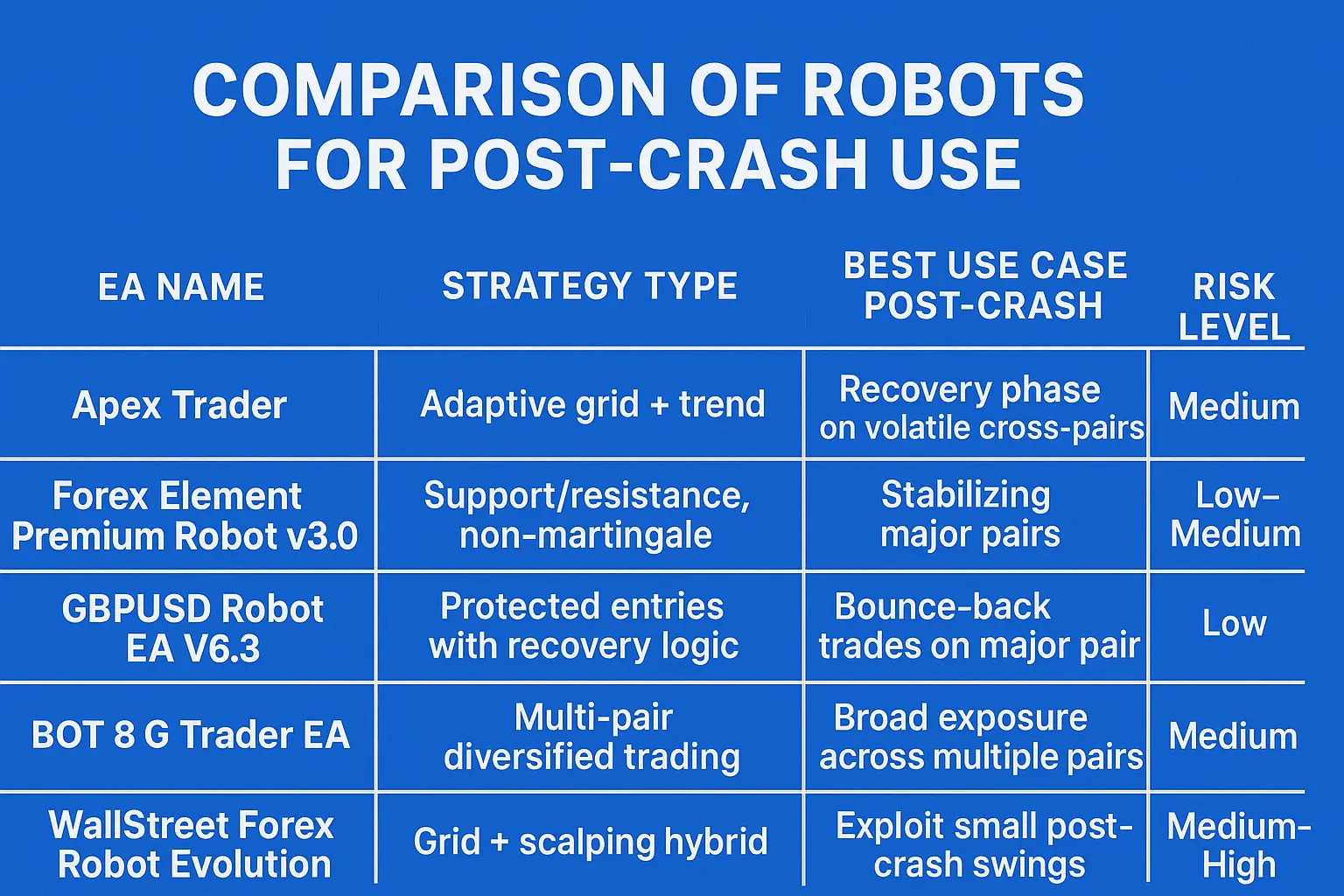

These Expert Advisors from your site demonstrate balance between risk control and opportunity — making them potentially effective after major crashes.

Apex Trader — this EA uses a smart grid-based system combined with trend-following and risk-managed grid logic. Its adaptive approach helps when markets swing wildly after crashes, by opening positions with dynamic take-profit levels and controlling risk on currency pairs like AUDCAD, AUDNZD, NZDCAD.

Forex Element Premium Robot v3.0 — this EA avoids martingale and instead trades based on support/resistance zones with conservative order placement. That kind of discipline works well when the market is settling after a crash and support/resistance levels become more meaningful again.

GBPUSD Robot EA V6.3 — with built-in stop-loss, take-profit, trailing stop, break-even and a recovery system, this EA is designed for stability. In post-crash markets when volatility subsides a bit but reversals remain frequent, such protective settings help preserve capital while trying to catch bounce-back moves.

BOT 8 G Trader EA — a multipair EA with presumably lower-risk strategy (given its low-risk preset), diversification across many pairs can help smooth out risk after a crash, when some pairs recover faster than others.

WallStreet Forex Robot Evolution — historically one of the more versatile EAs on your store, this robot includes grid and scalping strategies with money-management features. Post-crash retracements often create multiple small opportunities that such hybrid robots can exploit.

Using any EA — even a well-designed one — right after a crash requires caution and a smart plan. Here’s a recommended playbook:

| EA Name | Strategy Type | Best Use Case Post-Crash | Risk Level |

|---|---|---|---|

| Apex Trader | Adaptive grid + trend | Recovery phase on volatile cross-pairs | Medium |

| Forex Element Premium Robot v3.0 | Support/resistance, non-martingale | Stabilizing major pairs | Low–Medium |

| GBPUSD Robot EA V6.3 | Protected entries with recovery logic | Bounce-back trades on major pair | Low |

| BOT 8 G Trader EA | Multi-pair diversified trading | Broad exposure across multiple pairs | Medium |

| WallStreet Forex Robot Evolution | Grid + scalping hybrid | Exploit small post-crash swings | Medium–High |

Running a great EA is just part of the plan. Combining it with external monitoring improves chances of success:

Can any EA survive a crash without risk?

No. Even the best EA can suffer losses in extreme market conditions. What matters is risk management and adaptability.

Should I use multiple EAs at once after a crash?

Only if you manage risk carefully and keep lot sizes small. Multipair diversification helps but also increases complexity.

Is grid trading safe post-crash?

Grid can work if the EA has adaptive logic, good money management, and you control risk. Blind grid/martingale combos are dangerous.

When is the best time to re-enable EAs after a crash?

Wait until volatility subsides — ideally when major economic events are not projected and spreads return to normal.

Post-crash markets are dangerous, but they also offer unique opportunities for recovery and growth. With carefully selected, well-designed robots — like Apex Trader, Forex Element Premium Robot v3.0, GBPUSD Robot EA V6.3, BOT 8 G Trader EA, and WallStreet Forex Robot Evolution — traders can navigate the volatility, capture rebound moves, and rebuild after major losses.

Success depends not just on the EA, but also on disciplined risk management, external market awareness, and careful money management. By combining these elements, post-crash periods can become strong opportunities rather than just risks.

Jack Henry

03/12/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...