QuantFactory – Master Algorithmic Trading with Python

$299.00 Original price was: $299.00.$25.00Current price is: $25.00.

It works like a magic!

As a trader, I found this tool useful for spotting market trends and making informed decisions. The real-time data and clear chart patterns help identify potential trade opportunities.

Christina K

Verified Purchase

INSTANT DOWNLOAD!

Original price: $299.00

Our price: $25.00 92% OFF Retail!

Full Course (1.30 GB).

Python for Quant Trading Course Pack

Unlock the power of Python programming and quantitative trading with this comprehensive course pack. You’ll receive two complete courses designed to take you from Python fundamentals to advanced quant trading strategies, with hands-on coding and backtesting exercises.

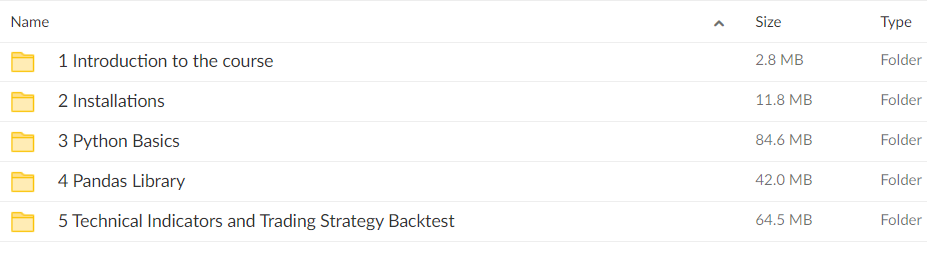

Course 1: Python Fundamentals for Quant Trading

Master Python basics tailored specifically for quantitative finance. This course covers:

Introduction & Setup

-

Installing Anaconda

-

Jupyter Notebook walkthrough

Python Basics

-

Variables, data types, and arithmetic operations

-

Loops, conditional statements, and logical operators

-

Functions and classes fundamentals

Pandas Library

-

Loading and manipulating financial data

-

Working with datetime indexes

-

Rolling window functions for time series

Technical Indicators & Strategy Backtesting

-

Downloading market data

-

Calculating key technical indicators

-

Building and backtesting your first trading strategy

-

Strategy performance metrics and course wrap-up

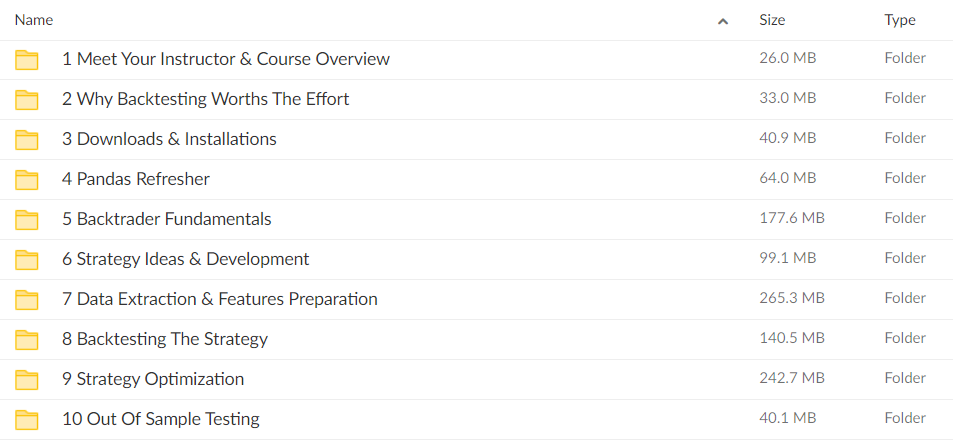

Course 2: Quant Trading Strategies with Python

Take your skills to the next level by developing, backtesting, and optimizing real quant trading strategies:

Introduction & Setup

-

Meet your instructor and course overview

-

Installing Python packages and setting up the environment

Backtesting Essentials

-

Why backtesting matters

-

Tools and rules for high-quality backtests

-

Using the Backtrader platform: data feeds, orders, exits, commissions, and analyzers

Strategy Development

-

Generating trading ideas and integrating indicators

-

Incorporating machine learning concepts

-

Step-by-step strategy building

Feature Engineering & Data Preparation

-

Extracting and preparing features from financial data

-

Weekly regime and daily options feature modeling

-

Calculating comprehensive technical indicators

Backtesting & Visualization

-

Building your own backtester

-

Visualizing strategy results and metrics

Strategy Optimization

-

Dynamic stop-loss techniques

-

Pattern-based intraday price action strategies

-

Parameter tuning for optimal results

Out-of-Sample Testing

-

Validating strategy robustness on new data

This pack is perfect for traders, quants, or developers eager to harness Python for financial markets, combining theory with hands-on projects to build practical skills.