Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Grid trading has always been a high-risk but high-potential strategy, especially during market volatility. The year 2025 was one of the most unpredictable years in recent forex history, with aggressive spikes, deep pullbacks, and unexpected flash crashes. Despite this chaos, a few grid systems managed not only to survive but also to outperform many trend and scalping robots.

The systems that performed well throughout 2025 included Grid Master Pro, AI Grid Scalper, Ultra Grid Manager Pro, and Gold Grid Sniper. These tools used smarter spacing, volatility filters, and controlled lot sizing—helping traders avoid dangerous basket buildup. The difference between successful and failed grid robots in 2025 came down to risk control, adaptive logic, and intelligent order management.

External resources like the volatility index from Investing.com and FXStreet market updates helped traders predict when the markets were unsafe. Traders who combined these insights with strong grid systems gained a big advantage.

The 2025 market environment was brutal. Assets like EURUSD, GBPUSD, XAUUSD, and NAS100 experienced multiple sudden 300–600 pip moves. Most basic grid EAs, especially those using martingale, blew accounts within minutes during high-volatility phases.

But advanced systems had built-in intelligence: widening grid distances, slowing down entries, or pausing trading when volatility became extreme.

Platforms like TradingView provided volatility indicators that helped traders adjust settings or temporarily pause trading.

The grid robots that did well in 2025 shared a few essential characteristics.

Systems like AI Grid Scalper automatically expanded spacing when ATR values increased. This prevented tight clustering of trades during chaotic movements.

Bots such as Grid Master Pro used fixed or semi-fixed lots. Avoiding aggressive doubling helped accounts stay stable.

Gold Grid Sniper was popular because it paused trading when gold entered sharp one-direction trends.

Traders frequently paired grids with safety tools like Account Protector Shield and Risk Manager Pro.

Below are the grid systems that proved their strength throughout extreme volatility.

A stable performer on EURUSD thanks to controlled lot sizing and smart trend recognition.

Well-known for reacting quickly to sudden spikes through adaptive spacing and volatility-sensitive logic.

Performed well across multiple pairs because of its slowdown mode that reduces order frequency during high-risk periods.

Designed specifically for XAUUSD, where volatility is always high. Its trend filters prevented unnecessary exposure.

In 2025, traders learned that grid systems alone are not enough. Many used recovery and protection tools to reduce drawdown and protect capital.

Helped recover baskets without enlarging lot sizes dangerously.

Stopped all trading automatically when drawdown reached the danger zone.

Protected traders during sudden spikes by freezing all EAs when equity dropped too fast.

For more volatility guidance from Myfxbook ensured traders avoided unstable sessions.

The following tools were among the most widely adopted by traders seeking safer, more stable, and more controlled grid performance throughout the turbulence of 2025. Each tool contributed a different layer of protection, automation, or adaptive intelligence—making them essential components of a modern grid trading portfolio.

A highly trusted grid engine known for its disciplined approach to lot sizing. Grid Master Pro became a favorite among conservative traders because it avoids aggressive martingale and incorporates trend recognition to prevent stacking positions against strong momentum. This tool excels on low-to-moderate-volatility pairs like EURUSD, where stability and controlled exposure are key.

One of the most advanced systems on the list, AI Grid Scalper uses machine-learning-inspired logic to adjust grid spacing in real time based on ATR, volatility spikes, and recent market behavior. It’s popular among traders who operate during news-heavy sessions and unpredictable markets. Its automatic spacing expansion helped many accounts survive sudden 300+ pip moves.

This multi-pair grid controller is designed for traders who run several grids at once. Its standout feature is “Slowdown Mode,” which reduces order frequency when volatility becomes dangerous. The system also dynamically widens spacing across correlated pairs to avoid simultaneous basket buildup. It is especially useful for sideways markets, range-bound trading, and portfolio-style grid setups.

Specially engineered for XAUUSD, Gold Grid Sniper focuses on identifying gold’s notoriously sharp one-way trends before they cause catastrophic drawdowns. Its trend filter and pause logic allowed traders to sidestep several 2025 gold breakouts that wiped out many traditional grid bots. This tool is widely used by gold scalpers and swing traders who want the benefits of grids without the extreme risk.

No grid strategy is complete without a strong risk cutoff mechanism. Risk Manager Pro functioned as a safety net during the 2025 volatility storms by halting all trading when drawdown reached a predefined threshold. It also offers dynamic equity protection, daily loss limits, and automated lot reduction—making it essential for preventing account blowouts during flash crashes.

This tool acted like an emergency brake for traders. When equity dropped too quickly or spreads suddenly widened, Account Protector Shield instantly froze all Expert Advisors. It was particularly effective during high-impact news events and unexpected spikes. Many traders credit this tool with saving accounts that otherwise would have been destroyed in minutes.

Rather than using aggressive martingale, Balance Recovery Engine offers controlled, soft recovery logic that gradually works out large baskets without dangerous lot escalation. It is ideal for traders running multiple grid systems or those who occasionally inherit oversized baskets during extreme volatility. Its ability to recover drawdown while maintaining risk balance made it one of the most valuable auxiliary tools in 2025.

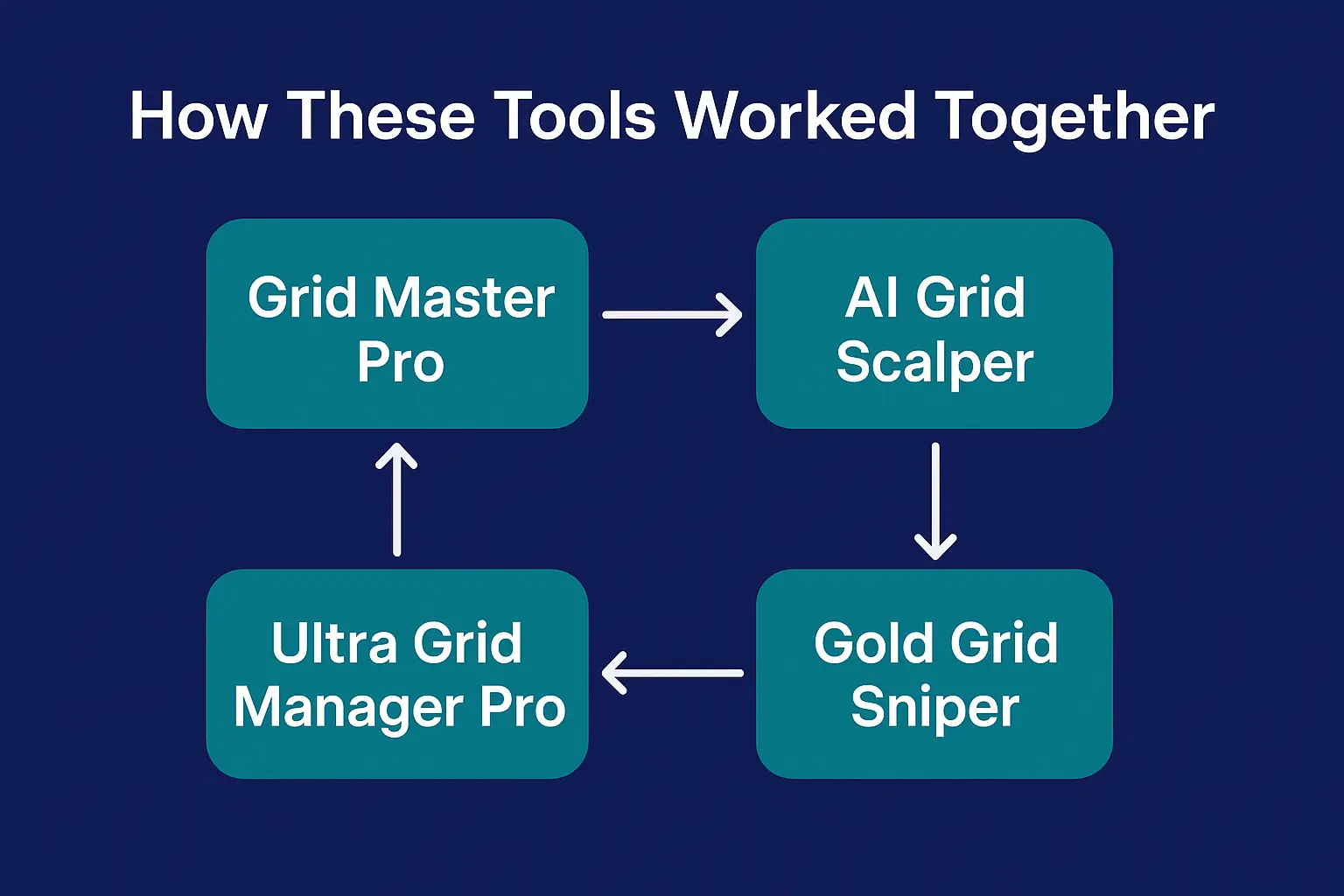

Traders who combined two or more of these tools gained a strategic advantage:

Each tool played a role in reducing risk, managing basket size, widening spacing during high volatility, and protecting accounts during unexpected market spikes.

| System Name | Best Market | Key Strength | Ideal User |

|---|---|---|---|

| Grid Master Pro | EURUSD | Trend filters + safe lot control | Conservative traders |

| AI Grid Scalper | GBPUSD | Adaptive spacing + volatility logic | Volatility traders |

| Ultra Grid Manager Pro | Many pairs | Slowdown mode + spacing automation | Sideways market users |

| Gold Grid Sniper | XAUUSD | Gold trend filters + stable scaling | Gold traders |

| Risk Manager Pro | All pairs | Equity stop + protection rules | Risk-focused traders |

| Balance Recovery Engine | All pairs | Soft recovery handling | Traders with large baskets |

Why did many grid systems fail in 2025?

They used tight spacing, aggressive martingale, and no volatility filters—leading to oversized baskets.

Which grid systems survived the most volatility?

Tools like AI Grid Scalper, Grid Master Pro, and Gold Grid Sniper performed exceptionally well due to adaptive logic.

Is grid trading risky?

Yes, but risk can be reduced with proper spacing, low lot sizes, and equity protection tools.

Can grid systems survive a market crash?

Strong ones with volatility adaptation can. Weak martingale grids usually cannot.

Grid trading is powerful but dangerous during extreme market shifts.

The year 2025 proved that only well-designed, safety-focused grid systems can survive high volatility. Systems such as Grid Master Pro, AI Grid Scalper, Ultra Grid Manager Pro, and Gold Grid Sniper outperformed because they adjusted spacing, controlled lot sizes, and avoided trading during risky conditions.

When paired with strong protection tools like Balance Recovery Engine and Account Protector Shield, grid traders managed to preserve capital and even profit during the most unpredictable market year.

With smart settings and careful monitoring, grid trading remains a viable approach for 2026 and beyond.

Jack Henry

29/11/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...