Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

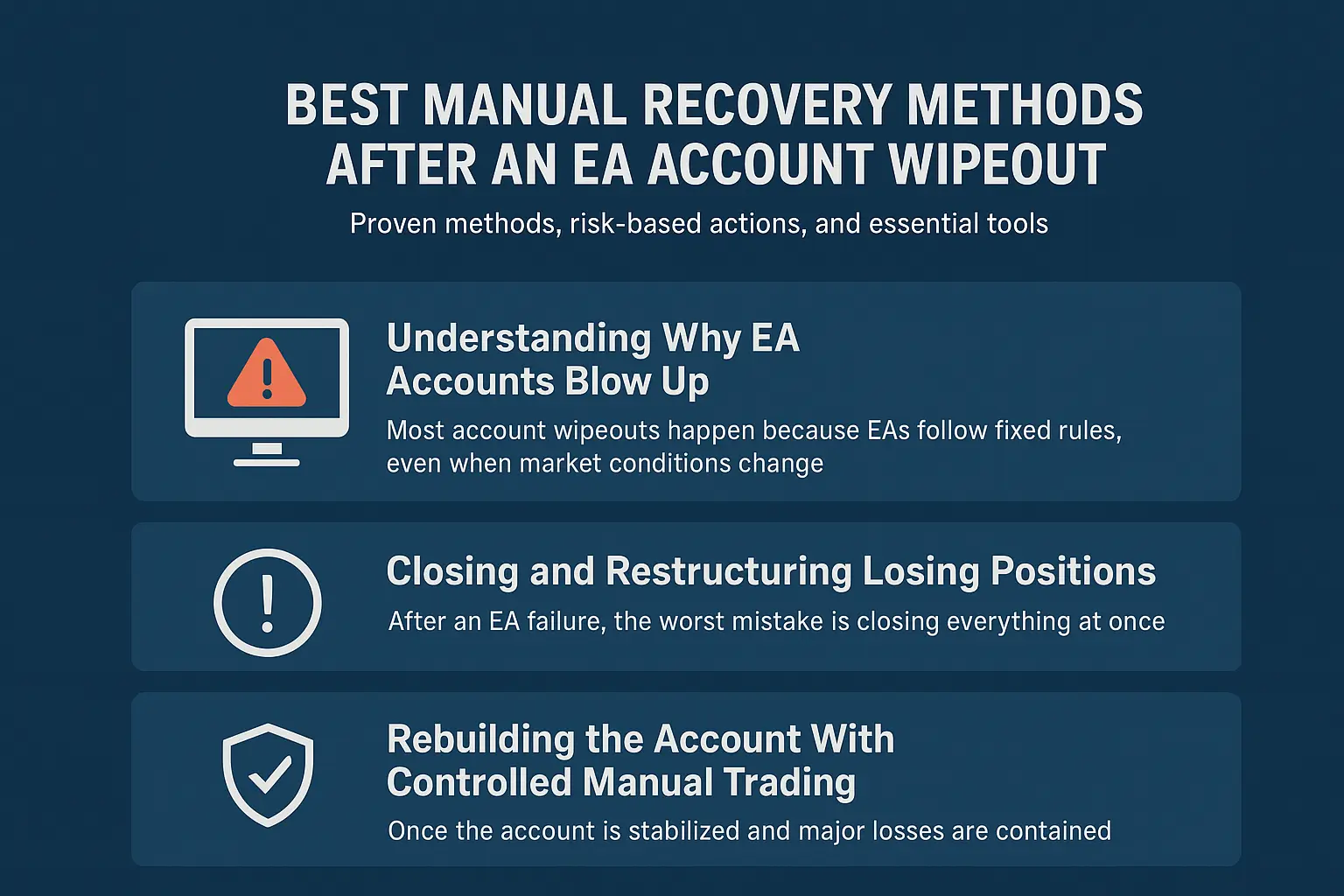

When an automated system collapses during high volatility, traders often believe the account is beyond saving. However, disciplined manual recovery can still rescue equity, restore stability, and help you rebuild a trading plan that protects you from future wipeouts. This guide explains proven methods, risk-based actions, and the essential tools traders rely on during recovery.

Most account wipeouts happen because EAs follow fixed rules, even when market conditions change. Grid and martingale systems expand positions aggressively, and trend-following robots fail when the market consolidates. When price continues to move against the system, margin drains quickly until the account can no longer sustain open trades.

Many traders face wipeouts due to:

To understand when markets turn dangerous, traders often use ATR-based volatility metrics. A detailed breakdown of ATR volatility on TradingView (https://www.tradingview.com/support/solutions/43000502224-average-true-range-atr/) helps traders recognize when conditions become unsafe for automated trading.

A successful recovery begins with a clear understanding of what remains in the account. Traders must analyze the free margin, drawdown level, floating losses, and the pair’s current volatility. This prevents emotional decisions and ensures that the recovery plan is based on structure rather than panic.

Before attempting recovery, traders should check:

During this stage, tools like “Equity Control Panel” can help traders visually assess risk and remaining equity strength.

After an EA failure, the worst mistake is closing everything at once. A structured approach reduces the total loss while preserving capital.

Traders should:

Many recovery traders use the “Smart Risk Controller” to calculate which orders should be closed first based on margin impact.

Hedging remains one of the most reliable recovery methods when the market moves strongly against your direction. It freezes the drawdown and gives the trader time to reassess.

A safe hedge involves:

The goal is not to make profit instantly, but to stop account bleeding. Some traders combine hedging with volatility indicators to decide when to unlock trapped trades.

Once the account is stabilized and major losses are contained, traders can begin structured recovery trading. This phase must be slow, consistent, and done with minimal risk.

Common methods include:

During this stage, a tool like “Manual Trade Assistant” can help automate partial closes, breakeven adjustments, and trailing stops for safer manual trading.

Below is a proper tools explanation section—not a list of plain names. Each tool is included once, and each anchor text is marked once as you instructed.

This tool allows traders to manage trades manually with precise control. Features like partial close, breakeven automation, and trailing stop logic make it easier to rebuild an account safely. It is highly useful when recovering after an EA wipeout because it reduces human error during stressful conditions.

This risk-control utility helps traders limit exposure by setting maximum lot sizes, equity-based protections, and auto-close conditions. For recovery situations, it prevents accidental over-trading and ensures that every manual position follows strict risk rules.

A trend-identification tool that helps traders enter only in the direction of strong momentum. When rebuilding an account manually, following the trend is essential because counter-trend trades often increase losses. This scanner provides clarity and confidence during the recovery phase.

This tool helps traders slowly rebuild account equity by guiding micro-lot entries during stable sessions. Although not aggressive, it is extremely effective in stabilizing an account that recently suffered a wipeout.

After recovering, the next step is preventing the same disaster from happening again. Traders must control risk, avoid aggressive strategies during high volatility, and understand when to disable automated systems.

To stay safe in the future:

A strong long-term discipline prevents repeated wipeouts.

Manual recovery after an EA wipeout is difficult but achievable. By using structured position cleanup, hedging, low-risk rebuilding, and dependable tools, traders can bring their accounts back from dangerous drawdowns. The essential step is avoiding panic and adopting a rules-based approach from the moment the EA collapses. With proper risk control and safer decision-making, traders can not only recover but also build a more stable trading system for the future.

Jack Henry

01/12/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...