Aeromir – 0 DTE Options Trading Workshop

$997.00 Original price was: $997.00.$45.00Current price is: $45.00.

It works like a magic!

As a trader, I found this tool useful for spotting market trends and making informed decisions. The real-time data and clear chart patterns help identify potential trade opportunities.

Christina K

Verified Purchase

INSTANT DOWNLOAD!

Original price: $997.00

Our price: $45.00 95% OFF Retail!

Full Course.

🧠 0DTE Options Trading Workshop: A Deep Dive Into Winning Strategies

Whether you’re a seasoned trader or just stepping into the world of 0 Days to Expiration (0DTE) options, this workshop delivered powerful tools, innovative strategies, and real-world examples from some of the most respected names in the business.

Here’s a recap of the standout strategies and expert insights shared throughout the sessions:

🔍 Highlighted Strategies & What You’ll Learn:

Jim Olson Iron Butterfly

A wide butterfly spread initiated early in the day. Most trades last just 10–20 minutes—perfect for fast movers.

Narrow Iron Condor – by Dan Harvey

Combines the Iron Butterfly’s precision with the Iron Condor’s flexibility. With an 80–85% success rate among traders, this is a standout.

The Morning Fade – by Scot Ruble

A high-probability strategy from Scot’s days as a CBOE market maker. Success rate? Around 80%.

Market-on-Close (MOC) Imbalance Trading – by Scot Ruble

A tactical end-of-day play using MOC buy/sell imbalances to capture late-market moves.

Wide Iron Butterfly – by Amy Meissner

A consistent winner in Amy’s toolkit, offering a balanced risk-reward profile.

Iron Condor Variations – by Amy Meissner

Unique variations to adapt to market conditions and improve win rates.

Calendar Spreads – by Wayne Klump

Learn how Wayne uses proprietary tools to profit from time decay and volatility differences.

Out-of-the-Money (OTM) Vertical Spreads – by Tom Nunamaker

Executed 12 intraday verticals in February—all winners. Yielded nearly $900 using $3,000–$9,000 in daily margin.

Breakeven Iron Condor – by John Einar & Tom Nunamaker

John’s most profitable strategy, with over 70% annual return across 16 months.

Asymmetric Risk Butterflies – by Ernie (0-dte.com) & Tom Nunamaker

Low-risk trades with high reward potential. Great for volatile days.

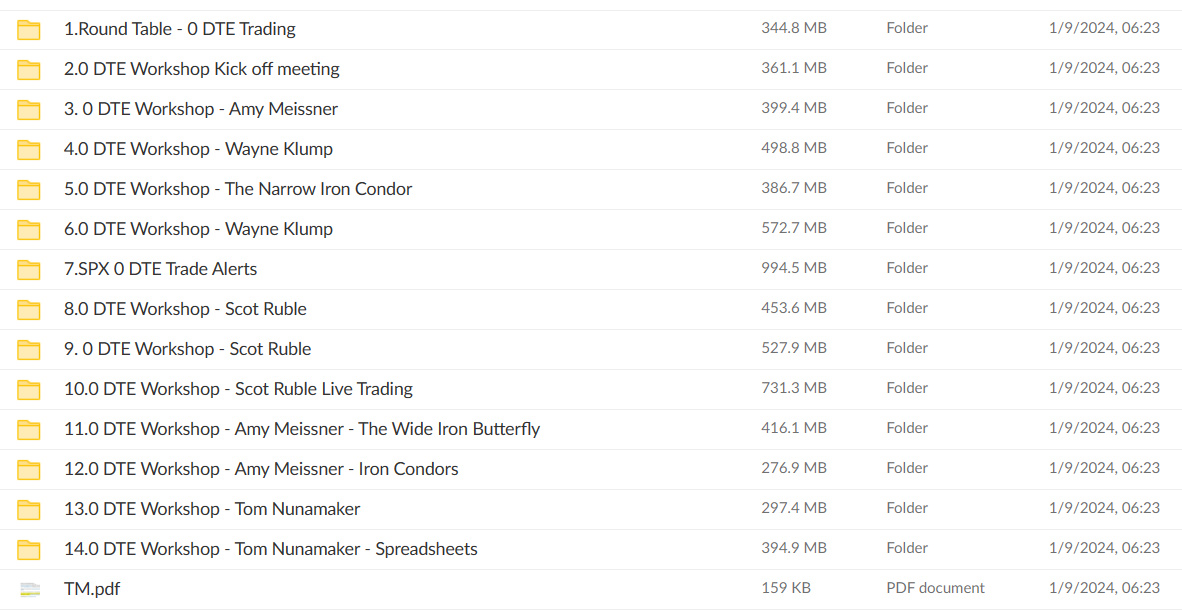

🎓 Workshop Sessions Overview

Session 1: Kickoff

Amy Meissner, Dan Harvey, Tom Nunamaker, Wayne Klump, and Scot Ruble set the stage.

Session 2: Amy Meissner

Understanding different 0DTE strategies, evaluation techniques, and key trade setups.

Session 3: Wayne Klump

How to diversify capital across strategies using known risk metrics.

Session 4: Dan Harvey & Tom Nunamaker

Introduction to the Narrow Iron Condor + a walkthrough of the NICE Spreadsheet.

Session 5: Dan Harvey & Tom Nunamaker

Live trading of the Narrow Iron Condor.

Session 6: Wayne Klump

Using structural edges and intraday fundamentals to manage strategy portfolios.

Session 7: Scot Ruble

Mastering the Unbalanced Condor strategy.

Session 8: Scot Ruble

Breakdown of the Morning Fade, MOC Imbalance Trading, and the Short Butterfly.

Session 9: Scot Ruble

Live trading demonstration.

Session 10: Amy Meissner

Detailed insights into the Wide Iron Butterfly.

Session 11: Amy Meissner

Iron Condor Variations tailored for different market conditions.

Session 12: Tom Nunamaker

An in-depth look at:

-

Jim Olson Iron Butterfly

-

Breakeven Iron Condor

-

Asymmetric Risk Butterflies

-

Intraday Vertical Spreads

Session 13: Tom Nunamaker

How to use trade tracking spreadsheets effectively.

Session 14: Tom Nunamaker

Live trading session to put theory into action.

💼 Who Should Attend Next Time?

This workshop is perfect for:

-

Traders looking to maximize returns with low-risk setups

-

Options enthusiasts wanting to sharpen their execution

-

Anyone seeking high-probability 0DTE strategies that actually work

👉 Missed the event? Stay tuned for access to recordings and future sessions. This is your chance to learn from pros who’ve proven their edge—live and unfiltered.