Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

As 2025 comes to a close, many traders are reassessing their trading setups to prepare for early 2026. Market conditions over the past year have shown increased volatility, tighter liquidity windows, and faster reactions to macroeconomic events. These shifts make it essential to rely on forex tools that emphasize risk control, adaptability, and consistency rather than aggressive recovery logic.

End-of-year portfolio adjustments are not about chasing performance. They are about removing weak tools, strengthening core systems, and entering the new year with strategies designed for modern market behavior.

This guide covers the most practical forex tools traders should consider adding before 2026 begins, focusing on stability, adaptability, and long-term usability.

Forex markets entering a new year often experience:

Traders who rely on the same tools year after year without review often face unexpected drawdowns when market structure shifts. The goal of an end-of-year setup review is to ensure that each tool serves a specific purpose, rather than overlapping or increasing risk.

Trend-following systems continue to outperform during periods where markets move in sustained directional phases rather than chaotic reversals. Sigma Trend Protocol EA focuses on identifying higher-probability trend continuation rather than attempting to predict tops or bottoms.

How It Fits a 2026 Setup

This EA is well-suited for traders who want exposure to directional moves while avoiding overtrading. It works best when combined with conservative risk parameters and session-based filters.

Suggested Use

Why It Belongs in an End-of-Year Setup

Breakout strategies remain relevant when markets transition from consolidation to expansion, a pattern often seen after year-end liquidity resets. Currency Pros Breakout EA focuses on structured breakouts rather than impulsive price spikes.

How It Fits a 2026 Setup

This tool complements trend systems by capturing volatility expansions after prolonged compression phases. It does not attempt to recover losses aggressively and relies on confirmation logic.

Suggested Use

Why It Belongs in an End-of-Year Setup

Adaptive systems are increasingly valuable as markets shift between trend, range, and volatility cycles more frequently. AI Forex Robot v5.2 adjusts its decision-making based on changing market behavior rather than following static rules.

How It Fits a 2026 Setup

This EA acts as a flexible component within a broader strategy, helping traders stay active without forcing trades during uncertain conditions.

Suggested Use

Why It Belongs in an End-of-Year Setup

No automated or semi-automated strategy is complete without proper risk control. Trade Assistant v10.27 functions as a support tool rather than a signal generator, helping manage exposure across multiple strategies.

How It Fits a 2026 Setup

This tool helps traders enforce discipline by standardizing risk, managing trade execution, and avoiding over-exposure during volatile periods.

Suggested Use

Why It Belongs in an End-of-Year Setup

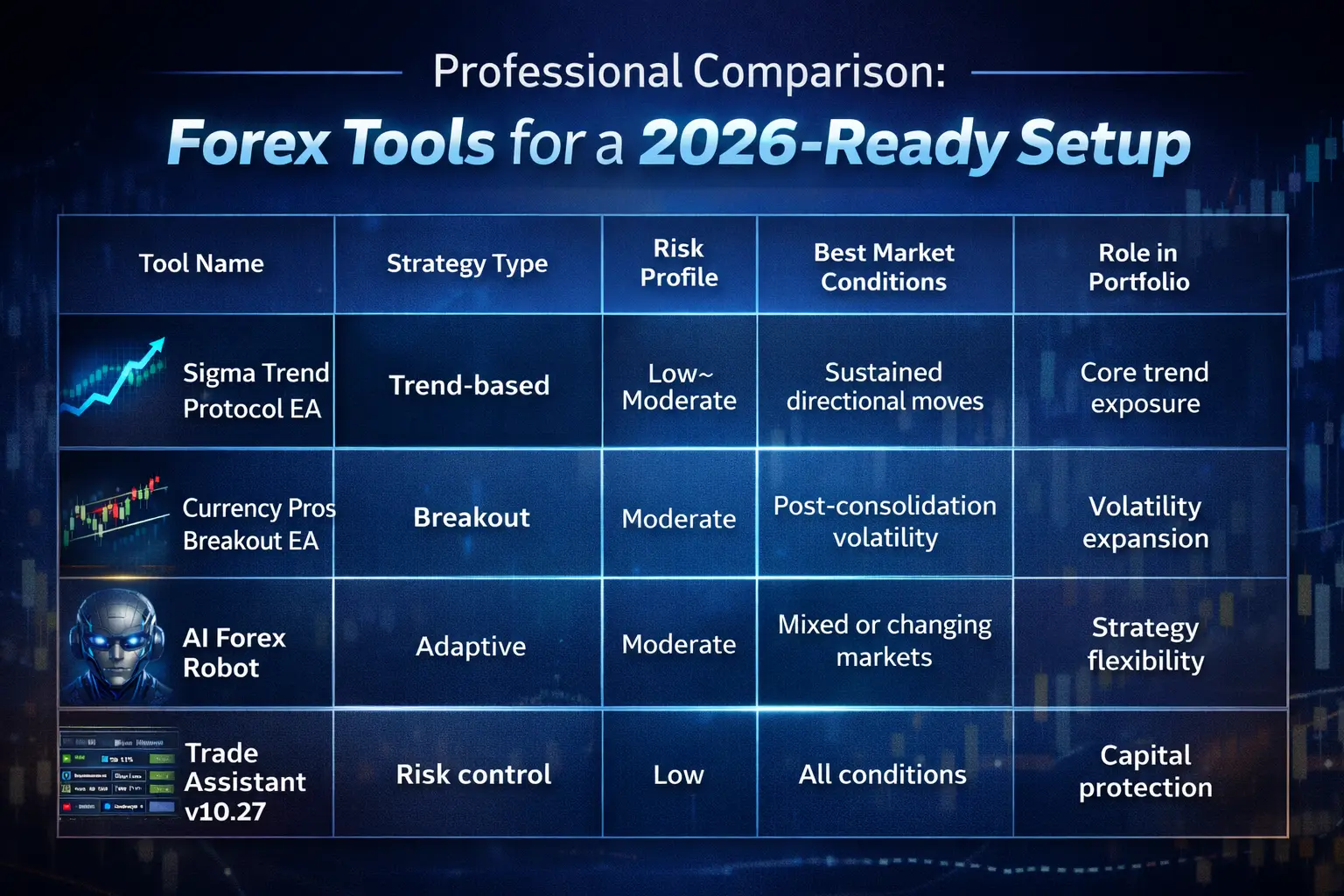

| Tool Name | Strategy Type | Risk Profile | Best Market Conditions | Role in Portfolio |

|---|---|---|---|---|

| Sigma Trend Protocol EA | Trend-based | Low–Moderate | Sustained directional moves | Core trend exposure |

| Currency Pros Breakout EA | Breakout | Moderate | Post-consolidation volatility | Volatility expansion |

| AI Forex Robot v5.2 | Adaptive | Moderate | Mixed or changing markets | Strategy flexibility |

| Trade Assistant v10.27 | Risk control | Low | All conditions | Capital protection |

Market behavior heading into 2026 suggests:

Each tool listed above serves a distinct function, reducing overlap while improving overall portfolio balance.

Should traders replace old EAs at the end of the year?

Not always, but reviewing performance and relevance is essential. Tools that no longer align with current market behavior should be reduced or removed.

Is it better to use multiple tools or one strong EA?

A small number of well-defined tools with different roles is generally safer than relying on a single strategy.

Do these tools work for both beginners and experienced traders?

Yes, provided risk settings are kept conservative and traders understand the role each tool plays.

Is risk management still necessary with automated tools?

Absolutely. Automation does not eliminate risk—it only manages execution.

Preparing for 2026 is not about predicting the market. It is about building a resilient trading setup that can handle uncertainty, volatility, and structural change. Trend systems, breakout logic, adaptive automation, and strong risk management tools form the foundation of a sustainable forex strategy.

By refining tool selection at the end of the year, traders place themselves in a stronger position to navigate early-2026 market conditions with confidence and control.

Jack Henry

25/12/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...