Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Trading in high-volatility markets can be challenging. Sudden swings, economic shocks, and geopolitical events can quickly turn profitable trades into losses. Safe-haven trading systems are designed to minimize risk while still capturing profits during turbulent periods. By combining strong risk management, adaptive algorithms, and tested strategies, these systems help traders maintain stability and confidence even in unpredictable markets.

Safe-haven trading systems are automated or semi-automated strategies focused on protecting capital during volatile conditions. They work by:

Investing in safe-haven systems helps traders survive market shocks without constant manual monitoring.

These systems rely on algorithms, technical indicators, and built-in risk controls. Common features include:

Some popular systems include Aero V2 MT5 and ARBITRAGE EA V2.0, both designed to survive volatile market conditions.

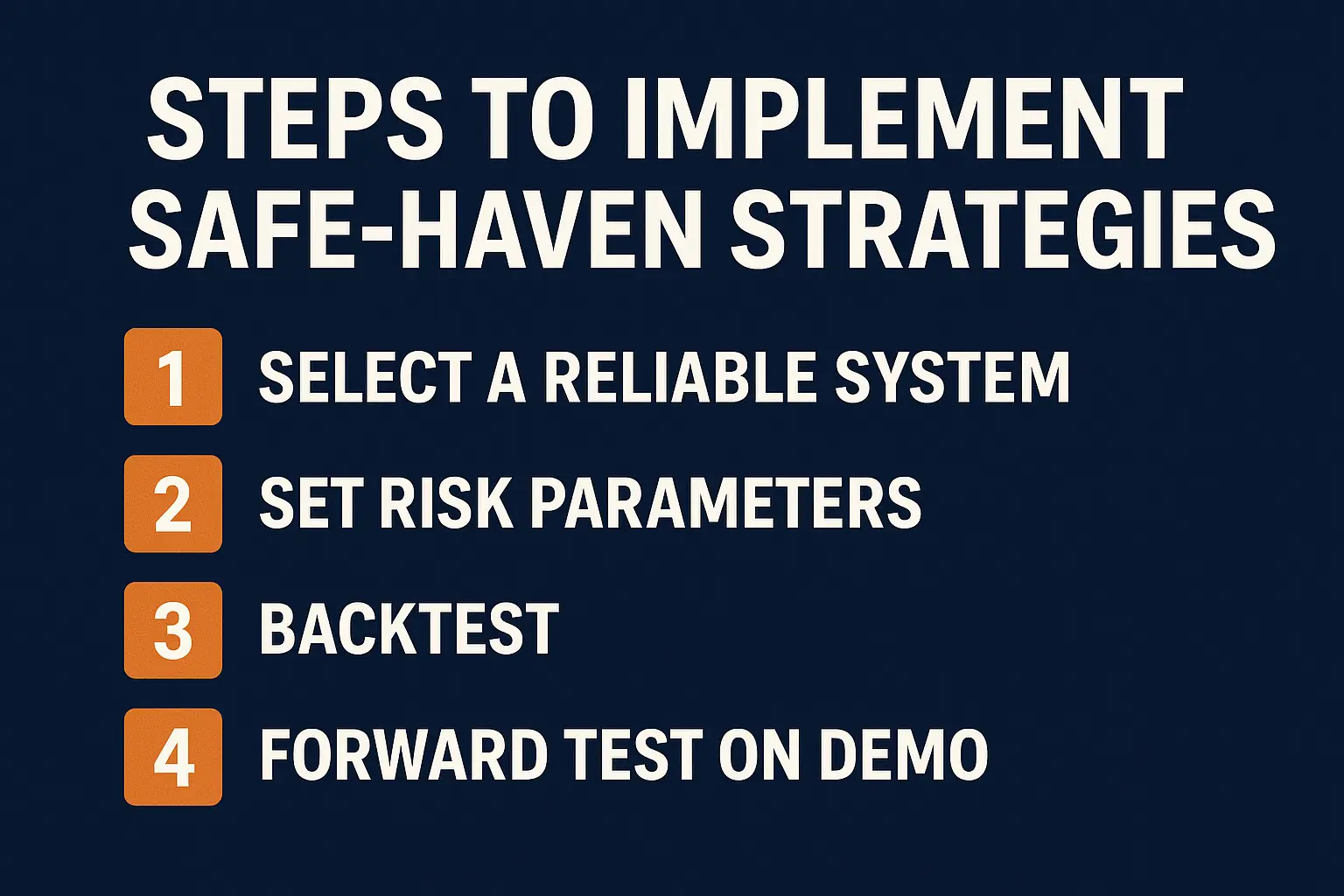

When selecting a safe-haven system, consider the following:

For more on testing EAs under volatility, see our guide on market crash simulations.

| System Name | Strategy Type | Risk Management | Timeframes | Supported Pairs |

|---|---|---|---|---|

| Aero V2 MT5 | Trend + Scalper | ✅ | Multi | EUR/USD, GBP/USD |

| ARBITRAGE EA V2.0 | Hedging | ✅ | Multi | Gold, USD/JPY |

| FX ID EA | Adaptive | ✅ | Multi | Major & Minor |

| IS PI Scalper EA MT4 | Scalping | ✅ | Multi | EUR/JPY, USD/CHF |

To help traders maintain stability, these products can complement your trading:

Q: Can safe-haven systems remove all trading risks?

A: No system eliminates risk entirely, but they reduce exposure during volatile markets.

Q: Which instruments are safest during high volatility?

A: Major currency pairs like EUR/USD, USD/JPY, and metals such as Gold are typically safer.

Q: Are these systems suitable for beginners?

A: Many have preset configurations and guides to help new traders.

Q: How often should I review my system?

A: Weekly monitoring is recommended to adapt to market changes.

Q: Where can I find more tools for volatility protection?

A: Check MT4 EA and MT5 EA categories.

Investopedia emphasizes that adaptive trading systems help manage risk in volatile markets (Investopedia guide). BabyPips recommends thorough testing of EAs to handle market swings (BabyPips guide). DailyFX highlights that automated systems maintain consistent performance even in high-volatility conditions (DailyFX education).

Safe-haven trading systems are essential for surviving high-volatility conditions. By using adaptive algorithms, risk management features, and thorough testing, traders can protect their capital while still seeking profit. Tools like Aero V2 MT5, ARBITRAGE EA V2.0, FX ID EA, IS PI Scalper EA MT4, and other systems from the trading systems category provide reliable options. Combined with regular monitoring and adjustments, these systems help maintain stability and profitability even in the most turbulent markets.

Jack Henry

17/12/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...