INSTANT DOWNLOAD!

Your price: $22.00

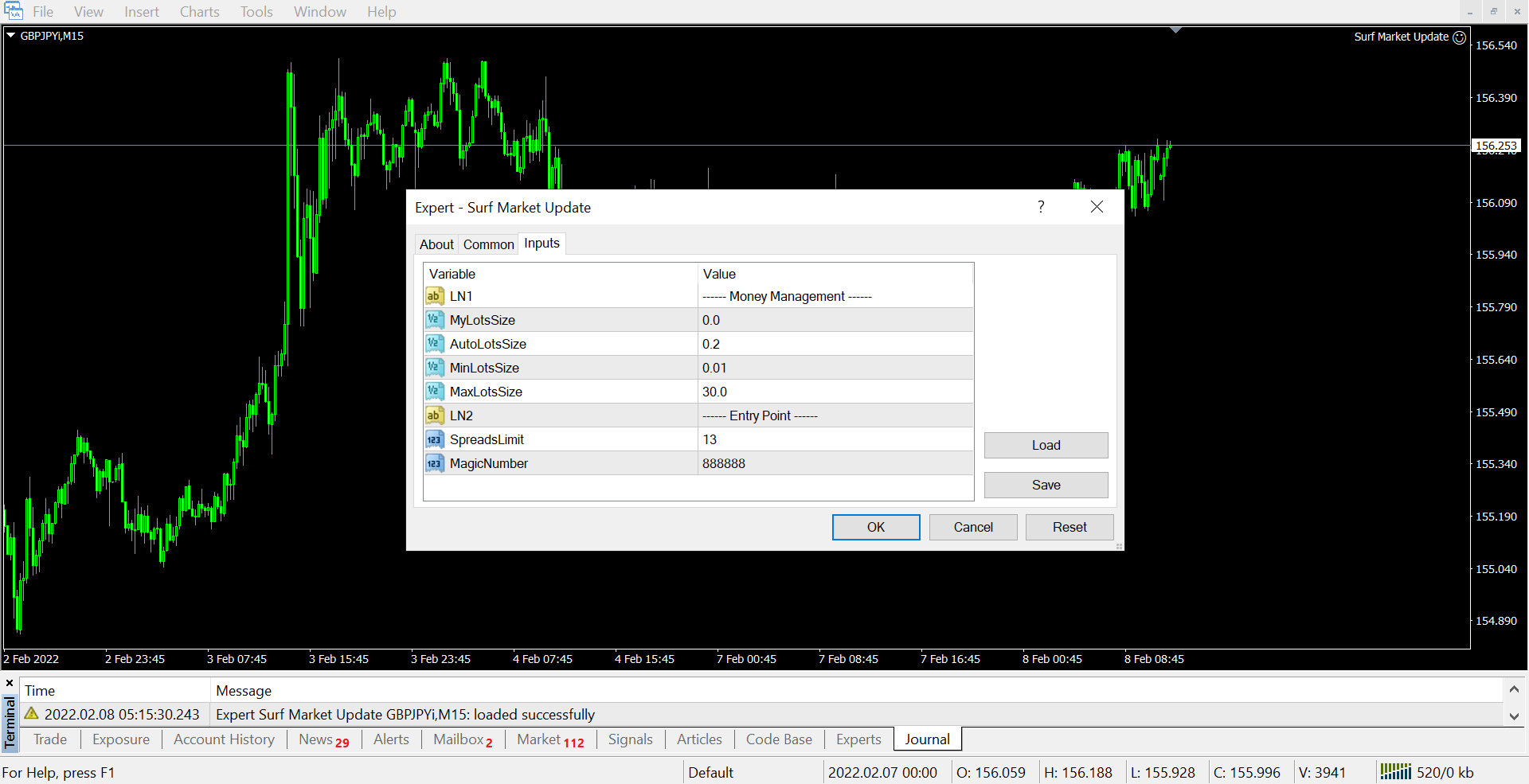

Content: Expert: Surf Market Update.mq4 v1.10 (Unlocked-Source Code), UserGuide: SurfMarket.txt.

Surf Market EA: Overview

Surf Market EA: Overview

The Surf Market EA is an advanced trading robot that utilizes Neural Networks and Deep Learning to predict price direction, aiming to enhance accuracy in forecasting market movements. This automated system is designed for traders who want to leverage sophisticated algorithms to make decisions based on historical and real-time data analysis.

Key Features:

-

Neural Networks & Deep Learning: The EA uses cutting-edge AI techniques to analyze market data and predict price directions, improving the likelihood of profitable trades.

-

Low Drawdown: The system is optimized to minimize drawdowns, making it a safer option for traders who want to manage risk effectively while aiming for consistent gains.

-

Compound Interest Option: You can choose whether or not to use compound interest. This feature allows traders to reinvest profits for exponential growth, or to focus purely on individual trades.

Trading Recommendations:

-

Brokers:

-

Darwinex

-

Dukascopy

-

Tickmill

-

ICMarkets

The best performance is achieved with ECN accounts that offer low or zero spreads. These brokers are recommended because they provide a more favorable environment for automated trading systems like Surf Market EA.

-

-

Trading Pairs:

-

GBPJPY

-

GBPUSD

These pairs are particularly recommended due to their volatility and relatively low spreads, making them ideal for the EA’s predictive capabilities.

-

-

Time Frame: The M15 (15-minute time frame) is the preferred time frame for optimal performance, as it provides enough market movement for the EA to analyze and act on.

-

Strategy Tester: If you are backtesting, make sure to update the spreads limitation in the strategy tester to match or exceed the spread set in the EA settings. This ensures more accurate testing and avoids discrepancies in the results.

Configurations:

-

Lots Size (0.0): If set to 0.0, the EA disables compound interest. If a specific value is provided, it allows for compound interest to be applied.

-

Auto Lots Size per $1000 = 0.2: This is the default setting where the EA will automatically calculate the appropriate lot size based on your account balance. For example, with $1000 balance, the EA will trade 0.2 lots.

-

Formula for Calculating Lots:

Lots=Margin×LeverageContract Size\text{Lots} = \frac{\text{Margin} \times \text{Leverage}}{\text{Contract Size}}Lots=Contract SizeMargin×Leverage

Example: For EURUSD, with 1000 EUR balance and Leverage 1:30:

Lots=1000×30100000=0.3 lots\text{Lots} = \frac{1000 \times 30}{100000} = 0.3 \text{ lots}Lots=1000001000×30=0.3 lots

-

Minimum Lot Size: 0.01 – This is the smallest trade size you can use.

-

Maximum Lot Size: 30 – This is the maximum trade size that the EA can use.

-

Spreads Limitation: By default, the spread is set to 13 points, but you can adjust this value depending on your broker’s spread. This setting helps ensure that the EA only trades when the market conditions (spread) meet certain criteria.

How to Use Surf Market EA:

-

Broker Selection: Choose an ECN broker with low or zero spreads for optimal performance.

-

Set the Lot Size: If you don’t want compound interest, set the Lots Size to 0.0. Otherwise, let the EA calculate lot sizes based on your account balance.

-

Trading Pairs: Focus on pairs like GBPJPY and GBPUSD, which are the most suitable for the strategy.

-

Time Frame: Use M15 for the best results.

-

Test and Adjust: Before running the EA live, perform backtests using the updated spread limitation to ensure the algorithm’s predictions match your settings.

Conclusion:

The Surf Market EA is a powerful tool for traders who want to automate their trading with the help of advanced AI technology. By combining Neural Networks and Deep Learning, this EA aims to predict market movements with high accuracy while keeping drawdown low. With adjustable settings for lot size, spread limitations, and compound interest, it offers flexibility to suit different trading preferences and risk tolerances.