INSTANT DOWNLOAD!

Your price: $12.00

Content: Indicator: ATRH.ex4 (Unlocked-Unlimited), UserGuide: ATRH.pdf.

ATRH Indicator Overview

The ATRH indicator measures the degree of price volatility and helps traders identify trend direction using a blend of Average True Range (ATR) calculations and trend-following methods.

How It Works:

-

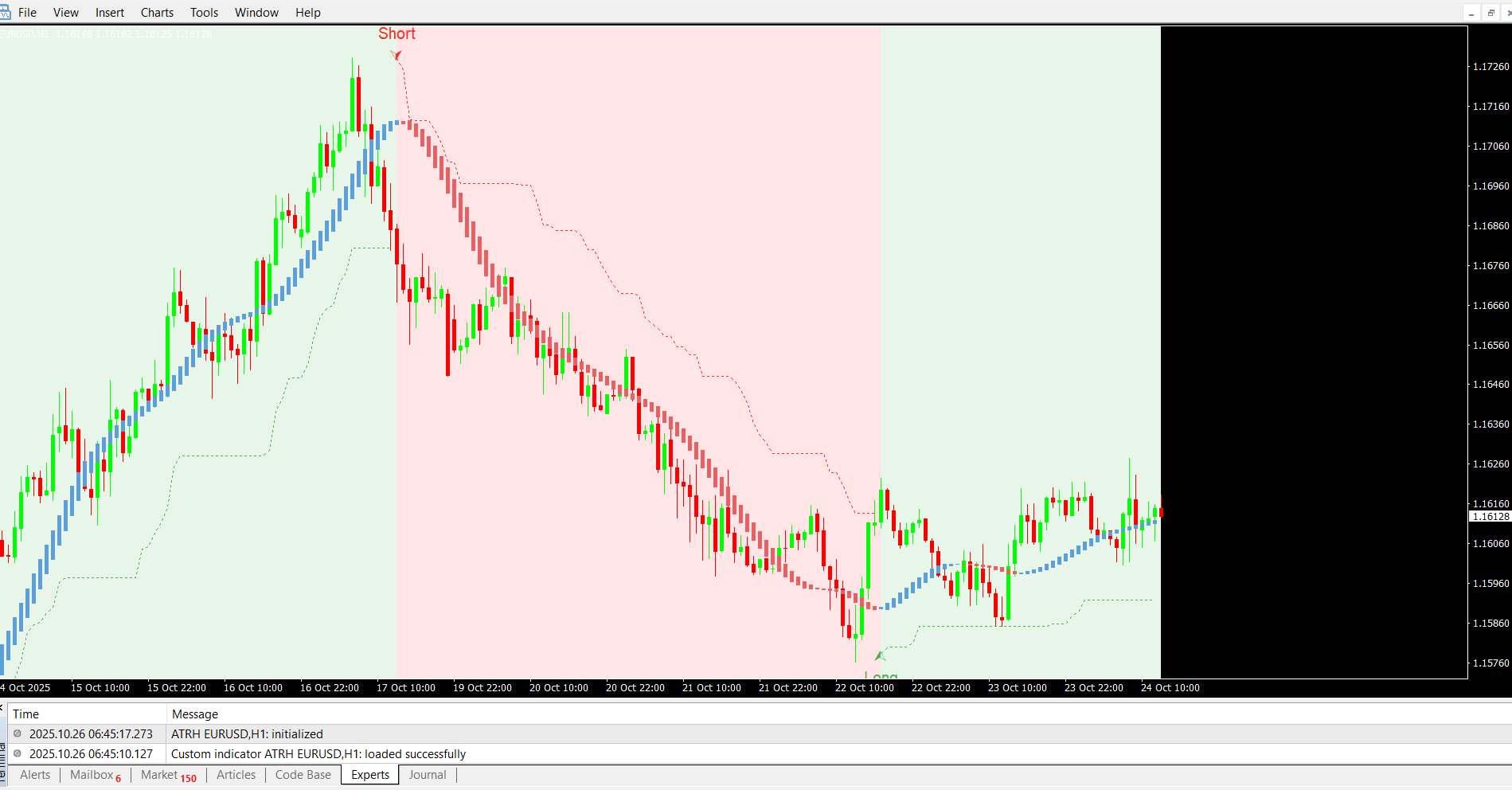

Signal Generation: Long and short signals appear when the indicator plots above or below the closing price, respectively.

-

Core Calculations: The indicator uses Average True Range and an Average True Range Multiplier to determine the frequency and strength of signals.

-

Sensitivity Control: A sensitivity parameter adjusts how quickly signals are generated, giving traders flexibility in tuning the indicator to their style.

-

Trailing Stop: The indicator includes an ATR-based trailing stop feature to help manage risk dynamically.

User-Friendly Features:

-

Alerts: Traders receive notifications for both long and short signals, ensuring timely awareness of potential trade opportunities.

-

Market Sentiment Visualization: The background color changes to reflect overall market sentiment — light red for bearish conditions and green for bullish momentum — providing at-a-glance context.

The ATRH indicator is designed for ease of use, delivering accurate insights into ongoing trends, market sentiment, and volatility, making it a powerful tool for traders seeking to follow and capitalize on market momentum.

Benefits of Using the ATRH Indicator

-

Triple Calculation Power: Combines Average True Range (ATR) Multiplier, Hull Moving Average (HMA), and Sensitivity to provide a comprehensive analysis of trend, volatility, momentum, and market sentiment.

-

Clear Trend Direction: Price above the Hull Moving Average signals bullish momentum, while price below indicates bearish pressure.

-

Dynamic Stop Loss Levels: ATR-based trailing stops adjust dynamically from entry signals and stretch until an opposite directional signal appears, helping manage risk effectively.

-

Dynamic Support and Resistance: The Hull Moving Average acts as a dynamic resistance when price is below it and as dynamic support when price is above, with frequent price tests resulting in breakouts or pullbacks.

-

Accurate Trade Signals: Generates potential long and short trade signals based on a complex formula blending volatility, momentum, and trend-following principles.

-

Trend Strength Visualization: The moving average color changes to green for uptrends and red for downtrends, helping traders assess trend strength at a glance.

-

Customizable ATR Calculation: Allows toggling between standard ATR and SMA-based True Range calculations for tailored volatility measurement.

-

Flexible Signal Display: Users can enable or disable long/short signal labels and background color for market sentiment visualization.

-

Multiple Hull Moving Average Types: Supports HMA, WMA, and EMA, with options to color the moving average line or display it as a band; candles can be colored based on the trend direction.

-

Alert Feature: Provides timely alerts for long and short signals, keeping traders informed in real-time.

Key Product Features

-

Scaling Indicator adaptable to various market conditions.

-

High Accuracy: Over 80% winning rate reported.

-

Universal Compatibility: Works on all timeframes and currency pairs.

-

Trade Signals: Clear buy and sell alerts.

-

Trailing Stop Functionality: Assists in locking profits and reducing losses.

-

Trend Clarification: Provides clear market direction and sentiment insights.

-

100% No Repaint: Signals remain stable without repainting, ensuring reliability.