Crash-Proof EA Templates You Can Use in 2026

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

As traders move into 2026, the focus is shifting from aggressive recovery systems to safer, rules-based automation. After a volatile 2025, protecting capital is now more important than chasing fast growth. Many traders are reviewing their setups while taking advantage of the 33% OFF CHRISTMAS SALE (Code: SANTA) to upgrade essential tools that emphasize stability, controlled risk, and long-term consistency.

This guide explains how to configure Expert Advisors safely, which settings matter most, and which automation tools are best aligned with cautious trading conditions expected in early 2026.

Even a high-quality EA can fail if configured poorly. Most losses come from:

Safe EA trading in 2026 means letting probability work slowly, not forcing recovery.

The core principles:

Before reviewing individual tools, these baseline settings should apply to any EA:

These settings reduce emotional trading and prevent account-ending drawdowns.

Category: MT4 / MT5 Expert Advisors

Sigma Trend Protocol EA is best configured as a slow trend-following system, not a high-frequency trader. Its strength lies in filtering noise and entering only confirmed directional moves.

Recommended Safe Settings for 2026

Why These Settings Work

These settings ensure the EA avoids sideways markets and does not overexpose during trend pullbacks.

Best Use Case

Longer-term traders who want smooth equity growth and minimal intervention.

Category: MT5 Expert Advisors

Breakout EAs are often risky, but Currency Pros Breakout EA becomes significantly safer when configured to trade fewer, higher-quality breakouts.

Recommended Safe Settings

Why These Settings Work

They prevent false breakouts and avoid chasing volatility spikes.

Best Use Case

Traders who want volatility exposure without grid or martingale risk.

Category: MT4 Expert Advisors

AI-based systems perform best when not pushed aggressively. AI Forex Robot v5.2 works well as a portfolio stabilizer when risk is capped.

Recommended Safe Settings

Why These Settings Work

They allow the AI logic to adapt while avoiding over-trading during unstable conditions.

Best Use Case

Traders running multiple EAs who need balance rather than aggression.

Category: Forex Risk Management Tools

No EA setup in 2026 should run without an external risk manager. Trade Assistant v10.27 acts as a final safety net.

Recommended Settings

Why This Matters

Even good EAs fail during rare market events. This tool prevents account wipeouts.

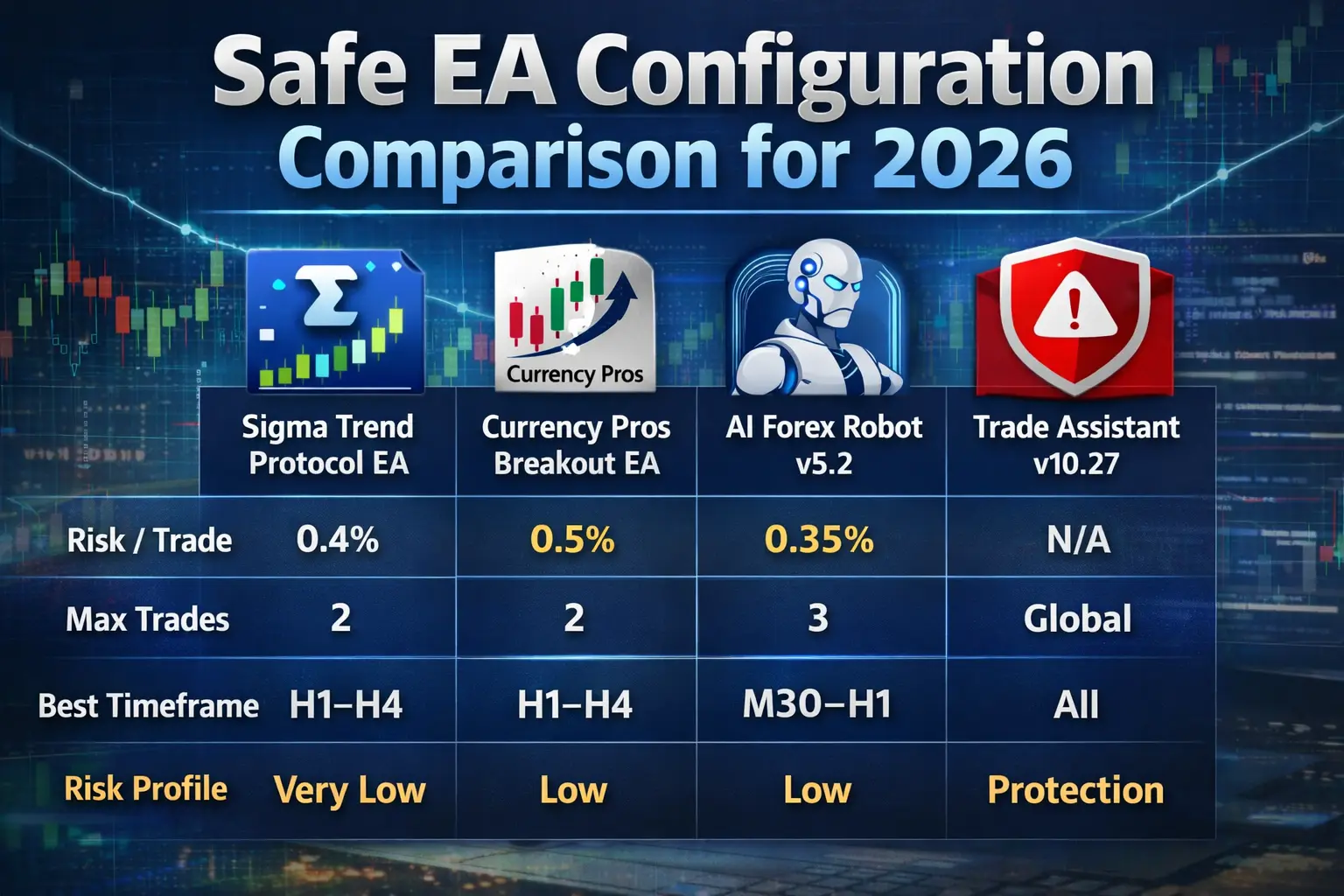

| EA | Risk / Trade | Max Trades | Best Timeframe | Risk Profile |

|---|---|---|---|---|

| Sigma Trend Protocol EA | 0.4% | 2 | H1–H4 | Very Low |

| Currency Pros Breakout EA | 0.5% | 2 | H1 | Low |

| AI Forex Robot v5.2 | 0.35% | 3 | M30–H1 | Low |

| Trade Assistant v10.27 | N/A | Global | All | Protection |

Safe trading is not about avoiding losses — it’s about controlling them.

Are low-risk EA settings less profitable?

They are slower but more sustainable. Most blown accounts come from aggressive settings.

Can I increase risk later?

Yes, after months of stable performance and equity growth.

Should I run multiple EAs together?

Yes, but only if each uses conservative risk and a shared risk manager.

Is a risk manager really necessary?

In 2026 market conditions, yes. It protects against black-swan events.

A safe start to 2026 is not about finding the most aggressive EA — it’s about configuring automation correctly. By using conservative settings with tools like Sigma Trend Protocol EA, Currency Pros Breakout EA, AI Forex Robot v5.2, and enforcing strict limits through Trade Assistant v10.27, traders can focus on survival first and growth second.

Proper settings turn average EAs into reliable tools — and unreliable EAs into account killers. In 2026, discipline wins.

Jack Henry

30/12/2025

Automated trading carries risks, but crash-proof EA templates protect capital and limit losses. These templates...

Understanding major and minor currency pairs is the first step in forex trading. Understanding major...