INSTANT DOWNLOAD!

Your price: $17.00

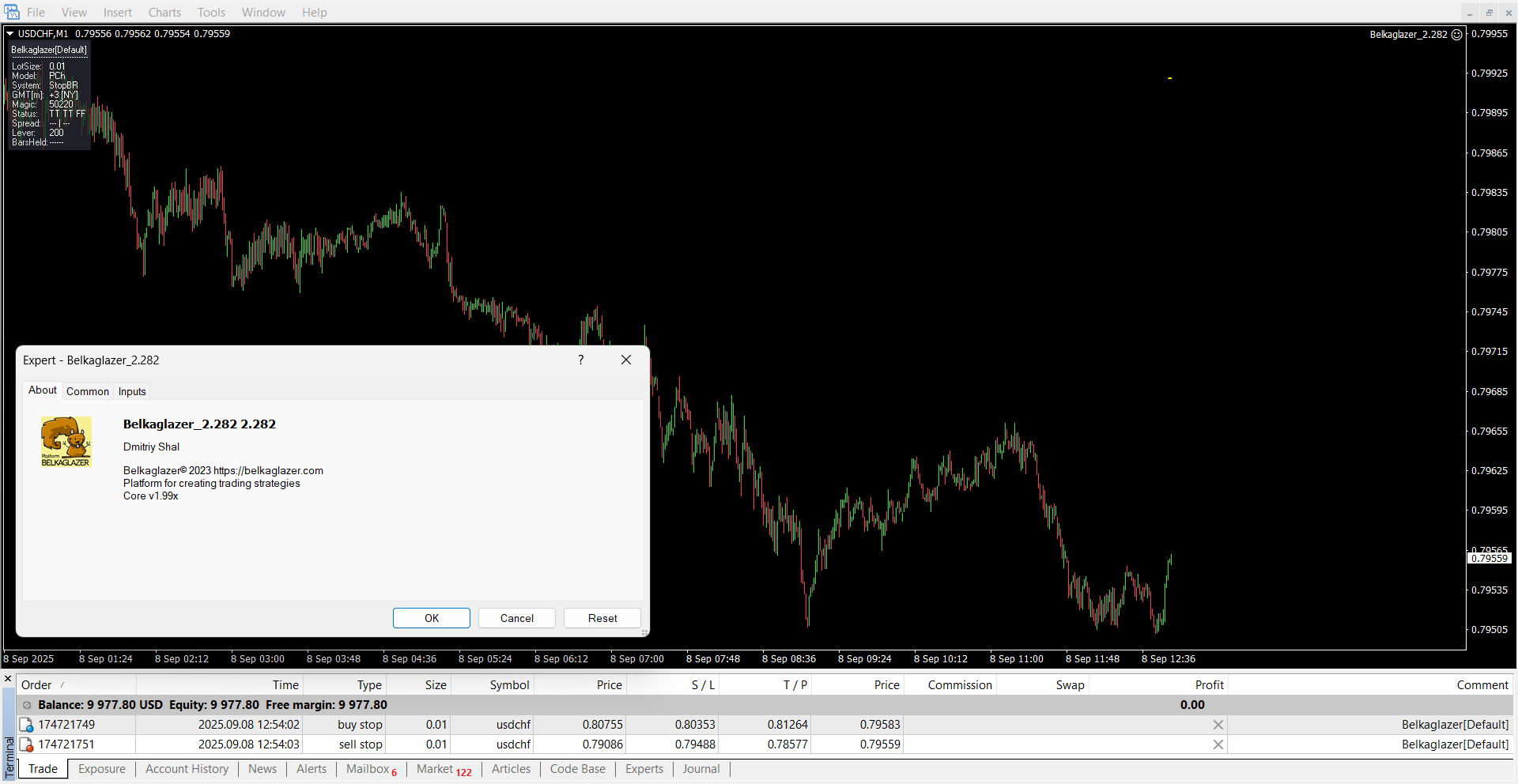

Content: Expert: Belkaglazer_2.282.ex4 (Unlocked-Unlimited), NO MANUAL.

🔧 Belkaglazer EA – Build Powerful Strategies Across Any Market

Belkaglazer EA is a highly advanced Expert Advisor that empowers traders to develop and automate a wide range of trading strategies across multiple markets—including FOREX, FORTS, Crypto, and Indices.

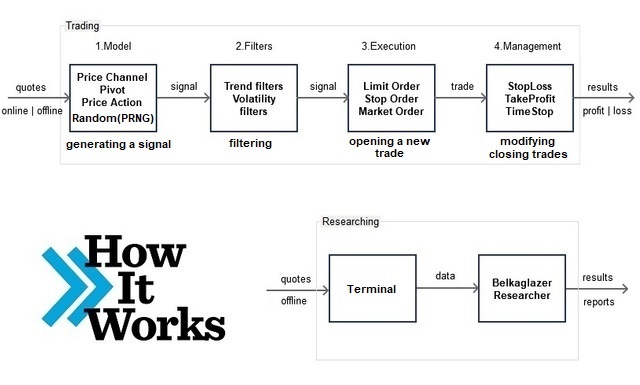

At its core, Belkaglazer is driven by four distinct logic models:

-

Price Channel

-

Pivot Levels

-

Price Action

-

PRNG (Pseudo-Random Number Generator)

Each model offers a unique strategic foundation, allowing you to build systems tailored to specific conditions, assets, or timeframes.

Whether you’re interested in momentum trading, breakout setups, countertrend moves, mean-reversion, or scalping, this EA has the flexibility to support your approach. Your strategy is only limited by how you configure the settings or use available set files.

Key Features

✅ Supports Limit, Stop, and Market Orders

✅ Compatible with Instant and Market Execution

✅ Automatically adjusts to both 4-digit and 5-digit quotes

✅ Adapts seamlessly to different trading instruments and account types

Belkaglazer is not just a trading robot—it’s a strategy-building engine for serious traders who want full control and advanced automation.

-

🎯 Precision Meets Control – Advanced Features of Belkaglazer EA

Belkaglazer EA comes equipped with powerful tools designed for traders who demand both reliability and flexibility.

🔍 Intelligent Filters & Automation

-

Integrated CBOE VIX Filter to account for market volatility

-

Advanced News Filter to backtest the market impact of any economic event

-

Automatic GMT Offset detection for accurate time alignment with your broker

💼 Smart Money Management

-

Supports a variety of money management styles

-

All of the author’s recommended strategies avoid Martingale, grid, and hedging, ensuring safer, controlled trading

-

Every trade is protected with a hard Stop Loss

🧠 Built for Strategy Designers

-

Engineered with a clear, logical structure for easy strategy creation

-

All parameters and strategies are fully customizable

-

Additional tweaks and advanced options can be configured via the belkaglazer.ini file

📈 Tested with Integrity

-

Backtested using 99.9% modeling quality with variable spreads

-

Backtest results are aligned with real-world live trading performance, ensuring high reliability

Whether you’re optimizing existing setups or building your own from scratch, Belkaglazer EA gives you the creative freedom and analytical tools to trade with confidence.

-

Strategies

-

📊 Core Trading Strategies Explained

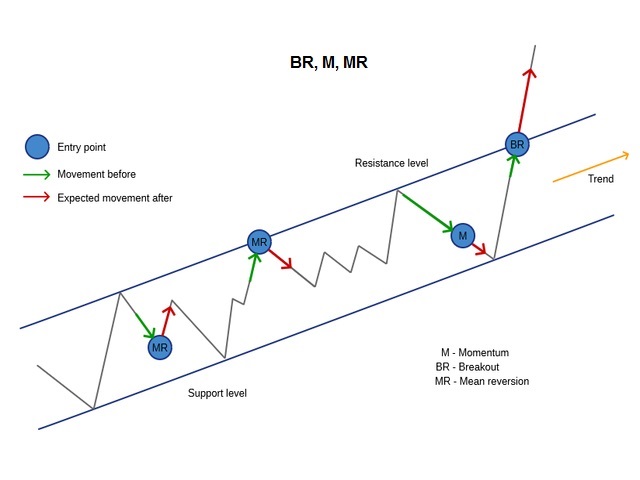

🔹 Breakout Strategy [BR]

A breakout occurs when price moves beyond a well-established support or resistance level, often after a period of consolidation.

The strategy aims to capitalize on strong market momentum by placing pending stop orders just above resistance (for buys) or below support (for sells). When volatility surges and price breaks through these levels, the order is triggered—allowing traders to ride the momentum.

Breakout trading is commonly used during news events or high-volume periods and is considered a subset of Momentum [M] trading.🔹 Momentum Strategy [M]

The momentum strategy is built on the idea that once price starts moving strongly in one direction, it’s likely to continue in that direction—at least for a while.

Traders enter the market using market orders following a sharp move up or down, expecting the trend to continue.

This approach is ideal for catching short-term trends and is often used in volatile conditions where the price movement is rapid and decisive.🔹 Mean Reversion Strategy [MR]

Mean reversion is based on the assumption that price tends to return to its average or “mean” after extreme movements.

This is often referred to as countertrend or reversal trading. When price deviates significantly from the norm—usually near a key support or resistance level—the strategy enters a trade in the opposite direction, expecting a reversal.

Entry is typically made using pending limit orders or carefully timed market orders once a reversal is likely.

📐Model

-

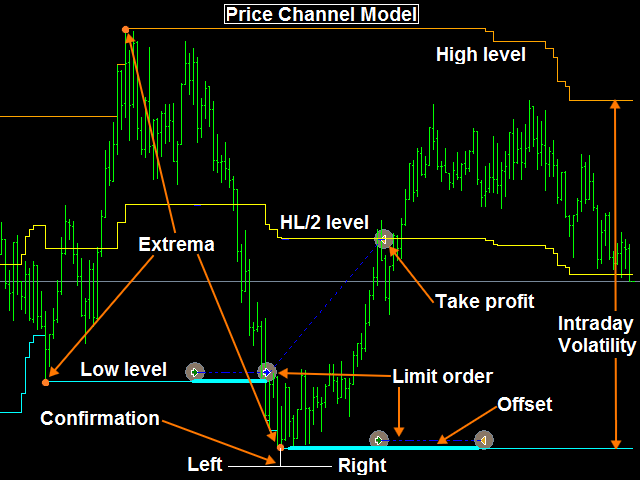

The Price Channel (PCh) model identifies key horizontal support and resistance levels based on the highest and lowest price extremes over a selected time period. These levels—known as High (resistance) and Low (support)—form a dynamic price range used to guide trading decisions.

This model is highly flexible and can be configured for two types of strategies:

-

Breakout Strategy – Enter trades when price breaks above the High or below the Low, anticipating a strong directional move.

-

Mean Reversion Strategy – Enter trades in the opposite direction when price nears these levels, expecting a return to the average.

For enhanced accuracy and performance, you can adjust the offset of the High/Low boundaries to fine-tune entry signals during optimization.

🔧 Tip:

When using the PCh model with momentum (M) or mean reversion (MR) strategies, the most effective Take Profit (TP) and Stop Loss (SL) levels are typically set at the midpoint of the price range—known as the HL/2 level (the average of High and Low). -

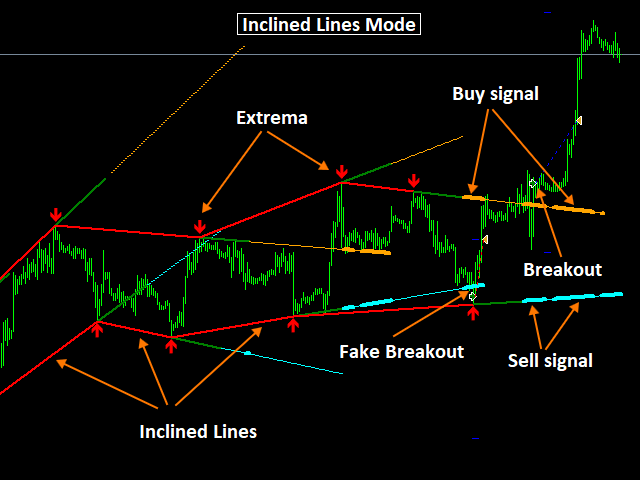

📈 Inclined Lines Mode (PCh) – Dynamic Support & Resistance Levels

New in Version 1.79, the Inclined Lines Mode adds a powerful enhancement to the Price Channel (PCh) model.

In this mode, the EA automatically draws two inclined lines—one acting as dynamic support and the other as dynamic resistance. These lines are constructed based on two confirmed price extrema, creating a sloped price range that adapts to current market direction.

The parameter “Expiration Bars” defines how long each inclined line remains valid after it’s been formed. Once the set number of bars passes, the line will expire and no longer influence the strategy—ensuring only relevant, timely levels are used for trading decisions.

This feature allows the EA to track trend-based price channels, making it ideal for both breakout and reversal strategies in trending markets.

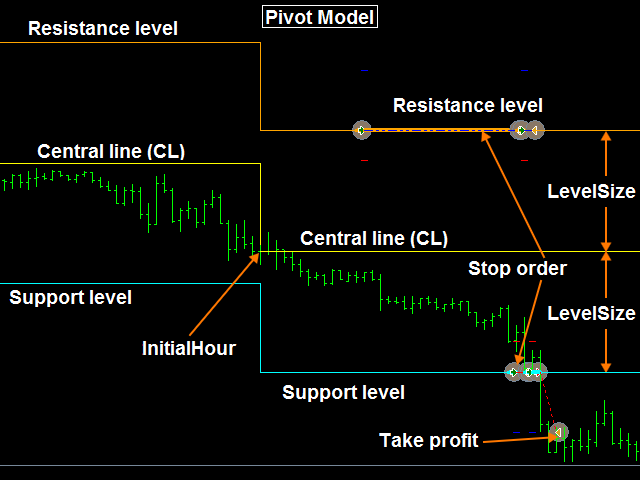

📊 Pivot Model – Precision-Based Support & Resistance Levels

The Pivot model uses calculated pivot points to identify key support and resistance zones, helping traders anticipate market turning points with greater accuracy.

At a defined Initial Hour, the EA calculates a Central Line (CL) using this formula:

CL = (High of Period + Low of Period + Close at Specific Time) / 3

From this central line, the EA then determines:

-

Resistance Level (RL) = CL + a percentage of the Daily ATR (Average True Range)

-

Support Level (SL) = CL – a percentage of the Daily ATR

These pivot-based levels serve as dynamic price markers and can be used in two strategic approaches:

-

Breakout Trading – Enter trades when price breaks above RL or below SL, signaling strong momentum.

-

Mean Reversion Trading – Enter trades in the opposite direction as price nears RL or SL, expecting a reversal toward the central line.

This model adapts to market volatility and provides traders with statistically grounded entry points.

-

The Price Action (PA) model focuses purely on analyzing how price behaves over time—without relying on traditional indicators.

-

By studying recent price movements, this model identifies straightforward momentum (M) and mean reversion (MR) patterns that reflect the market’s natural behavior. It’s ideal for traders who prefer a clean, data-driven approach based on price itself rather than external tools.

-

The PA model also supports the creation of seasonal trading strategies, making it effective for markets that show recurring behavior across specific days, weeks, or months.

-

Whether you’re looking to follow strong trends or capitalize on predictable reversals, the PA model offers the flexibility to trade what the market is actually doing, not just what indicators suggest.

-

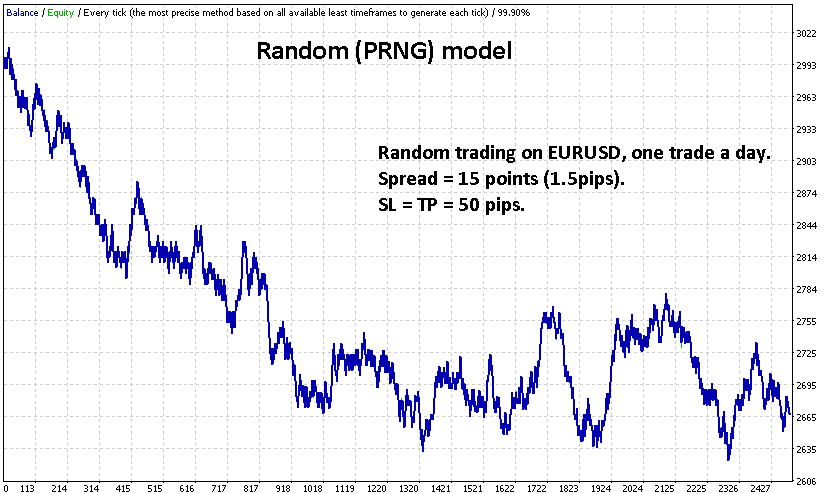

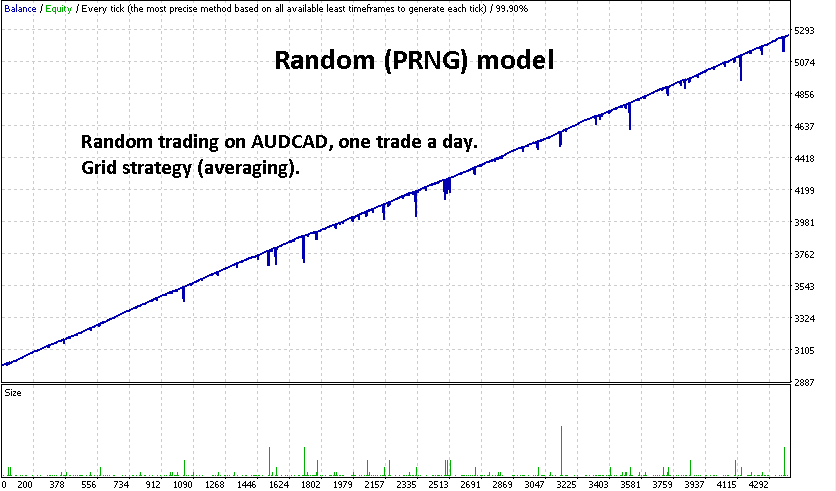

The Random (PRNG) model generates trading signals in completely random directions, without relying on market conditions or indicators. It’s designed primarily for research, stress testing, and simulation purposes—not for regular trading.

This model is especially useful for:

-

Market behavior studies

-

Monte Carlo simulations

-

Testing risk settings under unpredictable scenarios

-

Combining with high-risk strategies (e.g., Martingale or grid) to test robustness

The ‘Trading Frequency (PRNG)’ parameter lets you control how often the EA opens random trades—allowing you to fine-tune randomness intensity based on your goals.

While not intended for profit generation, the PRNG model is a powerful tool for understanding risk, testing execution stability, and experimenting with unorthodox setups.

-

🎛️ Filters & Execution – Smarter Trading with Belkaglazer EA

Download preset (v1.88x or higher): AUDCAD_M5_DMM.set

🚫 No Model Mode – Trade with Filters Only

The “No Model” mode allows you to disable all strategy models and generate trading signals exclusively using filters. This is ideal for traders who want full control over trade logic and wish to build custom, filter-based systems.

🔍 Powerful Trade Filters for Sharper Entries

Filtering helps you enhance trade quality by reducing poor entries and boosting strategy performance. While filters cannot turn a losing strategy into a winning one, they can increase the average profit per trade and help avoid unfavorable market conditions.

⚠️ Overusing filters can lead to curve-fitting. Always test your strategy’s core logic without filters first.

Available Filter Types:

-

📈 Trend Filters – Trade only in the direction of the dominant trend

-

Methods: Daily EMA, Daily HL/2

-

-

🌊 Volatility Filters – Avoid trading in overly quiet or excessively volatile markets

-

Methods: Intraday (price range width), Daily ATR

-

-

⏰ Time Filters – Exclude trades at specific times

-

Options: By minute, hour, day of week, or month

-

-

📰 News Filter – Skip trades around high/medium/low impact news events

-

Includes: News backtesting capability & multiple data source options

-

-

📉 CBOE VIX Filter – US market crash filter to avoid large drawdowns during instability

-

Backtest-compatible

-

-

📊 Range, Hurst, RSI & More – Extra options for tailoring conditions to your strategy

🛒 Trade Execution Options

Once a trade signal is generated (from models or filters), you can choose how the EA executes it:

-

Order Types: Market, Limit, or Stop

-

Execution Delay: Optional delay for smarter order timing

📂 Managing Open Positions

Belkaglazer EA includes full position management tools:

-

Take Profit / Stop Loss

-

Time-Based Exit (Time-Stop)

-

Trailing Stop

-

Money Management Options:

-

Fixed Lots

-

Proportional to Balance

-

% of Margin

-

Max Risk per Trade

-

Optimal F

-

You can also enable advanced risk strategies like:

-

Anti-Martingale

-

Martingale

-

Pyramiding

-

Averaging

🧪 Strategy Research Tool

Use the Belkaglazer Researcher to explore fresh ideas, experiment with different combinations of filters, execution styles, and risk models—and build your own edge in any market.

📥 Don’t forget to download the latest strategy presets and start testing today!