Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

When a market crash wipes out automated trading profits, disappointment can overshadow your next steps. Yet, these moments also provide the best opportunity to future-proof your trading. Rebuilding your EA portfolio after a meltdown isn’t about snapping up new bots blindly—it’s a process of reflection, testing, and strategic selection. Here’s how to rebuild smarter, stronger, and with confidence that your next crisis response will be fundamentally better.

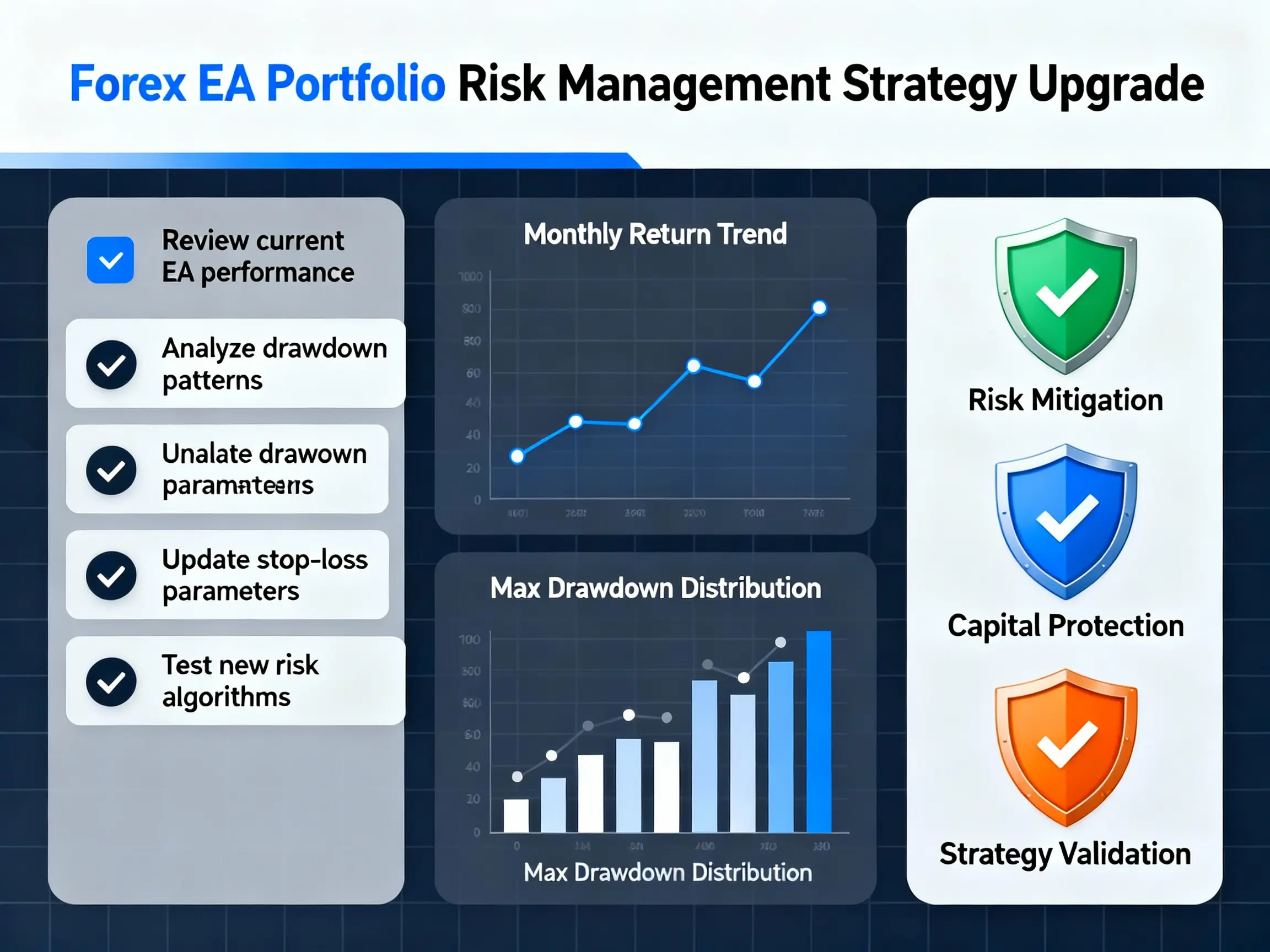

After a severe drawdown, begin by auditing all EAs in your lineup. Study each algorithm’s trade log, equity curve, and reaction to volatility. Use analytical tools like How to Backtest Your EA for Real Market Crashes to pinpoint whether bots failed due to overexposure, lack of news awareness, or simply poor stop-loss mechanics.

Dig into loss streaks and investigate whether failures came from structural flaws, late reaction to volatility, or breakdowns in signal quality. Benchmark each EA’s performance against crisis-proof portfolios documented on sites like Investopedia.

Weak EAs with rigid trade logic or missing risk controls undermine any portfolio, especially after a crash. Cut bots without adjustable drawdown caps or volatility adaptation as a priority.

Establish rules for your portfolio: EAs like WyFX Martingale Pro EA show how trade frequency controls and built-in equity caps can prevent a single bad cycle from destroying your capital. Only keep systems that meet your stricter risk rules.

Your new EA selections should demonstrate resilience: dynamic position sizing, real-time regime switching, and proven crash backtesting. Focus on best-in-class tools for each risk scenario.

Integrate at least one bot that senses and adjusts to market volatility, such as OXY AI EA MT4, for proactive risk scaling—a critical feature in unpredictable markets.

No matter how strong a single strategy seems, over-reliance is fatal. Blend trend, grid, breakout, and manual-intervention bots for currency, commodities, and different market sessions.

EAs like DS Gold Robot v4.0 MT4 specialize in volatile gold markets and avoid dangerous periods by restricting trade to safe sessions. Balanced portfolios are proven to reduce drawdown risk.

Every algorithm should be tested on years of historical data—including major crash periods—to validate its survival strategy. Use extreme settings for slippage and spread to simulate the real market chaos.

Complex bots such as Sniper Auto Trader v19 for NT8 demonstrate value with multi-timeframe logic, confirming that signals agree across several time scales before committing real capital.

| Portfolio Recovery Step | Key Feature | Example/Resource | Why It Matters |

|---|---|---|---|

| Remove failing EAs | Equity caps, manual overrides | WyFX Martingale Pro EA | Cuts risk, prevents total loss |

| Add adaptive, crash-tested bots | Dynamic sizing, volatility filters | OXY AI EA MT4 | Shrinks exposure as market risk grows |

| Diversify strategies and assets | Session & asset filtering | DS Gold Robot v4.0 MT4 | Avoids single-point failure, smooths overall returns |

| Rigorous live & crash backtesting | Multi-timeframe stress simulation | How to Backtest Your EA for Real Market Crashes | Identifies weaknesses before risking capital |

| Real-time monitoring & intervention | Dashboard alerts, manual journals | Ruth the Forex Lady BTMM | Lets traders halt EAs before deep drawdowns |

| Upgrade to event-driven risk rules | News filters, dynamic halts | Babypips Volatility Stop-Loss Guide | Protects against major news-driven moves |

| Community research & peer review | Forums, expert authority blogs | Investopedia, FXStreet | Ongoing insight, helps spot and avoid future traps |

Automation doesn’t mean ignoring live conditions. Set up dashboards, alerts, and instant-pause features. Always retain discretionary control to intervene when early signs of trouble appear.

Following lessons from Ruth the Forex Lady BTMM, maintain a log of when and why you intervene. Many 2025 survivors credit manual checks with preventing much steeper losses.

Layer on stricter equity limits, event-driven logic, and robust volatility-based trade rules everywhere.

Utilize alerts that trigger reduced exposure or full trade suspension as soon as volatility or drawdown exceed your thresholds. Reacting early is the essence of robust risk control.

Never stop learning. Follow leading technical blogs and engage in trader communities to review case studies, software updates, and crash testimonials.

Platforms like Investopedia and FXStreet deliver new strategies, while social trading communities provide invaluable peer insight on EA selection and portfolio defense.

How do I know if my portfolio is still too risky after a crash?

Audit each EA for proper equity limits, volatility and news filters, and past crisis performance. If any bot lacks these, or failed badly in stress tests, it’s time to replace or upgrade.

How many EAs should a robust portfolio contain?

It depends on your capital and diversification needs, but usually 3–6 bots spanning different strategies, timeframes, and asset classes works well. Avoid overexposure to one algorithm or market.

How important is crash backtesting before going live again?

It’s absolutely essential. Use guides like How to Backtest Your EA for Real Market Crashes and run simulations with extreme parameters to ensure your EAs survive future volatility.

Are manual controls and intervention really necessary?

Yes. Even the best bots can fail under rare conditions—manual dashboards, intervention logs, and alert systems let you pause or adjust trading before irreversible loss.

Should I rely on forums and blogs for EA recommendations?

Trader communities and resources such as Investopedia and FXStreet offer practical insights, but always validate bots and strategies for your specific needs and risk tolerance.

What is the single biggest risk when rebuilding after a crash?

Starting fresh with the same untested or rigid EAs. Always demand dynamic, adaptive risk logic and thorough backtesting in every new selection.

Can I ever insure against major losses?

You can’t prevent all risk, but with strong diversification, defensive settings, rigorous oversight, and real-time alerts, you drastically increase your odds of surviving future market meltdowns.

Successful rebuilding after a crash depends on honest analysis, smarter tool selection, daily risk discipline, and continuing education. By combining rigorous backtests, portfolio diversification, real-time oversight, and engagement with the latest industry thinking, you’ll build an EA portfolio that’s built not only for the next rally, but ready for the next storm.

Jack Henry

13/11/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...