Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

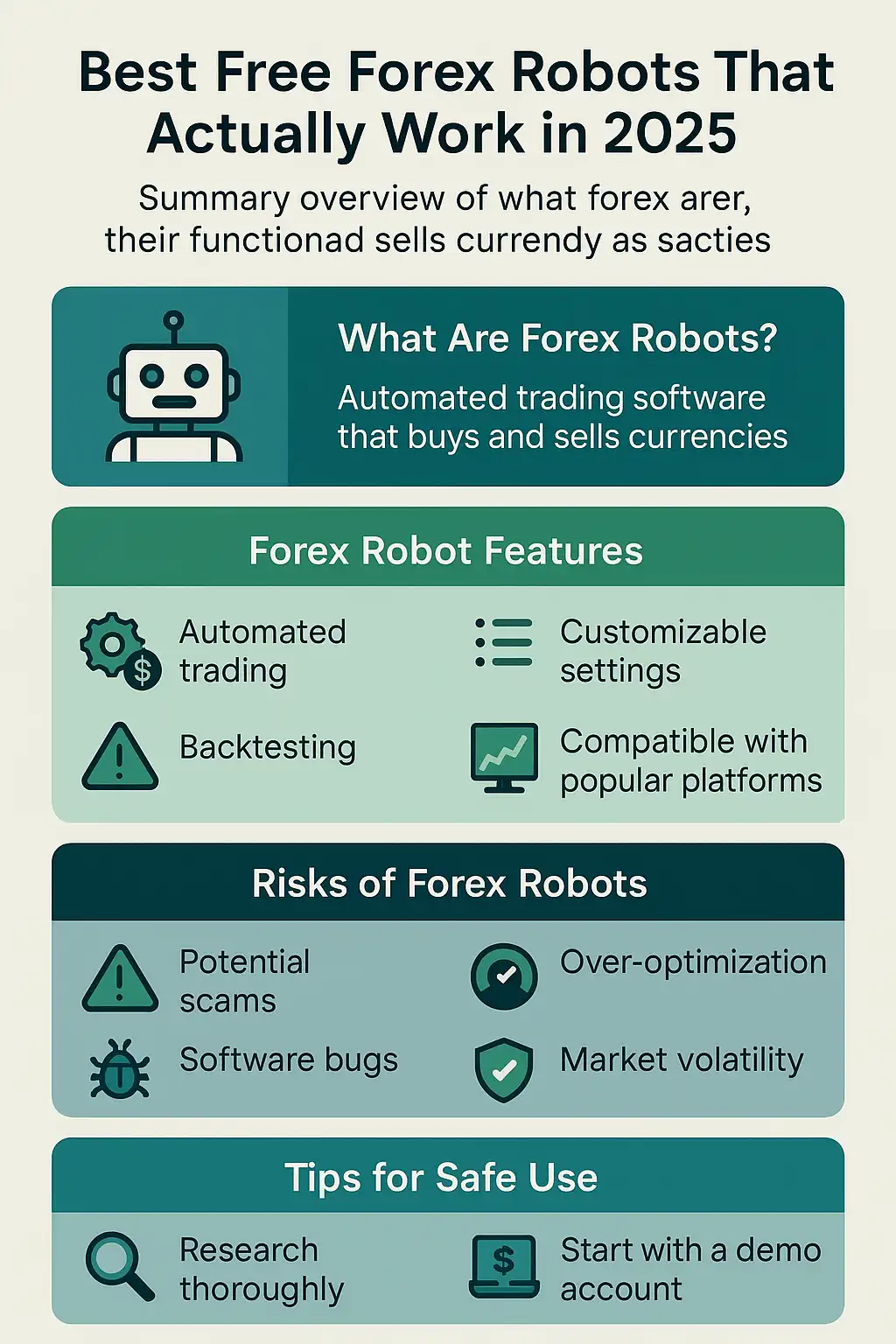

In the dynamic world of forex trading, the allure of automation has never been stronger. Traders, from novices to seasoned professionals, are constantly seeking an edge, a way to optimize their strategies, and perhaps, even trade while they sleep. This quest often leads them to the fascinating realm of forex robots, also known as Expert Advisors (EAs). These sophisticated software programs are designed to execute trades automatically based on predefined criteria, removing emotional biases and allowing for consistent application of trading rules. While many powerful EAs come with a hefty price tag, a significant portion of the trading community is always on the lookout for effective, reliable, and, most importantly, free forex robots that actually work. The year 2025 brings with it new advancements and challenges in the financial markets, making the search for top free EA MT4 and MT5 solutions more relevant than ever.

This comprehensive guide aims to demystify the world of free expert advisors, providing an in-depth look at what makes them tick, how to identify truly working free EAs, and how to leverage them for potential success in your trading journey. We will explore the benefits and limitations, discuss key features to consider, and offer practical advice on installation, optimization, and risk management. Our goal is to equip you with the knowledge to confidently navigate the landscape of free expert advisor download options and help you discover the best no-cost forex robots that can genuinely enhance your trading performance. For more general information on forex trading and a wide array of tools, visit GregForex.com.

At its core, a forex robot, or Expert Advisor (EA), is a piece of software that automates trading decisions and executions within the foreign exchange market [1]. These programs are built upon a set of pre-programmed rules, algorithms, and technical indicators that dictate when to open, manage, and close trades. The primary advantage of EAs is their ability to operate 24/5, continuously monitoring market conditions and executing trades without human intervention, emotion, or fatigue. This makes them a powerful tool for traders looking to implement systematic strategies with precision and consistency.

Free forex robots, as the name suggests, are EAs that are available to traders at no monetary cost. They can range from simple scripts designed for specific tasks to complex systems capable of managing intricate trading strategies. The availability of free expert advisor download options has democratized automated trading, allowing a broader audience to experiment with algorithmic approaches without a significant upfront investment. These free offerings often come from various sources, including independent developers, trading communities, or as promotional tools from brokers or software providers.

While the fundamental principle remains the same, there’s a clear distinction between free and paid EAs. Paid EAs typically come with dedicated support, regular updates, extensive backtesting results, and often proprietary algorithms developed by professional traders or firms. Free EAs, on the other hand, might offer less support, be community-driven, or serve as a basic version of a more advanced paid product. However, this does not diminish their potential. Many working free EAs have proven to be highly effective, especially for traders who understand their limitations and are willing to put in the effort to test and optimize them. The key is to approach free forex robots 2025 with a discerning eye, focusing on their underlying logic and performance rather than just their price tag. For a deeper dive into how these automated tools can improve your trading performance, you can refer to our article on how forex EA can improve your trading performance.

The appeal of free forex robots extends beyond just the absence of a price tag. For many traders, especially those new to the forex market or automated trading, free EAs offer a unique set of advantages that can significantly impact their trading journey. Understanding these benefits is crucial for appreciating the value that working free EAs can bring.

Firstly, accessibility for new traders is perhaps the most significant draw. The forex market can be intimidating, with its complex terminology, rapid price movements, and the sheer volume of information to process. Automated trading, while powerful, often requires a certain level of technical understanding. Free expert advisor download options lower the barrier to entry, allowing aspiring traders to experiment with automation without committing significant capital to software. This hands-on experience is invaluable for learning the mechanics of automated trading, understanding how EAs interact with the market, and developing a feel for algorithmic strategies.

Secondly, cost-effectiveness is a clear and undeniable benefit. High-quality commercial EAs can cost hundreds or even thousands of dollars, a sum that might be prohibitive for many individual traders. Free forex robots 2025 provide an alternative, enabling traders to allocate their capital directly to their trading accounts rather than to software licenses. This is particularly beneficial for those with smaller trading accounts, where every dollar saved on tools can be reinvested into trading capital. It allows for a more capital-efficient approach to exploring automated strategies.

Thirdly, free EAs present an excellent opportunity for learning and experimentation. The open-source nature of many free robots, or the availability of their underlying logic, allows curious traders to delve into the code, understand the strategy, and even modify it to suit their specific needs. This level of transparency is often absent in proprietary paid EAs. Experimentation with different free EAs can help traders identify which types of strategies (e.g., scalping, trend following, range trading) resonate with their trading style and risk appetite. For instance, if you’re interested in specific strategies, you might explore articles like Grid vs. Martingale to understand different approaches that EAs can employ.

Finally, while not guaranteed, free forex robots offer the potential for consistent profits. Many successful traders started their automated journey with free tools, meticulously testing and optimizing them to achieve profitability. The key lies in diligent research, rigorous backtesting, and careful risk management. While the term ‘free’ might sometimes imply lower quality, the vibrant community of developers and traders constantly contributes to and refines free EAs, making some of them surprisingly robust. The ability to automate trades 24/5 means that opportunities are not missed due to human limitations, potentially leading to more consistent execution of a profitable strategy. For those looking to improve their overall trading performance, understanding how these tools fit into a broader strategy is key, as discussed in our article on how forex EA can improve your trading performance.

In summary, free forex robots serve as an accessible, cost-effective, and educational gateway into the world of automated trading. They empower traders to explore, learn, and potentially profit from algorithmic strategies without the significant financial outlay typically associated with commercial trading software.

Identifying a truly effective free forex robot amidst the myriad of available options requires a discerning eye and a clear understanding of what constitutes a reliable automated trading system. While the allure of a free expert advisor download is strong, it’s crucial to evaluate potential candidates based on several key features that indicate their potential for success and longevity in the volatile forex market. Focusing on these aspects will help you distinguish between a promising tool and one that could lead to significant losses.

Firstly, performance metrics are paramount. A legitimate working free EA should ideally provide verifiable performance data, typically through backtesting and, more importantly, live forward testing results. Key metrics to scrutinize include:

•Drawdown: This represents the peak-to-trough decline in an investment during a specific period. A lower maximum drawdown indicates better risk management and stability [2].

•Profit Factor: Calculated by dividing gross profit by gross loss, a profit factor greater than 1.0 indicates a profitable system. The higher, the better.

•Win Rate: While a high win rate can be appealing, it’s less important than the overall profitability and risk-reward ratio. A system with a lower win rate but high average profits per trade can still be highly effective.

•Average Pips per Trade: This metric provides insight into the average gain or loss per trade, helping to assess the efficiency of the EA.

Secondly, reliability and stability are critical. A good free forex robot should operate consistently without frequent crashes, glitches, or unexpected behavior. It should be able to handle various market conditions, including periods of high volatility and low liquidity, without significant degradation in performance. This often comes down to robust coding and thorough testing by its developers or community. The best no-cost forex robots are those that demonstrate consistent performance over extended periods, not just during favorable market conditions.

Thirdly, customization options and flexibility are highly desirable. While free EAs might not offer the same level of customization as their paid counterparts, the ability to adjust key parameters such as lot size, stop-loss, take-profit, and even the trading strategy itself, is invaluable. This flexibility allows traders to adapt the EA to their specific risk tolerance, trading style, and evolving market dynamics. A top free EA MT4 or MT5 should ideally provide enough configurable settings to allow for optimization without requiring deep programming knowledge. For those interested in creating their own tailored solutions, our guide on how to create your own forex EA without coding might be a valuable resource.

Fourthly, community support and reviews offer a crucial insight into the EA’s viability. For free forex robots 2025, a strong and active community around the EA is a significant positive indicator. This community can provide valuable feedback, troubleshooting tips, shared optimization settings, and even updates or improvements to the code. Reviews on reputable forums, MQL5 marketplace, or independent trading websites can highlight both the strengths and weaknesses of a particular EA. Be wary of EAs with no community presence or overwhelmingly positive, unverifiable reviews.

Finally, compatibility with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) is essential, as these are the most widely used trading platforms for retail forex traders. Most free expert advisor download options are designed for one of these platforms. Ensuring the EA is compatible with your preferred platform and its specific version will save you significant headaches during installation and operation. For a comprehensive understanding of different EAs available, including those for MT5, you can explore our article on top MT5 expert advisor.

By meticulously evaluating these features, traders can significantly increase their chances of finding a truly working free EA that aligns with their trading objectives and contributes positively to their overall forex trading success. Remember, even the best no-cost forex robots require careful management and realistic expectations.

While naming specific free forex robots that will definitively be the “best” in 2025 is challenging due to the dynamic nature of the market and continuous development, we can discuss the general types of working free EAs that have historically shown promise and where to look for reputable free expert advisor download options. The landscape of free forex robots 2025 is constantly evolving, with new tools emerging and older ones being updated or deprecated. Therefore, understanding the categories and reliable sources is more valuable than a static list.

Common types of free EAs often found for MT4 and MT5 include:

•Scalping EAs: These robots aim to profit from small price movements, often opening and closing trades within seconds or minutes. They require low spreads and fast execution. An example of this type can be found in our article on Scalping EA for MT4.

•Trend-Following EAs: These EAs identify and follow established market trends, entering trades in the direction of the trend and holding them for longer periods. They are generally more robust to market noise.

•Grid Trading EAs: These robots place a series of buy and sell orders at predetermined intervals above and below a set price, aiming to profit from market volatility within a range. For a comparison of this strategy, see Grid vs. Martingale.

•Martingale EAs: While potentially high-reward, Martingale EAs are also high-risk, doubling the lot size after each losing trade to recover previous losses. Caution is advised with these systems.

•News Trading EAs: These EAs are designed to capitalize on market volatility around major economic news releases. They require extremely fast execution and reliable data feeds.

•Breakout EAs: These robots identify key support and resistance levels and enter trades when the price breaks out of these levels, expecting a significant move in the breakout direction.

When seeking top free EA MT4 or MT5, it is paramount to emphasize due diligence and rigorous testing. Never deploy a free EA on a live account without thoroughly testing it on a demo account first. This involves:

1.Backtesting: Running the EA on historical data to see how it would have performed in the past. While not a guarantee of future results, it provides valuable insights into the EA’s strategy and potential profitability. Ensure the backtesting quality is high (99% modeling quality).

2.Forward Testing (Demo Account): Running the EA on a demo account in real-time market conditions. This is crucial for understanding how the EA performs in live environments, including factors like spread, slippage, and broker execution. This step helps confirm if the EA is a truly working free EA.

Reputable sources for finding free expert advisor download options include:

•MQL5 Community: The official website for MetaTrader platforms, MQL5.com, has a vast marketplace and a vibrant community forum where developers share free EAs, indicators, and scripts. Many developers offer free versions of their EAs to gain feedback or as a lead-in to their paid products. This is often the best place to find working free EAs with community support [3].

•Reputable Forex Forums and Websites: Many established forex trading forums and websites have dedicated sections for free EAs. However, exercise extreme caution and always verify the credibility of the source before downloading any software. Look for active discussions, positive reviews, and transparent performance data.

•Developer Websites/Blogs: Some independent developers offer free EAs on their personal websites or blogs. These can be hidden gems, but again, thorough research into the developer’s reputation and the EA’s performance is essential.

Remember, the term “free” does not absolve you of the responsibility to conduct thorough research and testing. The best no-cost forex robots are those that have been proven through consistent performance on demo accounts and have a transparent development or community history. For a broader understanding of automated tools, you might find our article on best automated forex trading tools insightful.

Selecting the best free forex robot is not a one-size-fits-all endeavor. What works for one trader might not work for another, as trading styles, risk tolerance, and financial goals vary significantly. Therefore, a crucial step in leveraging free expert advisor download options is to align the EA with your individual trading profile. This section will guide you through the process of choosing a working free EA that complements your approach to the market.

Firstly, define your trading goals and risk tolerance. Before even looking at specific EAs, you need to have a clear understanding of what you aim to achieve and how much risk you are willing to take. Are you looking for aggressive growth, consistent small gains, or simply a tool to manage trades while you’re away from the screen? Your risk tolerance will dictate whether you should consider EAs with higher drawdowns or those that prioritize capital preservation. For new traders, understanding these fundamental aspects is critical, and our article on best trading strategies for new traders can provide a solid foundation.

Secondly, the importance of backtesting and forward testing cannot be overstated. Once you’ve identified a potential free forex robot, its historical performance is the first indicator of its viability. Backtesting involves running the EA on past market data to simulate its performance [4]. Look for EAs that have been rigorously backtested with high modeling quality (ideally 99%) over a significant period (several years) and across various market conditions. However, remember that past performance is not indicative of future results. This is where forward testing on a demo account becomes indispensable. A demo account allows you to test the EA in real-time market conditions without risking actual capital. This step is crucial for verifying if the free forex robots 2025 you are considering are truly working free EAs in a live environment.

Thirdly, demo account testing provides a safe sandbox for experimentation. Dedicate a sufficient period (at least a few weeks to a few months) to run the EA on a demo account. During this time, monitor its performance closely, observe how it handles different market scenarios, and pay attention to factors like spread, slippage, and execution speed from your broker. This practical experience will give you confidence in the EA’s capabilities and help you fine-tune its settings before considering live deployment. It’s also an excellent opportunity to understand the nuances of how forex trading works in an automated context.

Fourthly, analyzing historical data beyond just the EA’s provided backtest reports is a good practice. If possible, obtain the raw historical data and run your own backtests using the EA. This helps to confirm the integrity of the provided results and allows you to experiment with different settings to see how they impact performance. Understanding the market conditions during which the EA performed well or poorly can also inform your decision-making.

Finally, consider the EA’s underlying strategy and whether it aligns with your understanding of the market. For instance, if you prefer a strategy that focuses on specific currency pairs in forex trading, ensure the EA is designed to trade those pairs effectively. The best no-cost forex robots are those that you understand and trust, even if you didn’t develop them yourself. By meticulously following these steps, you can significantly increase your chances of finding a free forex robot that not only works but also genuinely supports your trading objectives.

Once you have identified a promising free forex robot, the next crucial step is its proper installation and setup on your trading platform. The vast majority of free expert advisor download options are designed for MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are the industry-standard platforms for retail forex trading [5]. While the specific steps might vary slightly depending on the EA and your broker, the general process remains consistent. This section provides a general guide, and for detailed, step-by-step instructions, you can always refer to our comprehensive guide on how to install EA on MetaTrader.

Here’s a simplified overview of the installation process:

1.Download the EA File: After selecting your free forex robot, download the EA file, which typically comes in an .ex4 (for MT4) or .ex5 (for MT5) format. Some EAs might also include additional files like indicators (.ex4 or .ex5) or libraries (.dll).

2.Open Your MetaTrader Platform: Launch your MT4 or MT5 trading platform. Ensure you are logged into your trading account (preferably a demo account for initial testing).

3.Access the Data Folder: In your MetaTrader platform, go to ‘File’ > ‘Open Data Folder’. This will open a new window displaying the MetaTrader terminal’s data directory. This is where all your custom indicators, EAs, and scripts are stored.

4.Navigate to the MQL4/MQL5 Folder: Inside the data folder, you will find a folder named ‘MQL4’ (for MT4) or ‘MQL5’ (for MT5). Open this folder.

5.Place the EA File: Within the MQL4/MQL5 folder, locate the ‘Experts’ folder. Copy your downloaded .ex4 or .ex5 EA file into this ‘Experts’ folder. If the EA came with additional indicators, place them in the ‘Indicators’ folder, and any library files in the ‘Libraries’ folder.

6.Refresh MetaTrader: Close the data folder and return to your MetaTrader platform. In the ‘Navigator’ window (usually on the left side), right-click on ‘Expert Advisors’ and select ‘Refresh’. Your newly installed EA should now appear in the list.

7.Attach the EA to a Chart: Drag and drop the EA from the ‘Navigator’ window onto the chart of the currency pair you wish it to trade. Alternatively, right-click on the EA and select ‘Attach to Chart’.

8.Configure EA Settings: A pop-up window will appear with the EA’s settings. This is where you can adjust parameters such as lot size, stop-loss, take-profit, and any other specific inputs the EA requires. It’s crucial to understand each parameter and its impact on the EA’s behavior. Ensure ‘Allow Live Trading’ (or ‘Allow Algo Trading’ in MT5) is checked in the ‘Common’ tab if you intend for the EA to execute trades.

9.Enable AutoTrading: On the MetaTrader toolbar, ensure the ‘AutoTrading’ (or ‘Algo Trading’ in MT5) button is green. This global setting enables or disables all EAs on your platform. If it’s red, no EAs will execute trades.

After these steps, you should see a smiley face icon (or a similar indicator) in the top right corner of the chart, signifying that the EA is running. Remember, initial testing should always be done on a demo account to ensure the EA functions as expected and to fine-tune its settings to your preferences and risk management strategy. This meticulous approach will help you maximize the potential of your working free EAs and avoid common pitfalls.

Acquiring a free forex robot is just the first step; unlocking its full potential requires diligent optimization. Even the best no-cost forex robots are not plug-and-play solutions. Their effectiveness in live trading hinges on how well they are configured and adapted to current market conditions and your specific trading objectives. This process involves understanding the EA’s parameters, rigorous testing, and continuous monitoring.

Understanding EA Settings and Parameters: Every Expert Advisor comes with a set of customizable parameters, often found in the ‘Inputs’ tab when attaching the EA to a chart. These parameters control various aspects of the EA’s behavior, such as lot size, stop-loss and take-profit levels, trailing stops, entry and exit conditions, time filters, and even the indicators it uses. It is crucial to understand what each parameter does and how changing its value might impact the EA’s trading decisions. Many free expert advisor download packages come with a user manual or a community forum where these parameters are explained. Take the time to read and comprehend them thoroughly.

The Role of Backtesting in Optimization: Backtesting is the cornerstone of EA optimization. It involves running the EA on historical data to evaluate its performance under past market conditions. MetaTrader platforms offer built-in Strategy Testers that allow you to perform detailed backtests. When optimizing, you’ll typically adjust one or more parameters and run the backtest to see if the changes lead to improved results (e.g., higher profit, lower drawdown, better profit factor). However, be wary of over-optimization or curve fitting, where an EA is optimized so perfectly to past data that it performs poorly in live, unseen market conditions. The goal is to find robust settings that perform well across a variety of historical periods, not just one specific favorable period. For a deeper understanding of how to manage risk in forex trading, which is crucial during optimization, refer to our article on how to manage risk in forex trading.

Importance of Demo Trading Before Live Deployment: After backtesting, the next critical step is forward testing on a demo account. This involves running the optimized EA on a demo account in real-time market conditions for an extended period (e.g., several weeks to a few months). Demo trading allows you to:

•Verify Backtest Results: See if the EA performs similarly in a live, albeit simulated, environment.

•Assess Broker Conditions: Evaluate how your broker’s spread, slippage, and execution speed affect the EA’s performance.

•Identify Unexpected Behavior: Catch any glitches or unforeseen issues that might not have appeared during backtesting.

•Build Confidence: Gain confidence in the EA’s ability to generate profits and manage risk before risking real capital.

Adapting to Market Conditions: The forex market is constantly evolving, influenced by economic news, geopolitical events, and shifts in sentiment. An EA that performs exceptionally well in a trending market might struggle in a ranging market, and vice-versa. Therefore, continuous monitoring and occasional adjustments to your EA’s settings are necessary. This doesn’t mean constantly tweaking parameters, but rather being aware of major market shifts and considering if your EA’s strategy is still appropriate. Some advanced EAs have adaptive algorithms, but most free forex robots 2025 will require manual oversight. For insights into using various tools to navigate market conditions, consider reading about top forex trading tools.

In essence, optimizing free forex robots is an ongoing process of testing, learning, and adapting. It transforms a basic free expert advisor download into a potentially powerful tool tailored to your trading style and the prevailing market environment. Remember, even working free EAs require your active participation to achieve their best performance.

While free forex robots offer numerous advantages, it is imperative to approach them with a clear understanding of their inherent risks and limitations. The term “free” does not equate to “risk-free,” and a failure to acknowledge potential pitfalls can lead to significant financial losses and frustration. Being aware of these challenges is crucial for anyone considering a free expert advisor download.

One of the most significant risks is the potential for scams and malicious software. The internet is rife with unscrupulous individuals offering seemingly miraculous free forex robots that promise unrealistic returns. These can often be disguised as malware, spyware, or simply poorly coded EAs designed to fail, leading to blown accounts. Always download free EAs from reputable sources like the MQL5 community or well-known forums with active, transparent discussions. Be extremely cautious of unsolicited offers or EAs promoted with exaggerated claims and no verifiable performance history. This is a common pitfall, and understanding common forex mistakes and their solutions can help you avoid such traps.

Another common limitation is the lack of dedicated support. Unlike paid EAs, which often come with professional customer service, updates, and community forums managed by the developers, free forex robots typically rely on community-driven support. While active communities can be incredibly helpful, they may not always provide immediate or comprehensive solutions to complex issues. This means traders using working free EAs might need to be more self-reliant in troubleshooting and problem-solving.

Over-optimization and curve fitting are significant technical risks. As discussed in the optimization section, it\’s easy to tweak an EA\’s parameters to perform exceptionally well on historical data. However, a system that is too perfectly tailored to past market conditions (curve-fitted) will likely fail when faced with new, unseen market behavior. Free forex robots 2025, especially those with many adjustable parameters, are susceptible to this. Traders must ensure their optimization process focuses on robustness rather than just maximizing historical profit.

Furthermore, performance variations in live markets are a reality. An EA that performs well in backtests or even on a demo account might struggle in a live trading environment due to factors like slippage, wider spreads, re-quotes, and the emotional impact of real money on the trader\’s psychology (even with automation, human oversight is still present). The difference between simulated and real-world trading conditions can be substantial, highlighting the importance of thorough forward testing on a demo account before risking live capital.

Finally, it\’s vital to maintain realistic expectations. No forex robot, free or paid, is a magic bullet for guaranteed riches. The forex market is inherently volatile and unpredictable. Free EAs, while powerful tools, are not immune to market shifts, economic events, or unexpected news. Expecting consistent, high returns without any drawdowns or losses is unrealistic and can lead to reckless trading decisions. Understanding concepts like leverage and margin in forex is crucial, as mismanaging these can amplify losses, especially with automated systems.

In conclusion, while free forex robots can be valuable assets, they come with a set of risks and limitations that demand careful consideration. Diligence in source verification, realistic expectations, and a commitment to thorough testing are paramount to mitigating these risks and leveraging the potential of the best no-cost forex robots effectively.

To truly harness the power of free forex robots and mitigate their inherent risks, adopting a disciplined approach and adhering to best practices is essential. Even the most promising working free EAs require careful management and strategic deployment to yield consistent results. By integrating these practices into your automated trading routine, you can significantly enhance your chances of success in the dynamic forex market.

Firstly, robust risk management strategies are paramount. This cannot be stressed enough. Automated trading, by its nature, can lead to rapid execution of trades, which means losses can accumulate quickly if not properly managed. Before activating any free forex robot, define your maximum acceptable drawdown, set appropriate stop-loss levels for each trade (if the EA allows), and determine your overall risk per trade as a percentage of your account balance. Never risk more than 1-2% of your capital on a single trade, regardless of how confident you are in the EA. Implement a global stop-loss for your account if available, or manually monitor your equity to prevent catastrophic losses. Understanding and applying sound risk management principles, as detailed in our guide on how to manage risk in forex trading, is non-negotiable.

Secondly, continuous monitoring and adjustments are crucial. While EAs automate trade execution, they do not eliminate the need for human oversight. The forex market is constantly evolving, and an EA that performed well in one market condition might struggle in another. Regularly check your EA\\’s performance, review its open trades, and analyze its closed trades. Be prepared to pause or disable the EA if market conditions change drastically or if its performance deviates significantly from your expectations. This proactive approach ensures that you remain in control and can intervene when necessary. For a comprehensive understanding of the forex market, consider reading our complete guide to forex trading.

Thirdly, diversification of EAs can help spread risk. Instead of relying on a single free forex robot, consider running multiple EAs that employ different strategies, trade different currency pairs, or operate in different market conditions. This diversification can help smooth out equity curves and reduce the impact of a single EA underperforming. However, ensure that the EAs are not correlated, meaning their strategies should not be similar enough to cause them to lose money simultaneously under the same market conditions. This is a more advanced strategy, but it can be highly effective for managing risk.

Fourthly, consider combining automated and manual trading. Free forex robots can handle the repetitive, emotionless execution of trades, freeing you to focus on higher-level analysis, strategy development, and manual intervention when market conditions warrant it. For instance, you might use an EA for trend following but manually close trades during major news events or periods of extreme volatility. This hybrid approach leverages the strengths of both automation and human intuition. Our article on how to use forex indicators for trading can provide insights into manual analysis that complements automated systems.

Finally, ensure regular software updates for your MetaTrader platform and any associated EA components. Developers often release updates to fix bugs, improve performance, or adapt to changes in market conditions or platform functionalities. Staying updated ensures your free forex robots 2025 are running optimally and securely. Always back up your settings and data before performing any updates. For a general overview of tools available, including those that can help with updates, refer to our article on top forex trading tools.

By diligently applying these best practices, traders can transform free expert advisor download options from mere experiments into powerful, reliable components of their overall trading strategy. The goal is to create a symbiotic relationship between the trader and the working free EA, where automation handles the heavy lifting, and human oversight provides the necessary guidance and risk control.

The landscape of forex trading is in a constant state of evolution, driven by technological advancements, regulatory changes, and shifts in market dynamics. Free forex robots, as a significant component of automated trading, are poised to evolve alongside these trends. Looking ahead to 2025 and beyond, several key developments are likely to shape the future of working free EAs, making them even more sophisticated, accessible, and potentially impactful for retail traders.

One of the most significant drivers of future innovation will be the continued advancements in Artificial Intelligence (AI) and machine learning (ML). While many current EAs operate on predefined rules, future free forex robots 2025 are likely to incorporate more adaptive and predictive capabilities. AI-powered EAs could learn from market data in real-time, identify complex patterns that human traders might miss, and adjust their strategies dynamically to changing market conditions. This could lead to more robust and resilient EAs that are less susceptible to over-optimization and more capable of navigating volatile environments. The integration of neural networks and deep learning algorithms could enable EAs to make more nuanced trading decisions, moving beyond simple indicator-based entries and exits [6].

Another trend is the growing community development and collaboration. The open-source movement has already significantly contributed to the availability and quality of free expert advisor download options. This collaborative spirit is likely to intensify, with more developers and traders sharing their knowledge, code, and backtesting results. Platforms like MQL5 will continue to serve as central hubs for this collaboration, fostering an environment where free EAs are continuously refined, debugged, and improved by a global community. This collective intelligence can lead to the rapid development of innovative solutions and quicker adaptation to new market challenges.

Furthermore, we can expect increased accessibility to automated trading tools. As technology becomes more user-friendly, the process of installing, configuring, and optimizing free forex robots will likely become simpler, requiring less technical expertise. Cloud-based solutions and web-based platforms might emerge, allowing traders to run EAs without needing to keep their MetaTrader terminals open 24/5 on a dedicated VPS. This enhanced accessibility will further democratize automated trading, enabling even more individuals to explore the benefits of free EAs. The general trend towards user-friendly trading tools, as discussed in our article on choosing the best forex trading tools, will undoubtedly extend to free EAs.

However, with increased sophistication and accessibility will also come new challenges. Regulatory bodies may introduce stricter guidelines for automated trading, and the market itself will become more efficient as more participants adopt algorithmic strategies. This will necessitate that free forex robots 2025 are not only intelligent but also highly adaptable and capable of operating within evolving market structures. The emphasis will shift from simply finding a working free EA to finding one that can consistently adapt and perform in an increasingly competitive and dynamic environment.

In essence, the future of free forex robots is bright, promising more intelligent, collaborative, and accessible tools for retail traders. However, success will continue to hinge on the trader\\\\’s ability to understand these tools, apply sound risk management, and remain adaptable in a constantly changing market. The journey with free EAs will remain one of continuous learning and strategic evolution.

The quest for the best free forex robots that actually work in 2025 is a journey that combines technological exploration with disciplined trading practices. As we have seen, free Expert Advisors offer an invaluable gateway into the world of automated forex trading, providing accessibility, cost-effectiveness, and a fertile ground for learning and experimentation. They empower traders to execute strategies with precision, manage risk, and potentially achieve consistent profits without the significant financial outlay often associated with proprietary software.

However, the path to success with free EAs is not without its challenges. It demands a discerning eye to identify truly working free EAs amidst a sea of options, a commitment to rigorous backtesting and forward testing on demo accounts, and a proactive approach to optimization and risk management. The potential for scams, the absence of dedicated support, and the ever-present risk of over-optimization are critical considerations that every trader must acknowledge and actively mitigate.

Ultimately, the effectiveness of a free forex robot lies not just in its code, but in the hands of the trader who wields it. By understanding the key features to look for, diligently choosing an EA that aligns with your trading style, meticulously installing and optimizing it, and adhering to best practices in risk management and continuous monitoring, you can transform a simple free expert advisor download into a powerful asset in your trading arsenal. The future promises even more intelligent and accessible free EAs, driven by advancements in AI and collaborative community development, further solidifying their role in the evolving forex landscape.

We encourage you to explore the vast potential of automated trading, always prioritizing education, thorough testing, and prudent risk management. For more tools, resources, and in-depth guides on forex trading, including various strategies and tools, we invite you to visit GregForex.com. Your journey towards smarter, more efficient trading starts here.

Jack Henry

30/07/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...