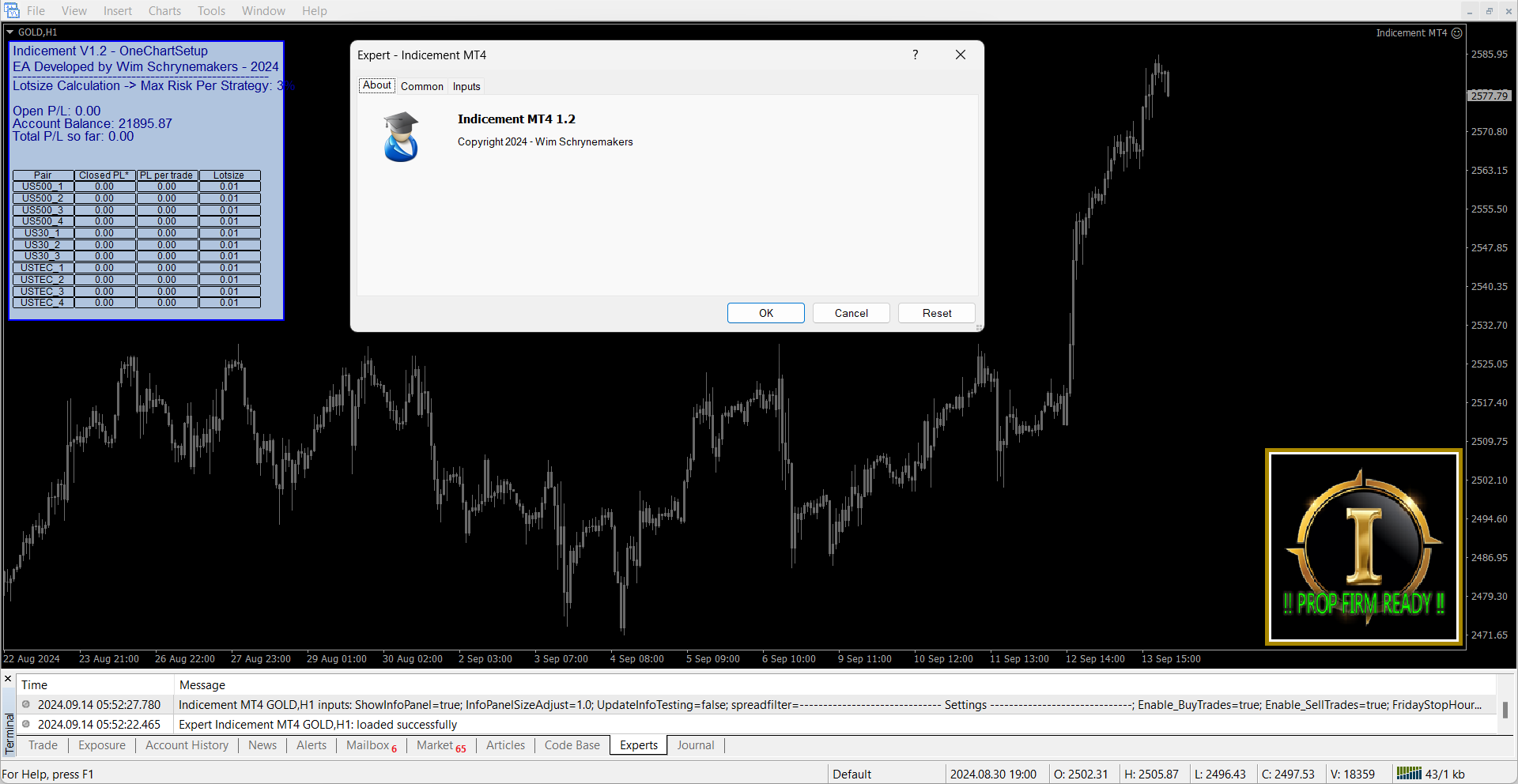

INDICEMENT EA – Key Features and Setup Guide

Overview:

INDICEMENT EA is designed to trade indices such as US500, US30, and NAS100. It uses a well-thought-out algorithm that employs multiple strategies to find the best entry points while minimizing risk. The EA relies on trading breakouts of important support and resistance levels, and it’s built for stable long-term performance with controlled drawdowns.

Key Features:

-

Algorithm-Based Entry and Exit:

The EA identifies the best entry price through a combination of pivot points, support/resistance levels, and trend analysis, ensuring that trades are executed at optimal moments. -

Stop Loss, Take Profit, and Trailing Stops:

Every trade has a stop loss (SL) and take profit (TP), and the EA also incorporates trailing stop loss and trailing take profit features to reduce risk and maximize trade potential. -

No Grid or Martingale:

The system avoids risky strategies like grid and martingale, instead using a solid risk management approach based on the breakout strategy. -

Optimized for Major Indices:

The EA is built specifically for the US500 (S&P 500), US30 (Dow Jones), and NAS100 (Nasdaq 100) indices. These markets are particularly well-suited for breakout strategies due to their high liquidity and volatility. -

Stable Growth with Low Drawdown:

Backtests show stable growth curves with low drawdowns and fast recoveries, making the system reliable for consistent performance. -

Stress Tested and Over-Optimized Free:

The EA has been stress tested for all three indices with multiple price feeds from various brokers, eliminating over-optimization risks and ensuring real-world reliability. -

Designed for Prop Firms:

The EA is suitable for prop firm challenges with settings tailored to pass challenges and handle funded accounts.

Setup Guide for Live Trading and Backtesting:

MT4 Setup for Backtesting:

-

Correct Symbol Names:

Ensure that the correct symbols for the indices (US500, US30, NAS100) are set in the parameters. Verify the actual names in the MarketWatch window. -

Select the Symbol for Backtest:

Choose the desired symbol in the Strategy Tester for backtesting. -

Set Maximum Drawdown:

Set the max drawdown per strategy in the parameters or use the provided set file.

MT4 Setup for Live Trading:

-

Load EA on H1 Chart:

Load the EA onto any H1 chart (recommended to use EURUSD for most ticks). The EA will automatically trade all three indices regardless of the chart. -

Correct Symbols for Indices:

Ensure that the correct symbols for the three indices are filled in the parameters. -

Max Drawdown Settings:

Set your desired max drawdown per strategy in the parameters, or use a provided set file. -

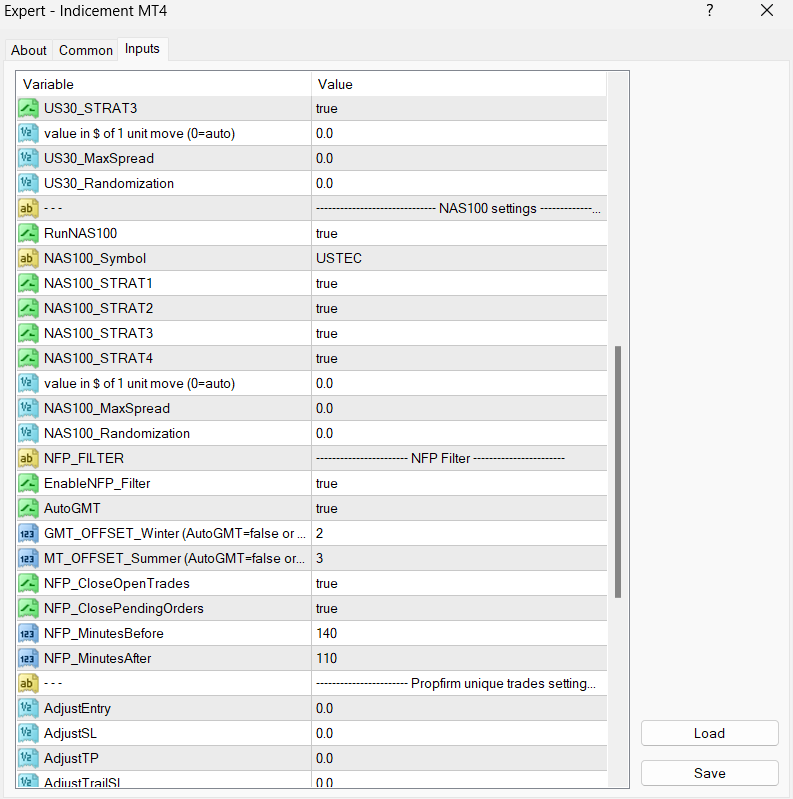

AutoGMT for Time Accuracy:

To ensure accurate trading times, enable AutoGMT and add the allowed URL “https://www.worldtimeserver.com/” for proper time synchronization.

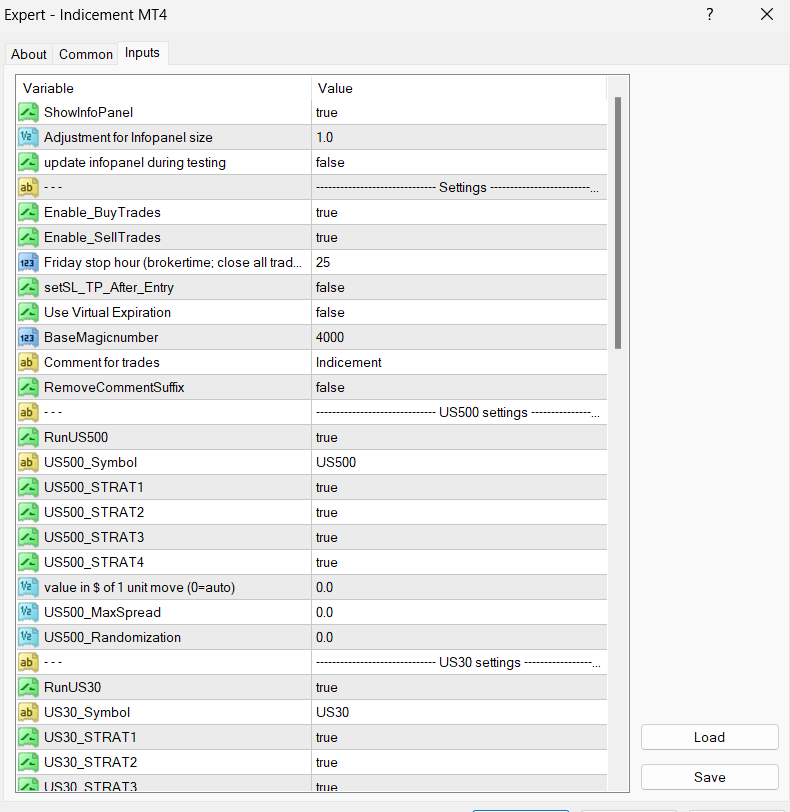

Parameters and Configuration Options:

-

ShowInfoPanel: Displays the information panel on the chart.

-

Friday Stop Hour: Set to stop trading before the weekend.

-

BaseMagicNumber: A base number used for all strategies.

-

RunUS500: Enable the strategy for the US500 index.

-

US500_MaxSpread: Set the maximum allowed spread for US500 trades.

-

NFP Filter Settings: Set how the EA will handle trades during Non-Farm Payroll (NFP) releases (close trades and pending orders).

-

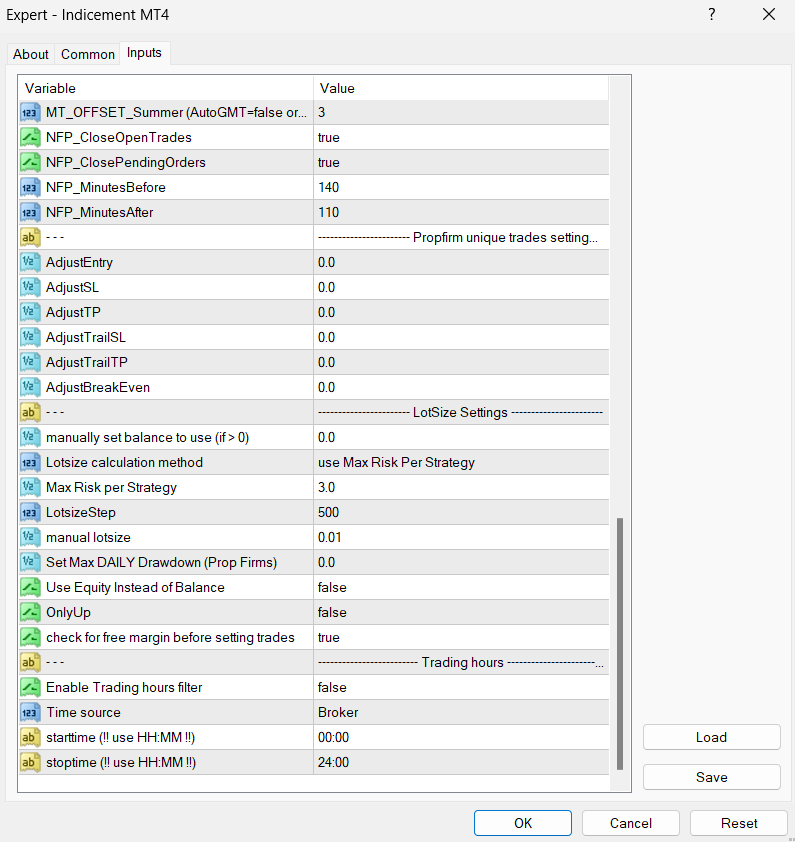

Prop Firm Settings: Modify entry and exit points for unique trades specific to prop firm challenges.

-

Lotsize Calculation Methods: Choose from fixed lot size, max risk per strategy, or lotsize step.

-

Set Max Daily Drawdown: Set a daily drawdown limit, useful for prop firm management.

-

Use Equity Instead of Balance: Calculate lotsize based on equity instead of balance.

Conclusion:

INDICEMENT EA offers a reliable, algorithm-driven system for trading indices like US500, US30, and NAS100. With a focus on breakout strategies, risk management, and stable long-term growth, it is ideal for both live accounts and prop firm challenges. The easy-to-use setup, stress testing, and lack of risky strategies make it a trustworthy tool for both novice and experienced traders.