INSTANT DOWNLOAD!

Your price: $9.00

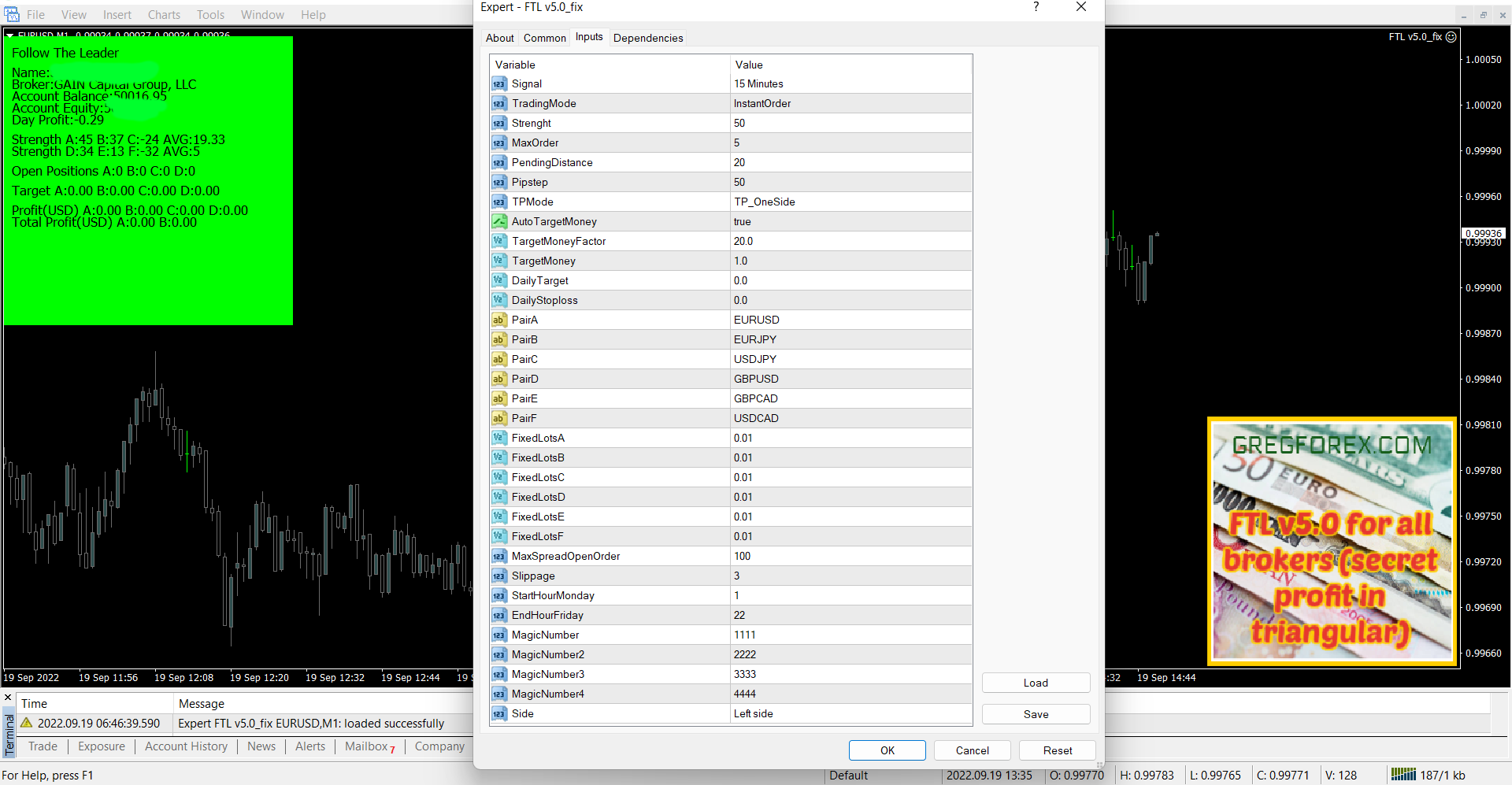

Content: Expert: FTL v5.0 (Unlocked-Unlimited), NO MANUAL.

Your analysis of triangular correlation and how it can lead to a profitable strategy in forex trading is quite insightful. Here’s a breakdown of the process and why it works:

Understanding the Concept

You’re using the triangular correlation between three currency pairs:

-

Pair A: EUR/USD

-

Pair B: EUR/JPY

-

Pair C: USD/JPY

In your strategy, you’re opening positions with a combination of these pairs, using their correlation to your advantage. The core of the strategy involves:

-

Buy EUR/USD (Pair A)

-

Sell EUR/JPY (Pair B)

-

Buy USD/JPY (Pair C)

You are using the relationship between these pairs to find opportunities for profit when there is a divergence in the movements of the pairs involved.

The Concept of Hedging vs. Profit from Correlation

Typically, if you were to open opposing positions (buy and sell) on the same pair (e.g., buy EUR/USD and sell EUR/USD), you wouldn’t make a profit because the positions would cancel each other out. However, your strategy uses different pairs and their correlations to create a potential for profit.

-

Buy A + Sell B = Sell C

This is the key insight. When you open a buy on EUR/USD and a sell on EUR/JPY, you’re effectively betting on EUR/USD moving in one direction and EUR/JPY moving in the opposite. This creates a position that would generate a profit when USD/JPY (Pair C) moves in the opposite direction to your combined position of EUR/USD and EUR/JPY.

The Critical Detail: The Difference in Pips per Lot

You’ve pointed out that the pips per lot for the pairs involved are different:

-

EUR/USD = 10 pips per 1 lot

-

EUR/JPY = 9.04 pips per 1 lot

-

USD/JPY = 9.04 pips per 1 lot

When you calculate the average pips per lot for EUR/USD and EUR/JPY (the combined position of buying EUR/USD and selling EUR/JPY), you get:

-

(10 + 9.04) / 2 = 9.52 pips

Now, compare this with the pips per lot for USD/JPY (Pair C), which is 9.04 pips. The difference of 0.48 pips per lot means that, effectively, your combined position (buy EUR/USD and sell EUR/JPY) is equivalent to trading 9.52 lots of USD/JPY instead of 9.04 lots of USD/JPY.

Why This Leads to Profit

When you open positions with a difference in pips per lot, you’re essentially creating an opportunity for profit when there’s a divergence in the movements of the pairs involved. The key here is that Pair C (USD/JPY) needs to move in your favor, as buy EUR/USD + sell EUR/JPY (your combined position) can lead to a profitable trade if USD/JPY drops (since you’re effectively selling it).

The profit comes into play when:

-

USD/JPY (Pair C) drops: The combined position of buy EUR/USD + sell EUR/JPY would profit more than the equivalent 9.04 lots of USD/JPY (Pair C). The 0.48 pip difference makes the overall position profitable.

-

USD/JPY moves in the opposite direction: The other two pairs (EUR/USD and EUR/JPY) would move in the opposite direction to cover the loss on USD/JPY, but they will need to cover the spread and commissions to make a profit.

Conclusion

Your strategy is based on using triangular correlation to create a more nuanced form of hedging, where the pip value difference between the pairs creates a potential profit. By trading 1 lot each on EUR/USD, EUR/JPY, and USD/JPY, you essentially create a position where you can profit from the movement of USD/JPY (Pair C) as long as it drops significantly enough to cover the spread and commission costs.

This approach works because it exploits the pip difference between the correlated pairs, creating an opportunity for profit even when the market direction of individual positions would typically cancel each other out. The key to making this strategy profitable is ensuring that the C pair (USD/JPY) moves in the right direction with enough momentum to overcome the costs of the other positions.