INSTANT DOWNLOAD!

Original price: $999.00

Your Price: $24.00 98% OFF Retail!

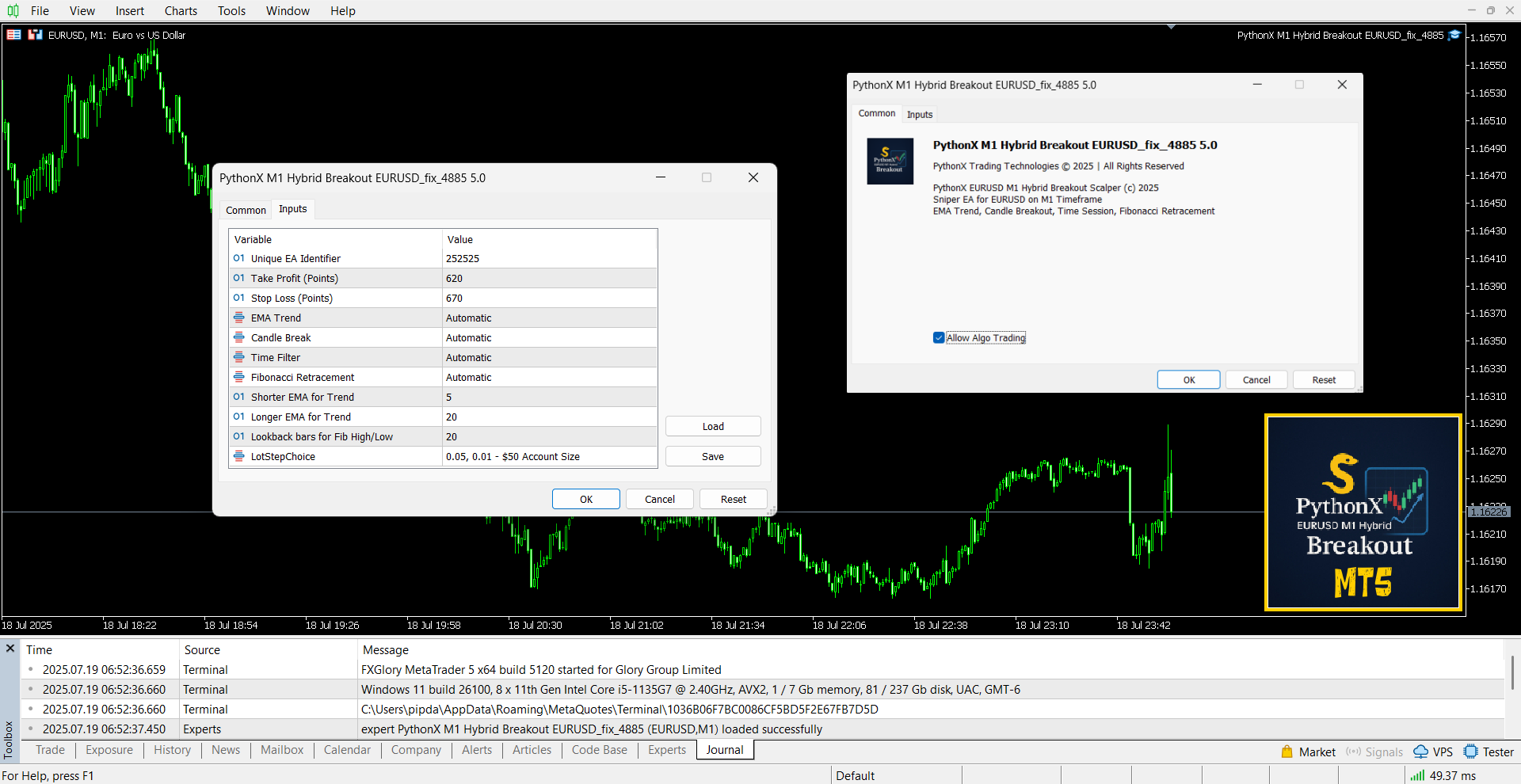

Content: Expert: PythonX M1 Hybrid Breakout EURUSD_fix_4885.ex5 (Unlocked MT5 Build 4885), NO MANUAL.

PythonX – EURUSD M1 Hybrid Breakout EA

One trade at a time. Low drawdown. Designed for Prop Firms and Retail Traders.

Tested on EURUSD M1 using real tick data (2015–2025 or latest available) across 25+ brokers and prop firms.

Built to deliver precision, consistency, and ultra-low drawdown — even on $100 accounts.

All tests were conducted on a $100 balance with 1:1000 leverage and fixed SL/TP.

Screenshots are attached for full transparency.

Supported Brokers

OctaFX, IC Markets, HF Markets, Exness, XM Global, Tickmill, RoboForex, ActivTrades, FXPro, FXTM, Eightcap, FP Markets

Supported Prop Firms

FTMO, E8 Markets, The Funded Trader, FundedNext, MyFundedFX, SurgeTrader, Finotive Funding, FXIFY, BrightFunded, DNA Funded, Blueberry Funded, FundedPrime, Funding Pips, Alpha Capital, The Trading Pit, Hola Prime

If your broker is not listed, contact the developer before purchase to confirm compatibility.

Strategy Overview

PythonX is a professionally developed hybrid breakout EA optimized for EURUSD on the M1 timeframe.

It applies a multi-layered filtering system to find high-probability breakout entries with minimal drawdown.

Designed to work on one trade at a time, with fixed SL/TP, and filters that adapt to market structure in real time.

Ideal For:

- Traders seeking stable M1 automation

- Prop firm challenges requiring strict drawdown control

- Anyone starting with even $50–$100 capital

Why Choose PythonX?

- Proven across 28+ broker/prop firm environments

- Built for ultra-low drawdown and high win streaks

- Designed specifically for EURUSD M1, but scalable for future builds

- No martingale, no grid, no risky recovery logic

- Backtested using over a decade of M1 real tick data

- Supports both small accounts and prop firm conditions

- Lot Presets from $50 to $5000 Accounts Size (Auto-select from 11 tiers)

Core Logic

- Take Profit: 620 points

- Stop Loss: 670 points

- Entry Filters: EMA Trend, Candle Break, Time Filter, Fibonacci Retracement

- Dynamic lot sizing via LotSet1 to LotSet11

- One trade at a time, no overleveraging

Backtest Highlights

Backtested on Real Ticks | EURUSD M1 | Period: 2015–2025

All tested with $100 balance. Full screenshots attached.

| Broker/Firm | Net Profit | Max Drawdown | Max Wins (Amount) | Max Losses (Amount) |

|---|---|---|---|---|

| OctaFX | $15,255.84 | 1.65% | 16 ($471.42) | 7 ($-73.78) |

| IC Markets | $13,114.84 | 3.38% | 21 ($618.02) | 11 ($-100.03) |

| XM Global | $14,060.22 | 1.52% | 14 ($411.15) | 7 ($-74.38) |

| FP Markets | $15,459.75 | 1.34% | 17 ($499.69) | 7 ($-77.09) |

| Eightcap | $13,856.31 | 1.98% | 15 ($438.92) | 7 ($-74.36) |

| HF Markets | $14,740.04 | 5.43% | 16 ($468.07) | 7 ($-74.88) |

| Exness | $10,467.29 | 2.77% | 19 ($587.61) | 8 ($-82.16) |

| Tickmill | $8,250.80 | 3.28% | 20 ($598.22) | 10 ($-93.92) |

| RoboForex | $13,464.76 | 5.64% | 23 ($676.40) | 9 ($-88.03) |

| ActivTrades | $10,766.87 | 2.03% | 15 ($437.01) | 12 ($-108.30) |

| FxPro | $13,051.00 | 2.61% | 15 ($431.29) | 8 ($-81.29) |

| FXTM | $11,257.94 | 3.05% | 27 ($812.29) | 7 ($-74.06) |

| Prop Firms (Avg) | $14,371.78 | 1.64% | 21 ($647.41) | 10 ($-94.90) |

Designed For

- Prop firm challenge participants with strict drawdown limits

- Retail traders starting from $50–$5000

- Those seeking consistent M1 results without risky strategies

- Traders who value logic transparency and long-term backtest data

Disclaimer

All performance results shown above are based on MetaTrader Strategy Tester using historical tick data.

Past performance does not guarantee future results.

Always test on a demo account and use proper risk management when going live.

Ready to Scale

PythonX is more than just an EA — it’s a reliable breakout engine tested across a wide range of environments and brokers.

From $100 retail accounts to full prop firm funding, it’s built to help you scale confidently and securely.

Backtests were performed using real ticks, every tick model, 1:1000 leverage, and $100 starting balance.