Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

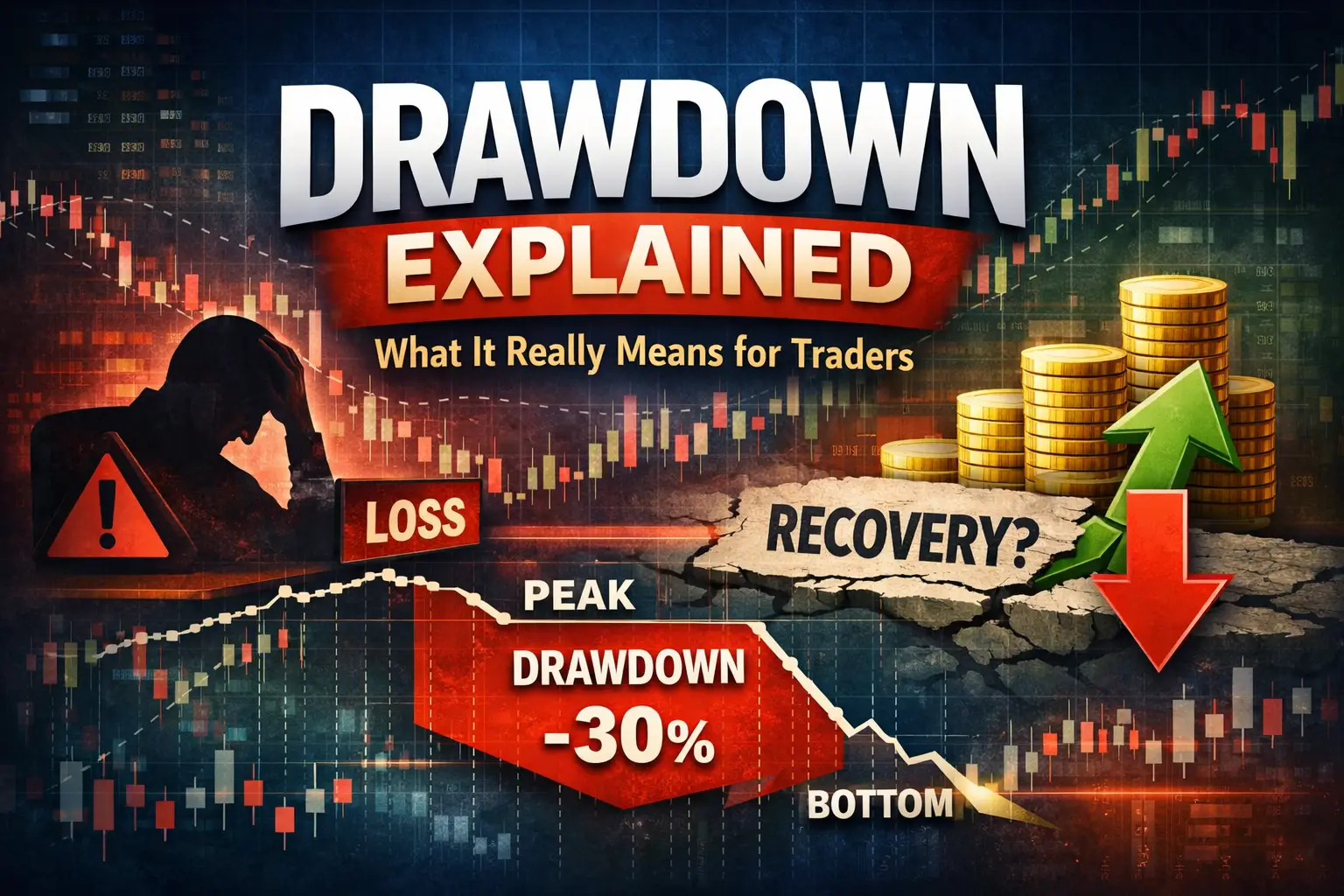

Drawdown is one of the most misunderstood concepts in forex trading. Many traders concentrate on profits, win rates, or monthly returns, but often ignore the metric that truly determines long-term survival. Drawdown measures how much an account declines from its peak before recovering—and more importantly, whether that recovery is realistic at all.

An account with high returns but uncontrolled drawdowns is fragile. One bad period can erase months or even years of progress. This is why experienced traders and professional systems evaluate performance through drawdown first, not profit alone.

In this article, we’ll break down what drawdown really means, how it works in real trading conditions, why it matters more than most performance metrics, and how traders can manage it effectively over the long term without destroying their accounts.

Drawdown refers to the percentage or monetary decline of a trading account from its highest point to its lowest level before a new high is reached. It shows the depth of losses during a losing period and gives a clear picture of how much an account can fall under pressure.

For example, if an account grows from $10,000 to $12,000 and then drops to $9,000, the drawdown is calculated from the peak of $12,000 down to $9,000. This represents a 25% drawdown, even though the account is only $1,000 below its original balance. This distinction is important because drawdown measures losses from equity highs, not from the starting capital.

Understanding drawdown helps traders evaluate whether a strategy is sustainable over time or simply experiencing temporary gains. For a detailed explanation of drawdown and its role in evaluating trading systems, you can read Investopedia’s guide on drawdown in trading.

While profit shows how much a trader can make, drawdown reveals how much they can potentially lose before things break. Two traders may achieve the same annual return, but the one with lower drawdown carries far less risk and stress. High drawdowns not only create psychological pressure but also force poor decisions and mathematically require much higher returns just to break even.

This is why professional traders and funds always prioritize drawdown control over aggressive growth—survival comes first. Protecting an account during unstable market conditions is crucial, and the importance of this becomes especially clear during high-volatility phases. For strategies to safeguard your trading account in turbulent markets, see our guide on how to protect a forex account during a market crash.

Many traders underestimate how difficult it is to recover from large losses. The deeper the drawdown, the harder it becomes to bounce back. Understanding the nonlinear relationship between losses and recovery is critical for long-term survival.

Key points to consider:

Automation doesn’t change the math: Traders chasing high win rates or fast growth, especially with automated systems, often ignore these principles. For insights on how expert advisors handle risk and recovery, see our guide on what makes a great Forex EA.

Small drawdowns are manageable: A 10% drawdown requires roughly an 11% gain to recover.

Moderate drawdowns grow fast: A 30% drawdown requires about a 43% gain.

Large drawdowns can be devastating: A 50% drawdown demands a 100% gain, making recovery extremely challenging.

Focus on realistic risk: Managing drawdowns isn’t about avoiding losses entirely, but keeping them small enough to recover from without jeopardizing the account.

Drawdown occurs in both manual and automated trading, but automation can amplify losses faster if risk controls are not properly implemented. Expert Advisors (EAs) execute trades exactly as programmed, without hesitation or fear, which means uncontrolled automation can lead to rapid account declines.

If safeguards such as position sizing, trade limits, or equity protection are missing, an EA can accumulate losses quickly during unfavorable market conditions. This is why drawdown control must be integrated into the strategy, not treated as an afterthought. Understanding how automated systems behave during losing periods allows traders to design safer, more resilient trading strategies. For practical insights, see our guide on how Forex automation really works.

Even the best automated strategies require platform-level oversight. MetaTrader documentation emphasizes the importance of monitoring equity, exposure, and trade activity when using automated systems. Learn more about account-level controls and trade management in the official MetaTrader 5 help guide.

Managing drawdown isn’t about finding the perfect trade entry—it’s about controlling exposure, position sizing, and trade frequency. Even the best strategies can fail if risk isn’t properly managed.

Professional traders use several key tools to keep their accounts safe. These include fixed percentage risk per trade, maximum daily loss limits, trade caps, and equity stop rules. Together, these measures ensure that a bad day or week doesn’t turn into a catastrophic loss.

Position sizing is central to effective risk control. Using the correct lot size relative to account balance helps limit potential losses and keeps drawdowns manageable. As explained by Babypips, proper position sizing forms the foundation of risk management and drawdown control. For a detailed guide on calculating and applying position sizing, check out Babypips’ position sizing guide.

Not all drawdowns are created equal. Maximum drawdown represents the worst historical decline in an account, while average drawdown measures how often and how deeply losses occur under normal market conditions.

A system with a rare but massive drawdown can be far more dangerous than one with frequent, smaller drawdowns. This is why traders should evaluate both metrics together rather than focusing on a single number. Backtests that hide drawdown behavior can give a false sense of security. Understanding how a system behaves under stress is essential for long-term survival. For practical examples of how automated systems handle sudden market drops, see our guide on real backtests and Forex EAs in volatile markets.

Drawdown isn’t just a financial issue—it’s a psychological challenge. Large drawdowns can trigger fear, revenge trading, strategy hopping, and abandonment of established rules.

Traders who accept small, controlled drawdowns are more likely to stay disciplined and stick to their strategies. Those who experience deep losses often deviate from their plans, jeopardizing long-term success. This underscores the importance of structured planning and predefined risk limits. For guidance on creating a structured approach, see our comprehensive guide on forex trading plans.

Understanding drawdown is only the first step. In real trading, controlling drawdown requires execution logic, position sizing rules, and protective automation, not just theory. Certain tools are specifically designed to limit exposure, reduce overtrading, and prevent aggressive recovery behavior that often leads to deep equity drops.

For traders focused on stability, systems like Sigma Trend Protocol EA use structured trend confirmation and controlled entries instead of frequent trades. This approach helps minimize prolonged drawdown phases during choppy markets. Learn more about this tool here: Sigma Trend Protocol EA.

Breakout-based strategies can also help control drawdowns by avoiding ranging market conditions. Tools like Currency Pros Breakout EA focus on defined price expansion zones rather than continuous market exposure, helping traders reduce losses during low-momentum periods. Check it out here: Currency Pros Breakout EA.

Adaptive systems, such as AI Forex Robot v5.2 MT4, use dynamic market filtering instead of fixed indicator thresholds. This allows the system to adjust to changing market conditions, reducing repeated losses and helping maintain a more controlled drawdown. Learn more here: AI Forex Robot v5.2 MT4.

In addition to entry logic, account-level risk controls are essential. Utilities like Trade Assistant v10.27 MT4 let traders enforce daily loss limits, trade caps, and equity protection rules, preventing minor drawdowns from turning into account-threatening declines. More details are available here: Trade Assistant v10.27 MT4.

Many traders unintentionally increase their drawdowns by raising risk after losses, removing stop-losses, or letting trading systems run unchecked during unfavorable market conditions.

These mistakes usually stem from impatience and emotional pressure, rather than a lack of knowledge. Reacting emotionally to losses often leads to even larger drawdowns and can threaten long-term account survival.

Recognizing these patterns early is essential for maintaining control over your trading account. By sticking to structured rules and risk limits, traders can avoid compounding mistakes and protect their capital. For a detailed guide on the most common errors and how to avoid them, see our article on common EA mistakes new traders still make.

Drawdown represents the true cost of trading. It measures risk, tests a trader’s discipline, and ultimately determines whether an account can survive long enough to grow.

Traders who focus solely on profits often encounter losses that are difficult—or even impossible—to recover from. In contrast, those who manage and control drawdown maintain their accounts through difficult periods, allowing skill, experience, and the power of compounding to work in their favor.

Understanding drawdown is not optional for serious traders; it is a fundamental requirement for long-term trading success. Mastering drawdown control ensures not only survival but also consistent growth in the competitive world of forex trading.

Jack Henry

05/01/2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...