Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

As the holiday season approaches, many traders look for automation tools that offer effective performance without demanding high investment. Not all good Expert Advisors (EAs) need to be expensive. Some budget-friendly robots deliver consistent logic, solid risk control, and real value, especially for traders who are building or diversifying their automated strategies without overspending.

This guide highlights the best affordable forex bots you can consider this Christmas — written with detailed explanations including usage, ideal settings, pros, cons, and best scenarios for each robot.

In the EA space, “budget-friendly” does not mean “low quality.” Rather, it refers to robots that:

The robots below match those criteria and have shown resilience across different trading environments.

Overview

FortiFX Master CL MT4 trades with a conservative structure that prioritizes risk control and stability. It avoids trying to catch every move and instead focuses on higher-probability setups.

How It Trades

This EA uses trend and volatility filters rather than scalp triggers. It waits for clear directional bias before opening trades, which reduces exposure to noisy markets.

How to Use

Suggested Settings

Pros

Cons

Best For

Traders seeking reliable automation with a focus on capital preservation.

Overview

Neuros Ninjas Sharp Shooter EA emphasizes precision entries rather than volume. It aims for controlled setups that align with trend strength and volatility clarity.

How It Trades

This robot applies confirmation layers and entry filters to avoid low-probability trades. It typically trades when multiple indicators agree, reducing repetitive low-quality signals.

How to Use

Suggested Settings

Pros

Cons

Best For

Traders who prefer selective, high-probability automation.

Overview

Gold remains one of the most active instruments throughout the year. Money Gold EA v1.0 is designed to trade gold with structured risk, making it suitable for both beginners and intermediate users.

How It Trades

The robot operates on gold’s volatility rather than relying on simple directional indicators. It uses breakout and momentum signals to identify entry zones, with built-in checks for excessive spread or price spikes.

How to Use

Suggested Settings

Pros

Cons

Best For

Traders who want exposure to gold with a systematic entry approach.

Overview

Though not a traditional EA, Trend Lines Pro MT4 is a strategic assistant tool that enhances automation by confirming structure. It helps traders ensure robots trade in the direction of dominant market movement.

How It Works

This tool draws and updates key trend lines and verifies breakouts or retests. When used alongside EAs, it helps reduce poor entries tied to false breakouts or range noise.

How to Use

Suggested Settings

Pros

Cons

Best For

Traders who pair manual structure analysis with automated entries.

Overview

Another strategic support tool, Forex Trend Detector v5.1 helps identify strong trend direction before an EA opens trades. This reduces false signals and improves consistency.

How It Works

The detector evaluates price behavior over multiple periods to confirm momentum direction. When the trend is strong, it signals alignment; when weak, it suppresses entries.

How to Use

Suggested Settings

Pros

Cons

Best For

Traders who want trend confirmation before automation triggers.

Overview

AW Recovery EA v3.3 is focused on drawdown management with controlled recovery logic. It isn’t a high-frequency growth bot, but when used with disciplined risk limits, it can assist accounts that have faced losses.

How It Trades

It uses structured recovery sequences rather than random grids. Instead of aggressive martingale, it spaces trades with risk rules to avoid runaway positions.

How to Use

Suggested Settings

Pros

Cons

Best For

Experienced traders working to stabilize accounts after losses.

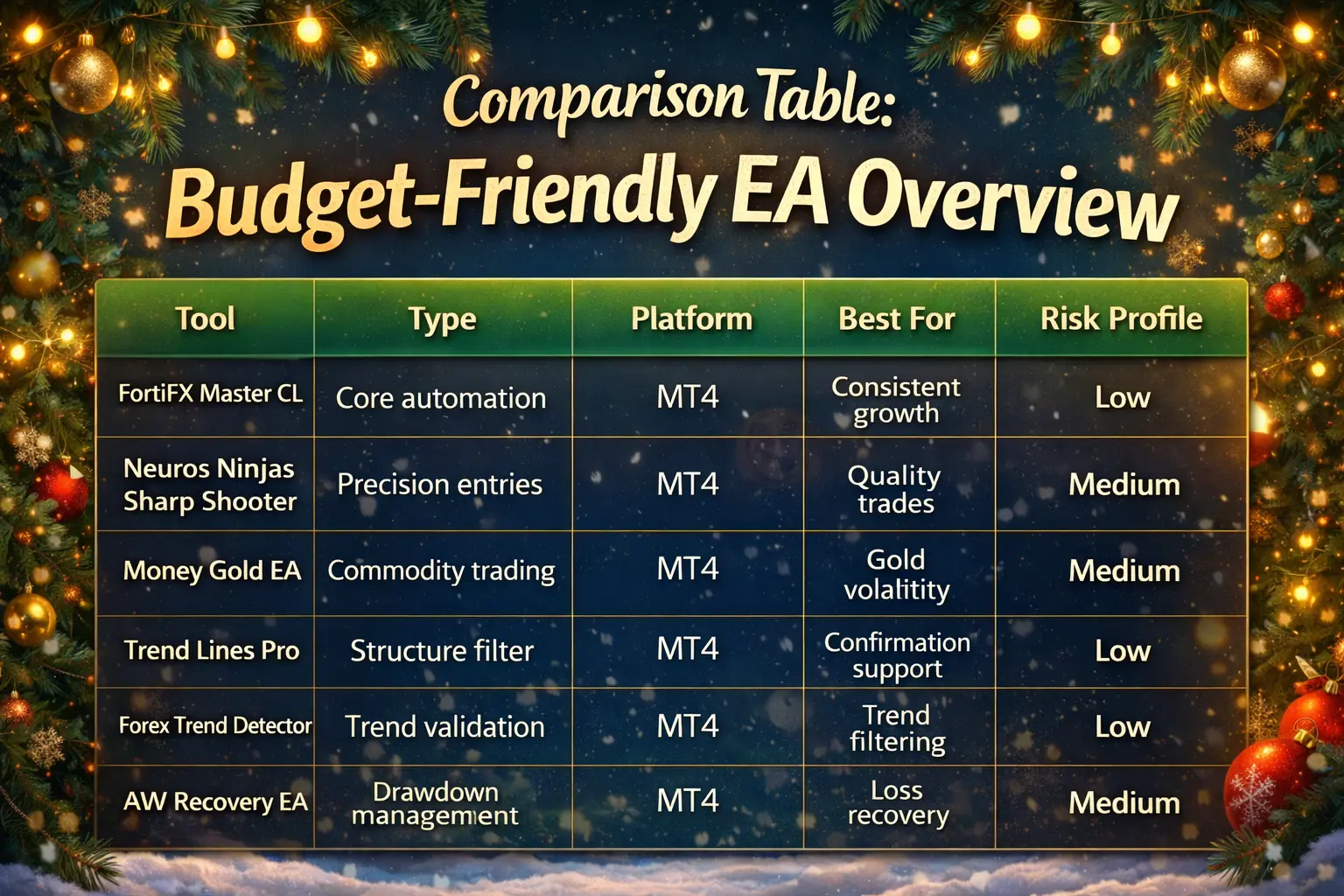

| Tool | Type | Platform | Best For | Risk Profile |

|---|---|---|---|---|

| FortiFX Master CL | Core automation | MT4 | Consistent growth | Low |

| Neuros Ninjas Sharp Shooter | Precision entries | MT4 | Quality trades | Medium |

| Money Gold EA | Commodity trading | MT4 | Gold volatility | Medium |

| Trend Lines Pro | Structure filter | MT4 | Confirmation support | Low |

| Forex Trend Detector | Trend validation | MT4 | Trend filtering | Low |

| AW Recovery EA | Drawdown management | MT4 | Loss recovery | Medium |

1. Base your choice on strategy fit

Do you prefer trend systems, precision setups, or drawdown support?

2. Use confirmation tools with automation

Pair tools like Trend Lines Pro or Forex Trend Detector with direction-based robots to filter signals.

3. Start with small risk settings

Lower risk per trade helps test performance without large exposure.

4. Avoid news spikes without filters

Holiday and major news can cause erratic behavior — use entry time filters.

Budget-friendly does not mean low-performance. Tools like FortiFX Master CL, Neuros Ninjas Sharp Shooter, Money Gold EA, and strategic assistants such as Trend Lines Pro and Forex Trend Detector offer solid logic and risk awareness without high costs. When used with proper settings and integrated into a structured trading plan, these robots are excellent options for traders looking to expand automation without overspending.

Jack Henry

19/12/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...